Cheapest Auto Insurance in Denver, CO

Do you need auto insurance in Denver, CO? At CheapCarInsuranceinc.com, you will find the best insurance rates in your city. To obtain free Colorado car insurance quotes from the top providers today, provide your zip code into the quote box on this page.

Located a mile above sea level, Denver is a central location for economic and transport activity in the western half of the United States. The city has enjoyed cyclical economic growth in the past, and now plans to renovate its infrastructure in order to make room for high technology industries. Also, Denver has one of the highest quality of life ratings in the US.

- Fun Fact: Did you know that Denver is #9 on the list of “Top 101 biggest cities in 2008”? Learn more about Denver.

Coverage Requirements - Auto Insurance in Denver Colorado

Here are the legal minimum insurance requirements for Colorado drivers:

| Coverage | Requirements | Most Common |

| Liability Bodily Injury | 25,500/50,500 | 105,000/305,000 |

| Liability Property Damage | 15,000 | 100,000 |

| Bodily Injury - Motorist Uninsured | Not required | 100,000/300,000 |

| Not required Coverage | Medical Payments Coverage | 5,000 |

| Collision Coverage | Not required Coverage | 700 Insurance deductible |

| Comprehensive Coverage | Not required Insurance | 300 deductible |

Remember: Liability only covers you if the accident was deemed your fault. Any other incident, and your insurance provider won’t pay out any claims. Likewise, if you purchased a newer vehicle and you are still financing it, you lender might require you to purchase additional insurance coverage, whether you like it or not.

Most Colorado drivers are finding themselves forking out around $130 per month for Automobile insurance in Colorado. However, Denver drivers have the opportunity to pay as little as $53/mo*! You can learn money-saving tricks and tips here in this article.

The Geico, Farmers, and Nationwide are offering some of the lowest rates in the Denver area right now. But that might not always be the case. Insurance providers are constantly changing their rates and updating their data. Not to mention that a low rate doesn’t necessarily predict good customer service or a smooth claims process.

Auto insurance providers evaluate numerous elements when assessing insurance quotes, including driving violations, accident claims, credit score/rating, miles driven each year, and multiple cars and drivers. Additionally,, premiums differ from provider to provider. To verify you’re still receiving the most favorable rate, compare cheap Denver auto insurance quotes online.

Most Car Insurance Facts to know in Denver CO

There are lots of ways in which your car insurance rate may be estimated. But not all of it is out of your control; there are things you can do so that you can control what discounts you are entitled to acquire. Listed below are a few of these components in greater detail:

- Your Zip code

The cheapest car insurance is usually found in cities with a lower population density. Because there are fewer vehicles on the road, there are fewer possibilities for you to get into a major car accident with another driver. The population of Denver is 649,495 and the median household income is $51,089.

- Automobile Accidents

The lower the rate of Deadly accidents in your zip code, the less you’ll end up playing in car insurance premiums. As you can see in the chart below, the accident rate is a little high. This may have an unfortunate effect on your monthly premiums.

- Car Thieving in Denver

Auto theft is a major problem, especially in densely populated cities. If your location and/or vehicle model put you at a greater risk for theft, you may have trouble finding low-cost car insurance. The total number of stolen vehicles in Denver was 3,487 in 2013. The good news is that theft rates are on the decline. The bad news is that if you don’t have any Comprehensive insurance coverage (which tends to be a little pricey), then you aren’t protected from auto theft.

- Your Credit Score

There are many things which are determined by your credit score – and, for better or for worse, car insurance is one of them. The better your score, the lower your monthly rate will be. Regrettably, motorists with poor credit are charged immensely higher rates, and the chart below shows.

- Your Age

Trying to insure a young, teenage driver? Well, it will likely be a confusing and expensive endeavor. This is because accident statistics are highest amongst young and inexperienced teenage drivers. However, good grades can qualify them for a “Good Student” discount, and driver’s Education courses can earn even further discounts.

- Your Driving Record

Insurance providers are increasingly offering “Accident Forgiveness” discounts for drivers with minor violations on their record. However, there are limits to these discounts. Most of them won’t apply to significant citations, such as a DUI or a Reckless Driving charge. Not only are such offenses expensive, but you may end up losing your coverage.

- Your Vehicle

Some drivers, especially those with an older or less expensive vehicle, can get away with the bare minimum insurance coverage. However, before you rush out to purchase a luxury vehicle for yourself, consider the fact that it will also come with a huge insurance bill each month. After all, you wouldn’t insure a luxury vehicle with Liability only, would you?

Minor Car Insurance elements in Denver

In addition to the elements mentioned above, you should also be concerned with:

- Your Marital Status

Being a single driver vs. a married one doesn’t net you any significant discounts as an individual motorist. However, bundling your insurance with your spouse can significantly put a dent in your monthly bill. However, this may require one or both of you to switch to the same insurance provider.

- Your Gender

Regardless of past misconceptions, the idea that one gender is safer behind the wheel than the other (and therefore deserves to pay less in premiums) is slowly fading away. Many companies don’t charge different premiums at all if gender is the only factor in question. For those that do, it rarely makes more than a 1-2% difference.

- Your Driving Distance to Work

The average commute to work for Denver motorists can last anywhere from 18-24 minutes on average. About 70% of drivers choose to drive to work in their own car, while another 3-12% carpool.

How much do you think you could save each year by limiting your driving? What if you only drive your vehicle to work or school? Well, you’ll probably save more on gas than you will on lower insurance premiums. However, if your vehicle is registered for business use, prepare for a rate hike as high as 10% or more.

- Your Coverage and Deductibles

Need more coverage, but don’t have enough money to budget each month? Talk to your insurance agent about raising your deductible. Yes, you will have to pay more in the event that you need to file a claim, but think about how much you can save long-term with a lower monthly payment.

- Your Education

The largest number of Denver motorists have earned a bachelor’s degree, while a lesser number are either still working on their high school diploma or have already graduated. And speaking of education, did you know that the more education you have, the more money you can save on your car insurance rate? It’ll actually give you a bigger discount than your profession, or your yearly salary.

Considering the fact that the Denver area supports more than 15 different two- and four-year institutions, it’s no surprise that so many drivers in the city have degrees in higher education. One of these Denver Universities, the Daniels School of Business, is ranked on list of the top 10 business schools in the country according to the Wall Street Journal. And for those who want to take an alternative approach to their education, there is the Colorado Free University with open enrollment options.

Regrettably for most insurance companies, a simple internet search can reveal many of their trade secrets. But even with the proper information, it can still be confusing for you as an individual to figure out your risk profile and find low-cost insurance. Make sure you do your due diligence before you commit to your next car insurance policy.

How We Conducted Our Car Insurance Analysis

Sources:

Colorado Division of Insurance

Colorado Division of Financial Services

Department of Highway Safety and Motor Vehicles

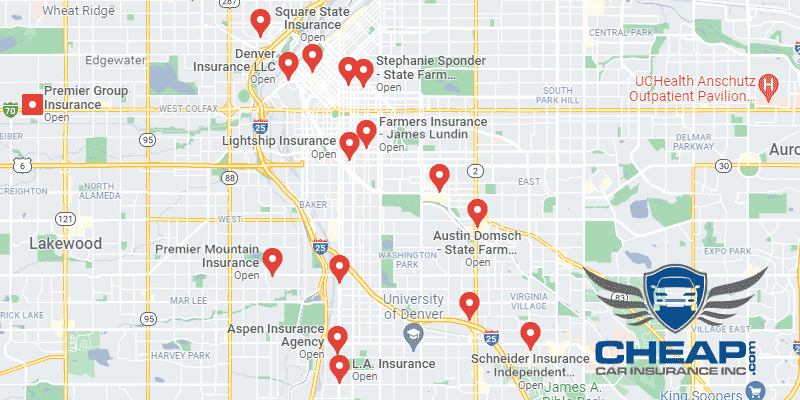

These Companies Offer Lowest Rates on Auto Insurance in Denver, CO – Compare Quotes Now – Select Your State Below