Cheap Auto Insurance in St. Petersburg, FL

In the market for cheap auto insurance in St. Petersburg FL? At CheapCarInsuranceinc.com, you could find the best insurance rates in your area. To get free quotes from the major providers today, type your zip code into the quote box on this page.

Affectionately referred to as “St. Pete” by locals, St. Petersburg is a thriving hot sport for tourism, sports, manufacturing, and health care. 75% of the city is bordered by beaches, and the consistently sunny weather attracts tourists and snow birds alike. The nearby Tropicana Field hosts the Devil Rays, making it a good city for baseball fans.

- Fun Fact: did you know that St. Petersburg is #25 on the list of “Top 50 cities with greatest precentage of females in occupations: Preschool, kindergarten, elementary and middle school teachers (population 50,000+)”? Learn more about St. Petersburg, FL.

Coverage Requirements - Auto Insurance in St Petersburg Florida

St Petersburg, like all Florida cities, requires the following minimum coverages on all Automobile insurance policies:

| Coverage | Requirements | Most Common |

| Liability Bodily Injury | Not required | 100,000/300,000 |

| Liability Property Damage | 10,000 | 50,000 |

| Bodily Injury - Motorist Uninsured | Not required | 10,000/20,000 |

| Not required Coverage | Medical Payments Coverage | 5,000 |

| Collision Coverage | Not required Coverage | 700 Insurance deductible |

| Comprehensive | Not required | 250 deductible |

Are you still making payments on a new car? Well, it’s important to let your insurance company know up front. Many lenders won’t let you purchase any kind of insurance which doesn’t contain Comprehensive and Collision coverage.

Good news for St. Petersburg drivers: on average, motorists who live in your city only pay about $99* per month for car insurance. That’s just below the state average of $153, and well below some of the more populated cities in Florida.

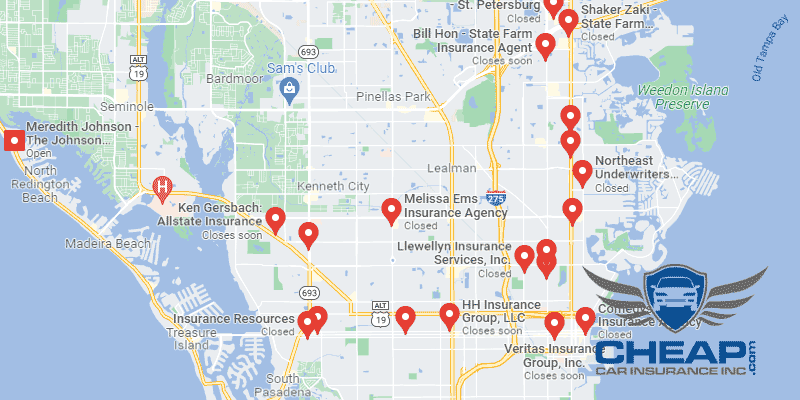

You have multiple good options to choose from when it comes to affordable Automobile insurance in your area. Allstate and 21st Century are two of the least expensive, with Allied and Liberty Mutual charging some of the highest rates. Just remember that a lower price doesn’t always mean better service. Do your research, and make sure you’re getting your money’s worth from your provider.

Auto insurance carriers evaluate numerous elements when determining insurance quotes, including marital status, Type of vehicle owned, education, and current insurance coverage and limits. Also keep in mind that premiums differ from company to company. To make sure you’re still forking out the cheapest rate, compare auto insurance in Florida online.

Most Car Insurance Facts to know in St. Petersburg FL

There are multiple ways in which your car insurance rate can be calculated. But not all of it is out of your control; there are things you can do in order to influence what discounts you are eligible to receive. Listed below are some of these elements in greater detail:

- Your Zip Code

Where you park your car each night will have a major impact on your auto insurance rate. Generally, car insurance is cheaper in rural areas because fewer cars on the road mean a smaller chance that you will get into a collision with another vehicle. The population of St. Petersburg is 249,688 with a median household income of $43,894.

- Automobile Accidents

For pretty obvious reasons, areas which have a higher rate of automobile accidents will likely come with higher insurance premiums as well. The accident statistics for St. Petersburg are relatively low, with only 17 Deadly accidents for the year 2013.

- Car Thieving in St. Petersburg

Finding cheap auto insurance can be confusing if you are at risk for auto theft. Certain popular vehicle models are attractive to thieves, as well as vehicles which are parked often in large cities. The total number of stolen vehicles in 2013 was 1,124 for the city of St. Petersburg, which is an increase from previous years. If you think your vehicle is at risk for vandalism or theft, make sure you add Comprehensive coverage to your insurance policy. This is the only form of coverage that will pay out claims on stolen vehicles.

- Your Credit Score

If you have good or excellent credit, you’re in luck. Drivers with higher credit scores will get offered substantially lower rates from their insurance providers. Low credit scores, on the other hand, tend to be penalized with a higher monthly premium.

- Your Age

Young, inexperienced drivers will generally be charged much higher rates per month than someone in their 30’s, 40’s, or beyond. The less experience you have behind the wheel, the more likely you are to cause an accident. Charging teenage drivers a higher premium is the insurance company’s way of offsetting potential expenses.

- Your Driving Record

Nobody gets on the road intending to get into an accident, but Regrettably driving mistakes happen. Whether it’s a low level speeding ticket or a minor traffic violation, you might want to ask your provider about accident forgiveness. It’s an easy way to make sure minor blemishes on your driving record don’t produce sky-high insurance premiums. More significant violations, such as a DUI, will immensely increase your rate. Sometimes, your insurance company may drop you all together if the violation is significant enough.

- Your Vehicle

Thinking about purchasing insurance for a luxury vehicle? If you can afford it, go right ahead – but keep in mind that you will need an equally luxurious insurance policy to keep yourself protected from accident- and theft-related expenses. Economical cars, on the other hand, don’t require as much coverage, and therefore have lower monthly rates.

Minor Car Insurance elements in St. Petersburg

Of course, those aren’t the only elements. The elements below will alter your rate too:

- Your Marital Status

Sometimes your marital status – whether you are single, married, or divorced – can immensely change your monthly rate. This is especially true for married couples who choose to bundle their insurance policies together. Some couples can save as high as 27% with the right company.

- Your Gender

No matter what sort of preconceived notions you may be harboring regarding gender and driving ability, the truth is that most insurance companies don’t know who is better at driving. That’s why some companies charge 2-3% more for males, and some charge less. Other progressive entities charge equal rates regardless of gender.

- Your Driving Distance to Work

Did you know that nearly 81% of St. Petersburg residents drive to work alone? Little more than 8% choose to carpool. The average commute is a slightly less stressful 23 minutes, when compared to the national average.

Your insurance company may ask whether you drive your vehicle for work/school, pleasure, or whether it is a business vehicle. You may also be asked how many miles you plan on driving each year. While the answers to these questions may adjust your rate by a few percentage points, only business vehicles will see a significant monthly rate increase above 10%.

- Your Coverage and Deductibles

Adding lots of coverage options makes sense for a more expensive vehicle. For vehicles of lesser value, however, you can save yourself some money each month by sticking to a more basic insurance policy. You can also add a few extra benefits to your coverage and keep your monthly rates low by raising your deductible – just make sure you can afford to shell out the cash if the worst happens.

- Education in St. Petersburg, FL

The more education you’ve had, the less likely you are to get into an accident according to insurance company statistics. For the city of St. Petersburg, most residents have at least a high school diploma or some equivalent. Thankfully, having a lower monthly income than you would like or a less-than-glamorous job won’t negatively impact your monthly rate. Your education level is a much more important factor.

St. Petersburg has a number of prestigious universities to offer its residents, whether you’re moving there for college or you’re a working adult looking to go back to school. Stetson University is home to Florida’s oldest law school. USF (the University of South Florida) also maintains a campus in St. Petersburg. Meanwhile Eckerd College, a private institution, is available for students who are interested in studying abroad or work-study programs.

Regrettably for most insurance companies, a simple internet search can reveal many of their trade secrets. But even with the proper information, it can still be confusing for you as an individual to figure out your risk profile and find low-cost insurance. Make sure you do your due diligence before you commit to your next car insurance policy.

How We Conducted Our Car Insurance Analysis

Sources:

Florida Office of Insurance Regulation

Florida Department of Financial Services

Department of Highway Safety and Motor Vehicles

Compare Insurance Rates from the Best Companies in St. Petersburg, FL. Get Better Coverage & Rates.