Cheap Auto Insurance in Macon, GA

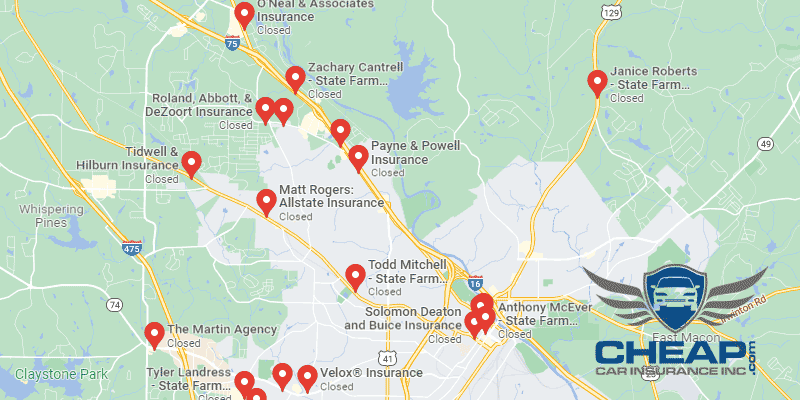

Do you require cheap auto insurance in Macon, GA? CheapCarInsuranceinc.com can help you find what you need. All you need to do is type in your zip code in the quote widget below – it’s that simple!

Macon earned its nickname based on geography: it lies precisely at the geographic center of the state, which is why locals like to refer to it as “the heart of Georgia”. Economically speaking, Macon is well known for its museums, tourism, and higher education.

- Fun Fact: single men, buy your plane ticket now, because Macon is #1 on the list of “Top 100 cities with the largest percentage of females (pop. 50,000+)”. Interested in discovering more about Macon? Click here!

Coverage Requirements - Auto Insurance in Macon Georgia

If you want to drive legally in Georgia, you must purchase at least:

| Coverage | Requirements | Most Common |

| Liability Bodily Injury | 25,500/50,500 | 105,000/305,000 |

| Liability Property Damage | 30,000 | 60,000 |

| Bodily Injury - Motorist Uninsured | Not required | 30,000/55,000 |

| Not required Coverage | Medical Payments Coverage | 5,000 |

| Collision Coverage | Not required Coverage | 700 Insurance deductible |

| Comprehensive Coverage | Not required Insurance | 300 deductible |

Keep in mind that just because Comprehensive, Collision, and other forms of coverage aren’t required doesn’t mean you shouldn’t look into them. The extra expense could be worth it in the long run.

Typical Georgia motorists can expect to pay around $183 per month for the average Automobile policy. However, Macon residents can get it as cheap as $40/mo* or less – if they know how to navigate the complicated waters of Automobile insurance shopping.

The Geico, Hartford, and Allied are offering the most competitive rates as reflected in the chart above. But that monthly rate doesn’t show how good their customer service is, or how efficient their claims service can be. Be sure to consider all the elements when shopping for a cheaper Automobile policy.

Organizations that offer insurance coverage consider different elements when figuring out insurance quotes, especially driving experience, where you live, your credit history, education, and business use of the vehicle. Also remember that premiums differ from carrier to carrier. To make sure you are still getting the cheapest premium, examine cheap Georgia Automobile insurance prices via the internet.

Most Car Insurance Facts to know in Macon GA

You may feel a bit powerless when your insurance agency is calculating your rate; let’s be honest, almost all the elements that they analyze aren’t items you can potentially change or control. Fortunately, however, there are various items that you may be in a position to change for higher discounts, for example:

- Your Zip Code

Where you park your car each night will likely have a significant influence on your automobile insurance rate. Generally, vehicle insurance is cheaper in rural regions because a lesser number of cars signifies a smaller chance that you’ll get into a wreck with another vehicle. The population of Macon is 89,981 and also the common family earnings are $24,623.

- Automobile Accidents

If your zip code has a lot of Deadly accidents each year, it may very well have an impact on your insurance premiums – and not for the better. As you can see in the chart above, Macon had multiple accident-related Deadlyities in 2013. This is likely to drive up premiums.

- Car Thieving in Macon

Anti-theft devices are usually a powerful way to protect yourself from auto theft. These are fairly inexpensive, very easy to get mounted, and once equipped, need no work by you. And best of all, most insurance providers will give you a discount on your vehicle insurance simply for having one! Within Macon, they had 489 Car Thieving in 2013. To protect yourself from theft, talk to your agent about Comprehensive coverage.

- Your Credit Score

Your credit score is one of those elements which you probably don’t think about often, but has a significant influence nonetheless. For those with good or even excellent credit, you can look forward to really low monthly rates. Those with poor credit, however, might face monthly charges which are immensely higher.

- Your Age

Your Automobile insurance gradually gets cheaper over time, because your experience behind the wheel ensures that you are less and less likely to get into an accident. But younger drivers and their lack of experience are at a much higher risk. And because they are so risky to insure, they must pay higher monthly premiums.

- Your Driving Record

As one would expect, the cleaner your driving record is, the less you can expect to pay for your Automobile insurance each month. However, your rates will likely go up if you start collecting speeding tickets or other moving violations. Some companies offer “Accident forgiveness” discounts, which might be helpful if your record is less than perfect.

- Your Vehicle

It should come as no surprise that luxury vehicles are more expensive to insure than your typical sedan. But some drivers may not be informed as to why. Expensive vehicles will naturally cost more to repair or replace, which means you’ll need much more than the state minimum coverage. And the more coverage you buy, the higher your monthly premiums will be.

Minor Car Insurance elements in Macon

- Your Marital Status

Married couples have the advantage over singles in that they can bundle multiple policies together and get savings discounts. Of course, all of your policies have to be bundled with the same company in order to be eligible first.

- Your Gender

Worried about being charged more simply because of an uncontrollable factor, such as your gender? Well, don’t worry too much, because most providers these days charge the same rate, regardless of gender. And if you do get charged a higher premium for being male or female, it won’t really change your premium by more than a few dollars per month.

- Your Driving Distance to Work

Commute times in and around Macon aren’t too strenuous. Average trips only take about 14-23 minutes, with some commutes lasting as short as 10 minutes. About 75% of residents get around in their own automobile by themselves, while an additional 18-21% carpool.

If you have your vehicle listed on your insurance policy as a business vehicle, you can expect to pay around 10% more, regardless of how often you drive each year. Total miles driven, as well as your purpose on the road (work/school/pleasure) won’t alter your monthly premiums by more than 1-2%.

- Your Coverage and Deductibles

Need more coverage, but don’t have enough money to budget each month? Talk to your insurance agent about raising your deductible. Yes, you will have to pay more in the event that you need to file a claim, but think about how much you can save long-term with a lower monthly payment.

- Education in Macon, GA

Recently, automobile insurance companies have started connecting your rates to your level of education (even more than your job or your yearly income). Specifically, the more education you have, the more likely your provider will be to lower your rate. In Macon, nearly 33% of locals have at least a high school diploma, while 28% have not quite finished their secondary schooling.

There are nearly 30,000 students enrolled in multiple different institutions of higher learning in Macon. The three largest of these are Macon State College, Mercer College, and Wesleyan College. Georgia College & State University also operates a small satellite campus in Macon.

Automobile insurance is without doubt one of the most important purchases you can make as a shopper. You need to ensure you discover an honest, dependable organization who’ll follow through on their claims. A couple of automobile insurance agencies usually are greater at this as opposed to others, and performing a rigorous web based hunt will let you differentiate the beneficial from the poor.

How We Conducted Our Car Insurance Analysis

Sources:

Georgia Department of Law Consumer Protection Unit

Georgia Department of Human Services Office of Financial Services

Department of Highway Safety and Motor Vehicles

Compare rates right away and save hundreds on your future insurance charges.