Cheap Auto Insurance in Arkansas

Whether you live in Little Rock, Fort Smith, Fayetteville, Springdale, and Jonesboro with so many companies offering Arkansas automobile insurance, how do you know what policy is right for you? Finding an affordable car insurance policy that fits your lifestyle can be a daunting task. We can help you decide how much coverage is right for you.

Arkansas Auto Insurance – Average Premiums

For most drivers in Arkansas, the typical price of insurance amounts to about $77 per month on average. However, rates will vary throughout the state. Some areas cost considerably more, such as Fort Smith, where the average monthly price is around $84/mo. Then again, there are cheaper cities such as Springdale, where many drivers aren’t forking out much more than $71 each month.

CheapCarInsuranceinc.com provides approximate measures of the relative cost of Arkansas vehicle insurance to consumers. In terms of expenditures for automobile insurance, Arkansas ranks 38 out of all 50 states, but this number depends on what sort of coverage is purchased.

Important Arkansas Auto Insurance Laws and Requirements

Arkansas requires liability insurance, with minimum of $25,000 for injury liability, $50,000 for all injuries, and $25,000 in property damage. Uninsured/underinsured motorist coverage and no-fault insurance are not required in this state. Find cheap Arkansas car insurance coverage online.

| Coverage | Requirements | Most Common |

| Liability Bodily Injury | 30,000/55,000 | 30,000/55,000 |

| Liability Property Damage | 25,000 | 25,000 |

| Bodily Injury - Motorist Uninsured | Not required | 30,000/55,000 |

| Not required Coverage | Medical Payments Coverage | 5,000 |

| Collision Coverage | Not required Coverage | 700 Insurance deductible |

| Comprehensive Coverage | Not required Insurance | 300 deductible |

Choosing the Right Amount of Arkansas Car Insurance Coverage

Naturally, your monthly payments will depend on what types of coverage you purchase for your vehicle, and in what amounts. Buying only the state minimums will save you money each month in the short term, but in reality Liability coverage protects you financially in only a few situations. For total protection, you’re going to also want to look into Comprehensive, Collision, and more.

Arkansas DUI Laws

For the first DUI offense, you will receive up to a $1,500 fine, face a 6 months license suspension, and up to 1 year of imprisonment. Drivers are required to file an SR-22 to reinstate a suspended driver license after a DUI, uninsured auto accident, or driving without insurance. And on top of everything, your insurance carrier will very likely increase your rates after a DUI conviction.

Age Limit Laws

Teenagers tend to pay the highest rates out of any other class of drivers, simply because their lack of driving experience usually leads to more accidents (and costs the insurance company more money forking out out claims). But to increase teenage driver safety, GDL laws have been passed in recent years. In Arkansas, these laws state that a driver’s Learner Permit can be obtained as early as age 14, but they must have an adult in the vehicle with them while driving. At the age of 16 (and after at least 6 months of supervised driving practice), Teenage motorists are eligible for an Intermediate Stage permit. This means that the teenager can drive alone, but that they cannot be on the road between 11:00 PM and 4:00 AM. It also means they cannot have more than one non-family passenger in the car at any time. At the age of 18, teen drivers in Arkansas can apply for a full license.

Credit Score Laws and Regulations

Adjusting your monthly premiums based on your credit score is a common practice many insurance companies do. In fact, it is perfectly legal in 47 out of 50 states. This means that drivers with a higher credit score will pay lower rates than those who are unfortunate enough to have poor credit. The chart below makes these price differences a little clearer.

Insuring your Vehicle in Arkansas

Many motorists, Regrettably, conform to the old belief that “insurance follows the vehicle”. Actually, though, the opposite is true: your insurance policy follows your vehicle, no matter who is driving it. What does this mean for you? Well, if you willingly let someone else borrow your car, and that driver causes an accident with your vehicle, you and your insurance company could be held liable. This is the main reason insurance companies ask about the make and model of the vehicle you wish to insure.

Additional Arkansas Auto Insurance Laws and Requirements

multiple of the elements mentioned above can drastically alter your monthly payments for insurance if they should suddenly change for any reason. However, there are other elements – such as the basic road safety laws and regulations listed below – that could alter your rates too if you happen to get caught breaking any of these laws.

Highway Safety Laws

There are no current laws against aggressive driving within the state of Arkansas. However, that doesn’t mean that certain violations often associated with aggressive driving (such as running a red light or tailgating) aren’t illegal in their own right; all it means is that a law enforcement officer can’t specifically charge you with an aggressive driving charge

| Aggressive Driving | No state law |

| Cell Phones and Texting Laws | 18 – 20 years old |

| Inc. Penalty for High BAC | BAC 0.15 |

| Admin. License Susp. on 1st Offense | 6 months |

Speed Limits and Cell Phone Use

As far as texting goes, there is an all-driver ban for the entire state. And this is a primary offense, too, meaning that law enforcement can pull you over and write you a ticket just for texting. But the rest of the cell phone laws in Arkansas can get a little tricky. For starters, talking on a cell phone while driving is illegal for school bus drivers, and it is a primary offense. It is also illegal if you are under the age of 18, but it is only a secondary offense (meaning law enforcement must have another reason for pulling you over first). Finally, cell phone use while driving is a primary offense if you are between the ages of 18-20 and you are alone in your vehicle.

| Rural Interstate | 70 mph |

| Urban Interstate | 55 mph |

| Other Limited-Access | 60 mph |

Important Arkansas Contacts

Visit the Arkansas Department of Revenue – Motor Vehicle Division for information on obtaining your driver’s license, requirements for ID Cards, and vehicle registration.

Official State Arkansas Website

Arkansas Department of Insurance DO NOT FORGET NO FOLLOW CODE

How to contact directly:

Arkansas Insurance Dept.

Consumer Services Div.

1200 W. Third St.

Little Rock, AR 72201-1904

Phone: 1-501-371-2600

Toll Free: 1-800-282-9134

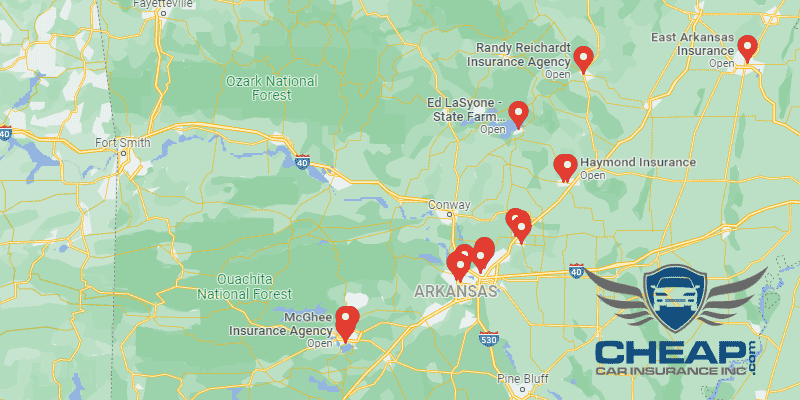

These Arkansas Car Insurance Companies Offer Lowest Rates In Your Area