Cheap Auto Insurance in Wichita, KS

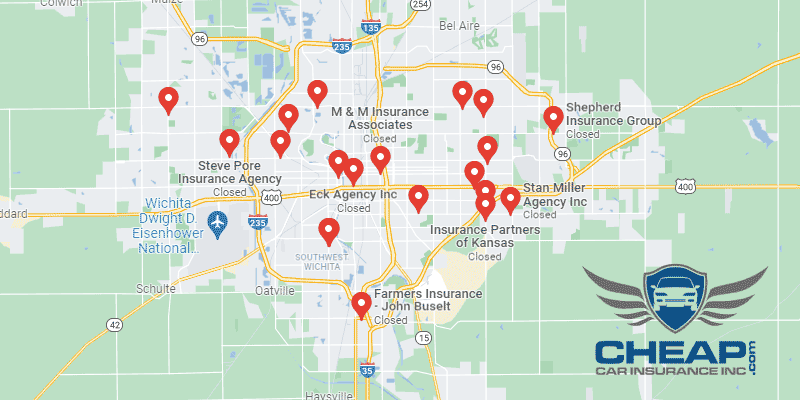

In the market for auto insurance in Wichita? At CheapCarInsuranceinc.com, you can get the best insurance rates close to you. To get free car insurance quotes from the top providers today, input your zip code into the quote box on this page.

Wichita has grown a lot over the years, which probably explains why it is the largest city in Kansas today. It has a long history of development and expansion which closely mirrors that of the historical US economy. Originally a cattle town, it soon evolved into a popular railroad stop. Eventually oil was discovered during the oil boom of the early 1900’s. Today, Wichita specializes in aviation technology. Learn more about Wichita, KS.

- Fun fact: Did you know that Wichita is #1 on the list of “Top 50 cities with greatest precentage of males working in industry: Transportation equipment (population 50,000+)”?

Coverage Requirements - Auto Insurance in Wichita Kansas

To drive legally in Wichita, you will need the following coverages:

| Coverage | Requirements | Most Common |

| Liability Bodily Injury | 30,000/55,000 | 100,000/300,000 |

| Liability Property Damage | 10,000 | 50,000 |

| Bodily Injury - Motorist Uninsured | 30,000/55,000 | 100,000/300,000 |

| Medical Payments | Not required | 5,000 |

| Collision | Not required | 500 deductible |

| Comprehensive | Not required | 250 deductible |

But remember that Liability coverage is extremely limited. Your Liability insurance will only pay out claims in the event that you get into an accident which you are deemed liable for (if the accident is your fault). If your car is stolen, or if you get into an accident caused by someone else, your insurance will not pay out on any claims.

Depending on many different elements, some Kansas motorists can expect to pay as high as $113/month for their Automobile insurance premiums. However, the average driver in Wichita with a good credit history and a clean record can get insured for around $32/month* from some of the top Kansas car insurance companies.

Based on the data above, it looks as though Hartford, Allied, and Nationwide are vying for lowest premiums in the state. But keep in mind there are other elements to consider, also. How good is their customer service record? Are they available 24/7 if you need to file a claim during non-business hours? How high will your monthly rate spike if you get a ticket? All of these questions can change what is and is not affordable based on your circumstances.

Auto insurance providers contemplate multiple elements when determining insurance quotes, including marital status, accident claims, occupation, driving distance to work, and theft protection devices. Also keep in mind that premiums differ from carrier to carrier. To find out whether you’re still getting the most affordable rate, compare cheap Kansas auto insurance quotes online.

Most Car Insurance Facts to know in Wichita KS

There is a variety of many items which may factor into the rate quotes you are provided with. Even though many of these things aren’t really anything you can do something about, a few of them are things that you can change for the better. Here are some elements which can affect your car insurance premium:

- Your Zip Code

Where you park your car each night will have a major impact on your auto insurance rate. Generally, car insurance is cheaper in rural areas because fewer cars means a smaller chance that you will get into a collision with another vehicle. The population of Wichita is 386,552 and the median household income is $43,538.

- Automobile Accidents

High accident rates in your zip code could equal higher premiums each month. Compared with the national average, Wichita’s Deadly accident statistics are fairly high, as you can tell from looking at the chart below. Ask your provider about safe driver discounts, which should help lower your rate.

- Car Thieving in Wichita

Finding cheap auto insurance can be confusing if you are at risk for auto theft. Certain popular vehicle models are attractive to thieves, as well as vehicles which are parked often in large cities. The total number of stolen vehicles in Wichita was 1,984 back in 2013. This means that Car Thieving are on the rise. Protect your vehicle from theft by making sure you have Comprehensive coverage on your policy.

- Your Credit Score

Your credit score can have a bigger impact on your monthly premiums than you might think. Just look at the data presented in the following chart. For someone with excellent credit, their monthly premium is anywhere from 50-75% cheaper than the monthly costs for someone with poor credit.

- Your Age

Statistically speaking, young and inexperienced drivers are the most likely to get into an accident. That’s why older drivers get charged lower monthly rates – because the insurance company is not taking on a huge financial risk by insuring them. If you are a young teenage driver, try looking into good student discounts, as well as Drivers Ed and defensive driving courses.

- Your Driving Record

After your credit score, your driving record is the next biggest factor which can alter your monthly premiums. Those with a clean driving record will pay substantially lower rates than motorists who have speeding tickets, other moving violations, or significant accidents in their recent past. If you have significant violations, such as a DUI, certain companies may refuse to insure you at all.

- Your Vehicle

As this chart shows, there is a significant difference between insuring a regular sedan and a fancy sports car. A good chunk of that price increase comes from the fact that a luxury automobile will require more than just basic insurance coverage.

Minor Car Insurance elements in Wichita

Now don’t forget about these elements, either:

- Your Marital Status

For individual policies, marital status will have a 1-2% difference, if it makes one at all. But married couples can save money by bundling their policies together with the same company. Insurance companies frequently give discounts as a reward for bundling multiple policies together.

- Your Gender

Gender has almost no substantial influence on your monthly rate. Many companies don’t charge different premiums based on gender at all. And those for those that still do, the rate rarely fluctuates beyond a 2-3% price difference.

- Your Driving Distance to Work

Wichita workers can anticipate an average commute lasting between 15-24 minutes. Over 85% of workers drive to their place of employment in their own vehicle each day, while around 6-12% carpool with their co-workers.

Your provider may ask you how many miles you anticipate driving each year, or why you’re driving in the first place (school/work/pleasure, etc). But whether or not your vehicle is for business is the largest factor. Business vehicles are charged 10-12% more on premiums than vehicles used to get to work and/or school.

- Your Coverage and Deductibles

Getting all the coverage you need can be expensive. That’s why some companies will charge you less per month if you agree to raise your deductible. However, be sure to save a little money away in case of an emergency if you choose to go this route.

- Education in Wichita, KS

It has recently been brought to light that drivers with a higher education often get better prices for their car insurance, even above drivers with prestigious jobs and/or high salaries. In Wichita, the greatest number of drivers on the road have obtained a high school diploma or an equivalent thereof. A smaller number of motorists have gone as far as earning a bachelor’s degree.

There are multiple options to choose from when looking for an institution of higher learning in Wichita. One popular choice is Wichita State University, a public institution offering scores of different degrees to more than 15,000 students each year. Friends University is a private school, but it educates nearly 3,500 students annually in just under 50 different degrees. There is also the University of Kansas School of Medicine-Wichita for those aspiring to join the medical field.

Regrettably for most insurance companies, a simple internet search can reveal many of their trade secrets. But even with the proper information, it can still be confusing for you as an individual to figure out your risk profile and find low-cost insurance. Make sure you do your due diligence before you commit to your next car insurance policy.

How We Conducted Our Car Insurance Analysis

Sources:

Department of Highway Safety and Motor Vehicles

Calculate YOUR auto insurance risks by entering your Wichita Zip Code into the calculator below.