Cheap Auto Insurance in New Orleans, LA

Do you need cheap auto insurance in New Orleans, LA? At CheapCarInsuranceinc.com, you can get the cheapest insurance rates locally. To find free car insurance quotes from the top providers today, input your zip code into the quote box on this page.

Despite the tragedy of Hurricane Katrina looming in New Orleans’ recent past, the city is still admired for its vibrant culture and a rich history. New Orleans started out as a key trading post between the Gulf of Mexico and the states bordering the Mississippi river. Today, it is host to professional sports teams and is still renowned as one of the top tourist destinations in the US.

- Fun fact: Did you know that New Orleans is #18 on the list of “Top 100 cities with strongest arts, entertainment, recreation, accommodation and food services industries (pop. 50,000+)”?

Coverage Requirements - Auto Insurance in New Orleans Louisiana

You need at least this much insurance coverage to drive legally in Louisiana:

| Coverage | Requirements | Most Common |

| Liability Bodily Injury | 15,000/30,000 | 15,000/30,000 |

| Liability Property Damage | 25,000 | 25,000 |

| Bodily Injury - Motorist Uninsured | Not required | 10,000/20,000 |

| Medical Payments | Not required | 5,000 |

| Collision | Not required | 500 deductible |

| Comprehensive | Not required | 50 deductible |

You’d think that having such low state minimum requirements for insurance would help make costs cheaper for Louisiana drivers. Not only is this false for average monthly premiums, but only carrying the bare minimum coverage in the event of an accident might still leave you with a pretty big bill.

Louisiana motorists pay some of the highest rates in the country – to the tune of $164 per month, on average. However, New Orleans drivers can find some pretty good discounts. You could even lower your monthly premium down to $114/mo* if you follow some of our tips.

Southern Farm Bureau and Nationwide are currently in the middle of a bidding war for lowest rates in New Orleans. But make sure you do your research on each company before you make a decision. Pay especially close attention to things like customer service reviews, and their ease of claims service.

Insurance companies evaluate many elements when establishing insurance quotes, including gender, driving violations, occupation, miles driven each year, and theft protection devices. In addition, premiums vary from carrier to carrier. To make sure you’re still getting the most favorable rate, compare cheap Louisiana auto insurance quotes online.

Most Car Insurance Facts to know in New Orleans LA

There is a wide array of many things which might factor into the rate quotes you get. While many of these issues aren’t actually anything you can do something about, a few of them are variables which you can change for the better. Here are a few elements which may alter your car insurance premium:

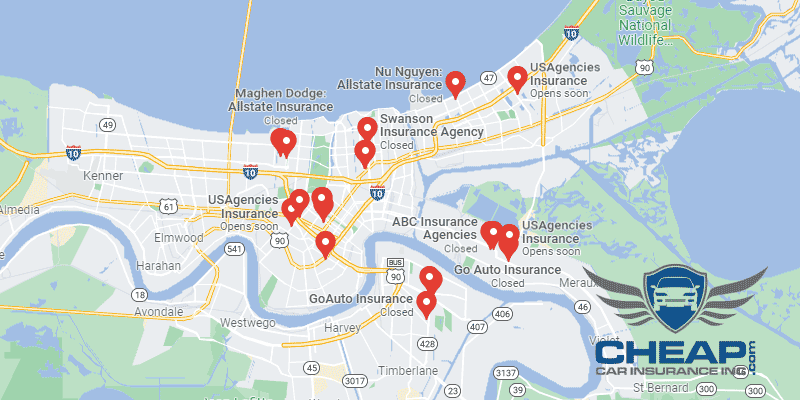

- Your Zip Code

Your auto insurance rates may differ based on where you call home. Usually, highly populated cities have higher auto insurance rates because the extra amount of drivers on the road boosts the probability of a collision! The population of New Orleans is 378,715 and the median household income is $36,631.

- Automobile Accidents

New Orleans has over a quarter million inhabitants, but that doesn’t necessarily excuse the high accident numbers in the chart below. In case you weren’t aware, areas with high rates of deadly accidents usually have more expensive insurance premiums, too. Ask your agent today if you can take advantage of any Safe Driver discounts to offset this risk.

- Car Thieving in New Orleans

Finding cheap auto insurance can be confusing if you are at risk for auto theft. Certain popular vehicle models are attractive to thieves, as well as vehicles which are parked often in large cities. The total number of stolen vehicles in New Orleans was 2,143 back in 2013. If you don’t have Comprehensive insurance coverage, you should consider adding it to your policy. Yes, it’s expensive, but raising your deductible might make it affordable.

- Your Credit Score

Are you aware of how high (or low) your credit score is? Because your insurance company is. In most states, they can’t calculate your monthly premiums without it. And if your credit is poor, you could end up forking out some significantly high premiums as a result.

- Your Age

Older drivers, by virtue of their many years of driving experience, get to enjoy immensely lower rates than their teenage and young adult counterparts. However, there is hope at a fair monthly rate for younger motorists, in the form of Driver’s Ed and Good Student discounts.

- Your Driving Record

Do you have a minor accident on your record that is sending your premiums through the roof? Well, that’s why the “Accident Forgiveness” policy was invented. It helps drivers like you get a fair monthly rate by omitting at least one minor citation from being calculated toward your overall premium.

- Your Vehicle

Luxury vehicles cost more to insure because, in order to protect that investment properly, you need to buy lots of different coverage types and in large amounts. And the more insurance you buy, the more you have to pay in premiums each month to maintain that coverage.

Minor Car Insurance elements in New Orleans

Of course, there are also these elements:

- Your Marital Status

If you’re married, then you get to take advantage of bundling discounts which single drivers don’t have access to. And it doesn’t stop at auto insurance. If you are currently covered by a major provider, ask and see if they offer other forms of insurance, such as homeowners, to bundle with as well.

- Your Gender

Do you know which gender should be charged more for their auto policy? Well, apparently, neither do most insurance companies. Most don’t bother to charge different rates at all anymore based on gender alone. And those that do only charge a few dollar’s difference per month.

- Your Driving Distance to Work

The average work commute for New Orleans drivers can range between 17-31 minutes. Only about 60% of workers drive to the office alone in their own car. Lots of drivers carpool, with 5-17% taking their coworkers into the office each day.

On average, registering your vehicle for business use will cost you 10-12% more in monthly premiums than for personal use. Additionally, it really doesn’t matter how many miles you drive each year, contrary to what you may have been told. Even a drastic decrease in miles driven may only save you 2-3% on your premiums.

- Your Coverage and Deductibles

One good way to lower your monthly rate is to raise your deductible. You see, the more you pay upfront when filing a claim, the less your insurance company has to pay to make good on that claim. And they offer lower rates as a reward for sharing more of the financial stress.

- Education in New Orleans, LA

More than one-quarter of New Orleans residents have not yet finished their high school education, while a similar number have in fact earned a high school diploma or similar equivalent. But did you know that taking your education one step further can lower your car insurance rates? It’s true! It’s the best way to get extra discounts, even beyond having a good job or a high salary.

There are nearly a dozen different schools to choose from if you’re looking to further your education in New Orleans. Eight of those are major four-year institutions, such as Louisiana State University Medical Center, the University of New Orleans, and Dil-lard University, to name a few. There are also many institutions which specialize in two-year and vocational degrees.

Determining your own personal financial risk can be extremely confusing or impossible for the standard insurance shopper. Insurance companies have an edge on consumers because of their statistics and experiential knowledge. Learn what insurance companies don’t want you to know. Learn more about New Orleans.

How We Conducted Our Car Insurance Analysis

Sources:

Louisiana Department of Insurance

Louisiana Office of Financial Institutions

Department of Highway Safety and Motor Vehicles

Find Cheap Auto Insurance in New Orleans, LA – See How Much You Can Save