Cheap Auto Insurance in Fort Wayne, IN

In the market for cheap auto insurance in Fort Wayne, IN? At CheapCarInsuranceinc.com, you could find the cheapest insurance rates in your area. To find free car insurance quotes from the very best providers today, type your zip code into the quote box on this page.

Back in the early days of American history, Fort Wayne was an important center for trade and travel. The convergence of three major river systems made it a perfect place to start a thriving town. Today, it maintains this tradition of economic prosperity while maintaining its frontier heritage and historical culture.

- Fun fact: Did you know that Fort Wayne is #4 on the list of “Top 50 cities with greatest precentage of males working in industry: Recyclable material merchant wholesalers (population 50,000+)”? Learn more about Fort Wayne.

Coverage Requirements - Auto Insurance in Fort Wayne Indiana

Driving legally in Fort Wayne requires:

| Coverage | Requirements | Most Common |

| Liability Bodily Injury | 25,500/50,500 | 105,000/305,000 |

| Liability Property Damage | 10,000 | 100,000 |

| Bodily Injury - Motorist Uninsured | Not required | 100,000/300,000 |

| Not required Coverage | Medical Payments Coverage | 5,000 |

| Collision Coverage | Not required Coverage | 700 Insurance deductible |

| Comprehensive | Not required | 0 deductible |

Keep in mind that just because Comprehensive, Collision, and other forms of coverage aren’t required doesn’t mean you shouldn’t look into them. The extra expense could be worth it in the long run.

Indiana insurance averages can be a little high – some studies show that the average driver is forking out somewhere around $100 per month for basic coverage. However, you can get covered in Fort Wayne for as little as $29/mo* while still maintaining good coverage on your vehicle.

Farmers and Nationwide are competing to offer the lowest rates in Fort Wayne right now. But you have to pause and ask yourself what else they have to offer besides a low monthly premium. You’ll want a company with good customer service, and a claims service second to none. All in all, your monthly premium is only part of what you’re shopping for.

Auto insurance companies contemplate many variables when figuring out insurance quotes, including marital status, occupation, years of driving experience, age, and theft protection devices. Additionally, premiums differ from provider to provider. To find out whether you’re still getting the most affordable rate, compare cheap Indiana auto insurance quotes online.

Most Car Insurance Facts to know in Fort Wayne IN

There are lots of ways your car insurance rate can be determined. But not all of it is out of your control; there are steps you can take so that you can control which discounts you are entitled to get. The following are a few of these elements in greater detail:

- Your Zip Code

Your auto insurance rates may differ depending on where you call home. In general, highly populated cities have higher auto insurance rates because the extra amount of drivers on the road increases the likelihood of an accident! The population of Fort Wayne is 256,496 and the median household income is $39,878.

- Automobile Accidents

If your zip code has a lot of Deadly accidents each year, it may very well have an impact on your insurance premiums – and not for the better. As you can see in the chart above, Fort Wayne had multiple accident-related Deadlyities in 2013. This is likely to drive up premiums.

- Car Thieving in Fort Wayne

Even in small cities or rural towns, auto theft can still be a problem. In order to make it less of a problem for you, think about installing a passive anti-theft system on your car. Your auto insurance company may reward you with lower rates for doing this. In Fort Wayne, there were 417 Car Thieving in 2012. This means that thefts are on the rise, and it might be a good time to consider adding Comprehensive coverage to your policy.

- Your Credit Score

It’s hard to make sure you have a good credit score – regardless, Automobile insurance companies still use this metric as a way to determine what to charge you each month for your coverage. And, as you can see, it can make a big difference.

- Your Age

The less experience you have behind the wheel, the more likely you are to get into an accident. Insurance companies have decades of data proving this unfortunate fact. And if you are more likely to get into an accident, your insurance company will protect itself against that risk by charging you higher rates, as you can see in the chart below.

- Your Driving Record

A speeding ticket here, a fender-bender there, and they can really pile up when it comes to insurance premiums. Luckily, providers have started offering Accident Forgiveness discounts for drivers with one or more minor violations. However, this forgiveness policy is less likely to apply to significant violations, such as DUI or Reckless Driving.

- Your Vehicle

If you have the disposable income for a luxury vehicle, make sure that you also possess some luxury insurance to go with it. Because carrying the bare minimum coverage for an expensive vehicle will likely leave you holding the bill in most claim filing situations.

Minor Car Insurance elements in Fort Wayne

The elements below may also have an influence in your monthly premium, although they might be a little harder to control:

- Your Marital Status

- Your Gender

This may be hard for some people to believe, but most companies don’t charge radically different rates for male or female drivers. Many companies these days charge the exact same rate, all other circumstances being equal.

- Your Driving Distance to Work

When travelling to and from work, the average motorist can expect a 16-25 minute commute in Fort Wayne. Around 80% of drivers use their own vehicle in order to get to work each day, and anywhere from 8-27% choose to carpool with their co-workers.

Some insurers want to make a big deal out of how many miles you drive yearly, or why you’re driving (work/school vs. recreation). But in truth, unless you’re driving a business vehicle (which can see rate hikes as high as 10%) or more, your reason or distance won’t drastically alter your rate.

- Your Coverage and Deductibles

Need more coverage, but don’t have enough money to budget each month? Talk to your insurance agent about raising your deductible. Yes, you will have to pay more in the event that you need to file a claim, but think about how much you can save long-term with a lower monthly payment.

- Education in Fort Wayne, IN

A great number of drivers in Fort Wayne have earned a high school diploma or other equivalent; nearly 40%. A lesser number of residents have yet to complete their high school education. If you’re thinking about improving upon the education you already have, but aren’t sure, consider this: auto insurance companies often give discounts to drivers who have a bachelor’s or a master’s degree. These discounts are even more than what you can get for working a specific job or getting paid a high salary.

Fort Wayne naturally has a great variety of public and private institutions to choose from. IPFW (also known as Indiana University-Purdue University at Fort Wayne) is not only the biggest university in the northeast region of the state, but also a combination of Purdue and Indiana universities. It educates almost 12,000 students each year, and has recently incorporated student housing. There is also the University of St. Francis for a religious education, or Indiana Tech for a business/technology degree.

Regrettably for most insurance companies, a simple internet search can reveal many of their trade secrets. But even with the proper information, it can still be confusing for you as an individual to figure out your risk profile and find low-cost insurance. Make sure you do your due diligence before you commit to your next car insurance policy.

How We Conducted Our Car Insurance Analysis

Sources:

Indiana Department of Insurance

Department of Highway Safety and Motor Vehicles

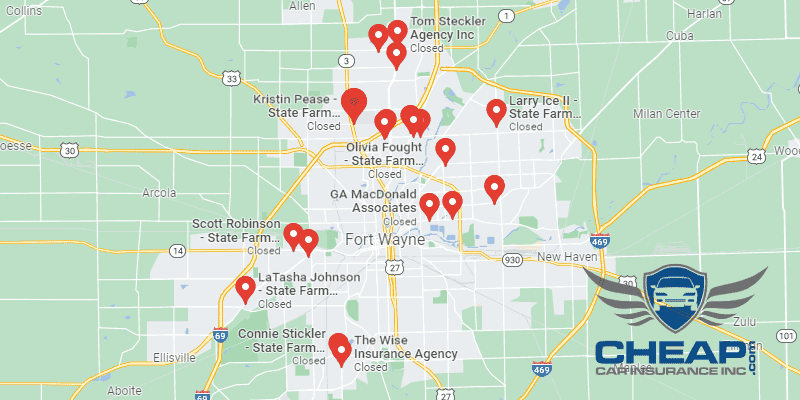

These Companies Offer Affordable Car Insurance in Fort Wayne, Indiana – Act Now