Cheap Auto Insurance in Bridgeport, CT

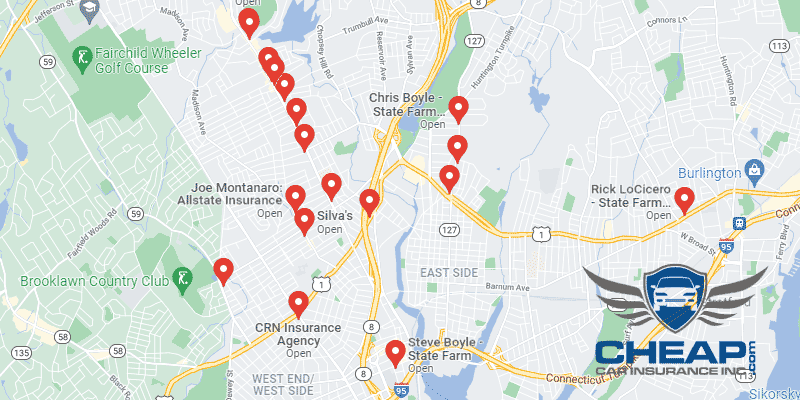

In the market for auto insurance in Bridgeport? At CheapCarInsuranceinc.com, you’ll find the best insurance rates in your city. To acquire free car insurance quotes from the best providers today, input your zip code into the quote box on this page.

Bridgeport, Connecticut was renowned for being a manufacturing hub up until the cold war ended in the 1990’s. At that time, the hit that Bridgeport took to its industries was so severe that the city had to declare bankruptcy. Thankfully, Bridgeport has been on the road to recovery lately with new sports stadiums and downtown renovations attracting tourists and sports fans alike.

Fun fact: Did you know that Bridgeport is #2 on the list of “Top 50 cities with greatest precentage of males in occupations: Transportation, tourism, and lodging attendants (population 50,000+)”? Learn more about Bridgeport.

Coverage Requirements - Auto Insurance in Bridgeport Connecticut

If you want to drive legally in Connecticut, you’ll need:

| Coverage | Requirements | Most Common |

| Liability Bodily Injury | 20,000/40,000 | 100,000/300,000 |

| Liability Property Damage | 10,000 | 50,000 |

| Bodily Injury - Motorist Uninsured | Not required | 20,000/40,000 |

| Not required Coverage | Medical Payments Coverage | 5,000 |

| Collision Coverage | Not required Coverage | 700 Insurance deductible |

| Comprehensive | Not required | 0 deductible |

In some parts of Connecticut, insurance can cost as much as $137 per month for certain motorists, on average. However, living in Bridgeport can give you the option of getting insurance for as little as $79/mo*!But remember that Liability coverage is extremely limited. Your Liability insurance will only pay out claims in the event that you get into an accident which you are deemed liable for (if the accident is your fault). If your car is stolen, or if you get into an accident caused by someone else, your insurance will not pay out on any claims.

Based on the data above, it looks as though Liberty Mutual, Allstate, and Nationwide are vying for lowest premiums in the state. But keep in mind there are other elements to consider, also. How good is their customer service record? Are they available 24/7 if you need to file a claim during non-business hours? How high will your monthly rate spike if you get a ticket? All of these questions can change what is and is not affordable based on your circumstances.

Auto insurance carriers consider various elements when assessing insurance quotes, including your career, zip code, marital status, credit score/rating, and business use of the vehicle. In addition, premiums change from company to company. To verify you’re still forking out the most favorable rate, compare cheap Connecticut car insurance on our website.

Most Car Insurance Facts to know in Bridgeport CT

There is a variety of many things which may factor into the rate quotes you are given. While many of these issues aren’t actually anything you can do something about, a few of them are elements which you can change for the better. Here are some components that might change your car insurance premium:

- Your Zip Code

The cheapest car insurance is usually found in cities with a lower population density. Because there are fewer vehicles on the road, there are fewer possibilities for you to get into a major car accident with another driver. The population of Bridgeport is 147,216 and the median household income is $42,687.

- Automobile Accidents

Zip codes with a high rate of reported accidents tend to have higher insurance rates, on average. In 2013, there were 7 reported accident-related Deadlyities in Bridgeport, which was a slight rise from the previous year.

- Car Thieving in Waterbury

Even in small cities or rural towns, auto theft can still be a problem. In order to make it less of a problem for you, think about installing a passive anti-theft system on your car. Your auto insurance company may reward you with lower rates! In Bridgeport, there were 663 Car Thieving in 2013. While this is a significant drop from recent years, you should always consider the benefits of Comprehensive coverage when tailoring an auto policy.

- Your Credit Score

It turns out that your credit score is one of the biggest influential elements when it comes to determining your insurance premiums. Just look at the chart below. If you have poor credit, your rates could be anywhere from 2x to 3x higher than someone with better credit.

- Your Age

As you can see from the chart below, young teenage drivers get charged immensely higher rates. Their youth, as well as their lack of driving experience, make them much more risky to insure. However, teenage drivers can try to alleviate some of this financial stress by looking into a Good Student discount, or taking additional driver education courses.

- Your Driving Record

A clean driving record will get you the lowest rate, while accidents and tickets will raise your monthly cost. Too many citations, or significant violations such as a DUI, might result in a loss of coverage all together. Be sure to talk to your insurer about Accident Forgiveness discounts in order to save some money.

- Your Vehicle

Luxury vehicles will cost more to replace, and also require more coverage, hence the extra expense. Less expensive and fairly common cars, however, typically don’t cost as much to insure.

Minor Car Insurance elements in Waterbury

Here are some other elements which may also influence your rate:

- Your Marital Status

For single policies, marital status is a negligible factor when determining your premiums. However, married couples have the option of bundling their policies together. Most insurance providers will offer substantial discounts for this.

- Your Gender

No matter what you may have heard, there is no significant difference in risk between male and female drivers – according to most insurance companies. If your provider charges a different rate at all, it should amount to no more than 2-3%. And some companies reward female drivers, while other providers charge less for males.

- Your Driving Distance to Work

Workers in Bridgeport can expect a commute of 25-31 minutes on average. About 60-98% of motorists drive their own car to work, anywhere from 2-20% prefer to carpool.

Some companies pay lip service to your purpose for driving, as well as the miles you drive each year. However, when you analyze the data, most of these elements barely make a dent in your monthly premium – for example, there may be no more than a 4% difference between driving fewer miles for work and tens of thousands of miles for pleasure each year. However, business vehicles tend to have about 10-15% higher premiums than regular vehicles.

- Your Coverage and Deductibles

Adding lots of coverage options makes sense for a more expensive vehicle. For vehicles of lesser value, however, you can save yourself some money each month by sticking to a more basic insurance policy. You can also add a few extra benefits to your coverage and keep your monthly rates low by raising your deductible – just make sure you can afford to shell out the cash if the worst happens.

- Education in Bridgeport, CT

Given the tough economic times Bridgeport has seen in recent decades, many drivers have either less than a high school diploma or a high school diploma/equivalent. But did you know that going back to school can save you money on your car insurance? It’s true! Auto insurance providers typically give lower rates to motorists with higher levels of education, even if they have a good job or a high salary.

The University of Bridgeport has been around since the late 1920’s and provides students with a variety of professional and liberal arts degrees ranging from the baccalaureate level all the way up to doctorate. There are also many religious universities in Bridgeport, including Sacred Heart and Fairfield University, to name a few.

Finding affordable auto insurance can be a hassle. There’s a lot of information you need to consider and, figuring out how insurance companies evaluate your potential risk can be complicated. But don’t let the wrong insurance company talk you into purchasing the wrong policy.

How We Conducted Our Car Insurance Analysis

Sources:

Connecticut Insurance Department

Connecticut Department of Banking – Financial Institutions Division

Department of Highway Safety and Motor Vehicles

Cheapest Car Insurance this Year (CT Residents Could Save More!) – Compare Rates Now!