Cheap Auto Insurance in Arvada, CO

Want cheap auto insurance in Arvada, CO? At CheapCarInsuranceinc.com, we can help you find affordable auto insurance in Colorado. All you need to do is enter in your postal code in the quote widget down below – it’s that simple!

One of the first discoveries of gold in the Rocky Mountains happened near Arvada, but prospectors who couldn’t make their fortune in minerals soon began farming the nearby land. Agriculture became a profitable business as gold resources grew scarce. Today, many know Arvada by its nickname, “The Celery Capital of the World”.

- Fun fact: does the air seem a little thin up in Arvada? Because this city is #10 on the list of “Top 100 highest located cities (pop. 50,000+)”. Learn more about Arvada by clicking here.

Coverage Requirements - Auto Insurance in Arvada Colorado

Driving legally in Arvada requires:

| Coverage | Requirements | Most Common |

| Liability Bodily Injury | 25,500/50,500 | 105,000/305,000 |

| Liability Property Damage | 15,000 | 100,000 |

| Bodily Injury - Motorist Uninsured | Not required | 100,000/300,000 |

| Not required Coverage | Medical Payments Coverage | 5,000 |

| Collision Coverage | Not required Coverage | 700 Insurance deductible |

| Comprehensive Coverage | Not required Insurance | 300 deductible |

Technically, you don’t have to purchase any of the coverages or amounts on the right side of the table above to be able to drive in Colorado. However, you’ll likely end up being financially responsible if you cause any sort of accident, get your vehicle stolen, or suffer damage from a severe storm. However, many motorists find that a compromise between the middle and right columns above is an affordable way to protect themselves in many different situations.

Colorado really has some pretty reduced rates. The typical monthly premium for many motorists is about $82. However, Arvada motorists can beat even this low cost – how do you want to pay less than $31/mo*?

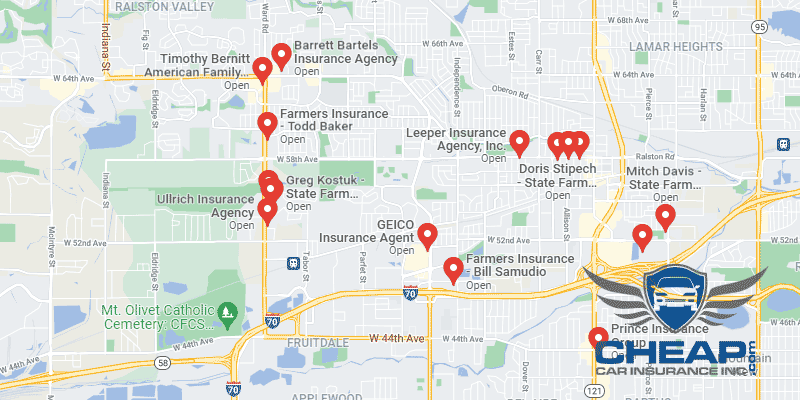

Farmers, Amica, and Nationwide are offering reduced rates in your town at this time. But when you are considering switching companies, take some time to discover what else they need to offer. In the end, customer support and efficient claims processing are essential areas of the insurance coverage experience.

Companies that supply insurance coverage evaluate numerous elements while figuring out insurance quotes, especially gender, where you live, your credit report, education, and business use of the vehicle. On top of that, premiums differ from amongst providers. To make sure you are still forking out the lowest-cost fee, compare cheap Arvada motor vehicle insurance premiums on the web.

Most Car Insurance Facts to know in Arvada CO

Each time your vehicle insurance agency gets ready to craft your plan, they take many elements into consideration. A few of these, such as credit history or your particular location, can be improbable to vary. Here are various other examples:

- Your Zip Code

Insurance companies need to know your location (or the place you will probably be driving a vehicle usually) as a way to evaluate the prospect of an accident. The whole thing amounts to a very simple principle: the larger the populace, the greater amount of vehicles there will be on the road, as well as the more chances you could have to hit or even be hit by another car or truck. The population of Arvada is 106,433 and also the common family earnings are $66,378.

- Automobile Accidents

Did you know that insurance companies tend to offer their lowest rates to motorists who live in the safest cities? And the roads of Arvada, with its low rate of Deadly accidents, makes it one of those safe cities. You may already be getting lower rates automatically.

- Car Thieving in Arvada

Acquiring inexpensive automobile insurance can be confusing if you are at risk for auto theft. Certain popular car or truck models are alluring to thieves, as well as vehicles which are left often in huge metropolitan areas. The full amount of thieved cars in 2013 dropped to 207 for Arvada.

- Your Credit Score

In certain states, you will find car insurance companies that provide clients a rest and charge more sensible rates (for example Countrywide or Allstate within the chart below) for getting a minimal credit ratings. A lot of companies, however, charges you you drastically greater premiums for getting under perfect credit.

- Your Age

significant driving violations makes it confusing, otherwise impossible, to locate affordable coverage. But when you are like the majority of motorists, you most likely have a couple of annoying citations in your record which are making your payments irritatingly costly.

- Your Driving Record

significant driving violations makes it confusing, otherwise impossible, to locate affordable coverage. But when you are like the majority of motorists, you most likely have a couple of annoying citations in your record which are making your payments irritatingly costly.

- Your Vehicle

If you are likely to buy a costly luxury vehicle, you are going to need to buy a luxury automobile insurance plan to choose it. Anything under high levels of various sorts of coverage (comprehensive, collision, UM/UIM, etc) and you’ll have to assist your insurance provider purchase repairs, damages, hospital bills, or changing your automobile.

Minor Car Insurance elements in Arvada

Of course, assuming you can control any of the following, you can lower your rate further with:

- Your Marital Status

Are you aware that most providers offer huge discount rates for bundling multiple insurance plans together? And married people possess the best chance to benefit from such discount rates. Also it does not visit vehicle insurance – you are able to bundle boat, motorcycle, or homeowner’s guidelines, too.

- Your Gender

A long time ago, providers accustomed to charge different monthly rates according to gender. However that is not the situation any longer. Many providers charge both women and men equal rates. Individuals that do charge in a different way only vary their prices by 1-3%.

- Your Driving Distance to Work

More than 82% of Arvada residents depend on their own truck or car as their primary means of transportation, which could explain why insurance rates are so high. It might also explain the traffic problems too: average commutes typically last 20-25 minutes, with 30-35 minute commutes also highly likely. Less than 5% of drivers carpool.

If you’re able to avoid insuring your automobile for business use, it’s well worth the effort, since that kind of coverage costs around 10-12% greater than personal-use vehicles. As well as your yearly miles don’t matter around you may think they are doing. A 5,000-mile difference will not improve your premiums by greater than 3-4%.

- Your Coverage and Deductibles

Are you aware that modifying your deductible can drastically change your monthly premium? Most motorists will most likely choose to raise their deductible, since it can help to eliminate the price of their monthly repayments. Keep in mind when the worst happens, you’ll have to pay that greater deductible first before your insurance provider will give you any financial help.

- Education in Arvada, CO

Nearly 26% of all Arvada residents have earned a high school diploma, while an impressive 20% have also gone on to successfully complete a college degree. If you are a member of this highly educated group, you can use your degree to get lower rates on your insurance policy. The more education you have, the higher the discount you should be eligible for. Contact your provider for details.

There are many different educational possibilities you can pursue if you live in Arvada. At Regis University, you can earn a 4-year degree in one of multiple fields, or even a master’s in business administration. And for a useful degree in less time, aspiring students might want to look into Red Rocks Community College or Heritage College.

You shouldn’t let an undesirable automobile insurance provider persuade you into purchasing a motor vehicle insurance policy that is not right for you. Sure, the quantity of information required in order to assess your personal risk profile can be overpowering, however comparison internet websites like this might help make your search much easier. Just submit a couple of specifics below, and we’ll take over from there.

How We Conducted Our Car Insurance Analysis

Sources:

Colorado Division of Insurance

Colorado Division of Financial Services

Department of Highway Safety and Motor Vehicles

Compare Multiple Rates Side By Side