Cheap Auto Insurance in Tucson, AZ

Are you looking for auto insurance in Tucson? At CheapCarInsuranceinc.com, you will discover the best insurance rates close to you. To receive free car insurance quotes from the leading providers today, enter your zip code into the quote box on this page.

Tucson may have a past full of Native American, Spanish, Mexican, and American Pioneer influence, but the city has developed into so much more. Culture is thriving in Tucson, with symphonies, ballets, theatrical productions, and even opera. Additionally, Tucson is in the heart of the “Silicon Desert” with many information and high-tech jobs. It also boasts a sunny and warm climate almost year-round.

- Fun fact: Did you know that Tucson is #1 on the list of “Top 50 cities with greatest precentage of males in occupations: Occupational and physical therapist assistants and aides (population 50,000+)? Learn more about Tucson, AZ.

Coverage Requirements - Auto Insurance in Tucson Arizona

If you want to drive legally in Arizona, you need to purchase the following coverage:

| Coverage | Requirements | Most Common |

| Liability Bodily Injury | 15,000/30,000 | 100,000/300,000 |

| Liability Property Damage | 10,000 | 25,000 |

| Bodily Injury - Motorist Uninsured | Not required | 15,000/30,000 |

| Not required Coverage | Medical Payments Coverage | 5,000 |

| Collision Coverage | Not required Coverage | 700 Insurance deductible |

| Comprehensive | Not required | 0 deductible |

Keep in mind that just because Comprehensive, Collision, and other forms of coverage aren’t required doesn’t mean you shouldn’t look into them. The extra expense could be worth it in the long run. Need more information on car insurance in Arizona? See more info below.

Most motorists in Arizona typically have to pay around $67 per month or more for their insurance coverage. But did you know that Tucson drives can get covered for as little as $42/mo*? Keep reading, and we’ll show you how to find the right company who offers the most discounts for drivers like you.

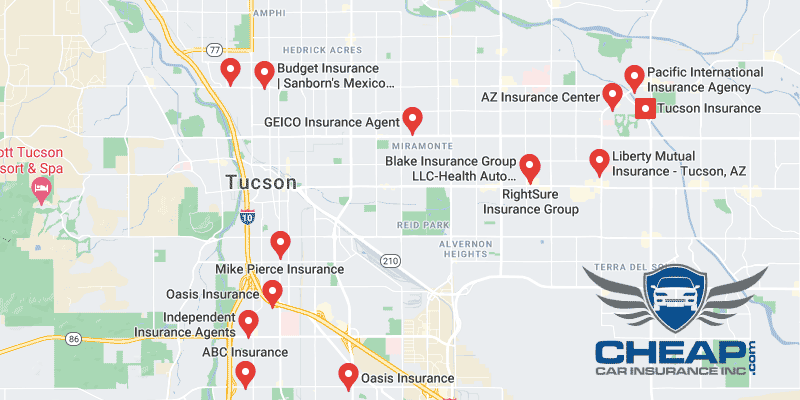

Liberty Mutual, Farmers, and Nationwide are offering some of the cheapest rates on Automobile insurance in Tucson right now. But is that the most important aspect of your search? Do they offer low rates and excellent customer service? Are they the cheapest, but with a convoluted claims process? Just because they are offering the lowest rate doesn’t mean they are the best company. You need to research all aspects of your insurance provider before you make a decision.

Auto insurance companies contemplate numerous elements when figuring out insurance quotes, including driving violations, accident claims, occupation, education, and business use of the vehicle. Also keep in mind that premiums change from carrier to carrier. To make sure you’re still getting the cheapest rate, compare cheap Tucson auto insurance quotes online.

Most Car Insurance Facts to know in Tucson AZ

There are multiple ways in which your car insurance rate might be calculated. But not all of it is out of your control; there are steps you can take to be able to control what discounts you are entitled to acquire. The following are a few of these components in greater detail:

- Your Zip Code

Where you park your car each night will have a major impact on your auto insurance rate. Generally, car insurance is cheaper in rural areas because fewer cars means a smaller chance that you will get into a collision with another vehicle. The population of Tucson is 526,116 and the average median household income is $35,720.

- Automobile Accidents

Between 2012 and 2013, most of Tucson’s accident statistics fell – except for the number of pedestrians involved in Deadly accidents. That number has risen to 26, as you can see in the chart below. Why is it important to know about accident statistics? Because your insurance company may charge you higher rates for living in a zip code which suffers frequent accidents.

- Car Thieving in Tucson

Living in a large city (Especially one with a high crime rate) will increase your risk of being a victim of auto theft. If your general location has high rates of theft and claims, you can expect to pay more for auto insurance to offset these costs. The total number of stolen vehicles in Tucson was 2,190 back in 2013. That statistic is a little high, considering the population. For a little extra money each month, though, you can protect yourself from auto theft by adding Comprehensive coverage to your insurance policy.

- Your Credit Score

Depending on your credit, a poor score can end up nearly doubling your monthly rate. Luckily, Arizona average insurance rates are fairly low to start with, so it may not break your budget. And there are local providers who still offer low rates, in spite of poor credit.

- Your Age

The younger you are, and the less experience you have behind the wheel, the more you can expect to pay for your Automobile insurance each month. As you can see in the chart below, a teenage driver (without any Good Student or Defensive Driving discounts) has to pay a lot more each month.

- Your Driving Record

A clean driving record will get you the lowest rate, while accidents and tickets will raise your monthly cost. Too many citations, or significant violations such as a DUI, might result in a loss of coverage all together. Be sure to talk to your insurer about Accident Forgiveness discounts in order to save some money.

- Your Vehicle

For affordable, compact, fuel-efficient sedans, your insurance rates will be much lower than if you choose to purchase and drive around in a luxury vehicle. More expensive cars require more coverage, and more expensive policies.

Minor Car Insurance elements in Tucson

Although the following may seem important to most, they don’t always have a significant impact on your monthly rates:

- Your Marital Status

Whether you are single or married, as an individual, your marital status will not influence your monthly rate by more than a few percentage points, if at all. However, married couples can get access to lower rates by bundling their policies together with the same company. You can get further discounts by bundling homeowner’s insurance, or renter’s insurance to your auto policies.

- Your Gender

This may be hard for some people to believe, but most companies don’t charge radically different rates for male or female drivers. In fact, many companies these days charge the exact same rate, all other things being equal.

- Your Driving Distance to Work

The average commute for Tucson motorists can last around 14-26 minutes with some commutes lasting as long as 25 minutes. Nearly 75% of all commuters choose to drive their own car to work, while a little over 13% may carpool.

If you have your vehicle listed on your insurance policy as a business vehicle, you can expect to pay around 10% more, regardless of how often you drive each year. Total miles driven, as well as your purpose on the road (work/school/pleasure) won’t alter your monthly premiums by more than 1-2%.

- Your Coverage and Deductibles

Obviously, someone who only buys the state minimum mandatory coverage will pay less per month than a driver with additional coverage on their policy. If you feel you need more than the mandatory minimum coverage, but don’t want to pay expensive premiums each month, try raising your deductible. This is especially economical for safe drivers who don’t anticipate a need to file multiple claims.

- Education in Tucson, AZ

Some people believe that having a prestigious job or a high salary will get them lower insurance rates. But the truth is that improving your level of education can also yield improvements in your car insurance rate. For Tucson, most drivers have a high school diploma or less. But many motorists have at least one year of college under their belt if not a full four-year degree.

There are multiple institutions of higher learning to choose from in Tucson. The University of Phoenix has a campus in Tucson, as well as Prima Community College and the University of Arizona, with 18 different colleges and 12 unique schools to choose a degree from.

Finding affordable auto insurance can be a hassle. There’s a lot of information you need to consider, and figuring out how insurance companies evaluate your potential risk can be complicated. But don’t let the wrong insurance company talk you into purchasing the wrong policy.

How We Conducted Our Car Insurance Analysis

Sources:

Arizona Department of Insurance

Arizona Department of Financial Institutions

Department of Highway Safety and Motor Vehicles

Start Comparing Quotes Now – These Companies Offer Lowest Rates on Auto Insurance in Tucson, AZ