Cheap Auto Insurance in Tallahassee, FL

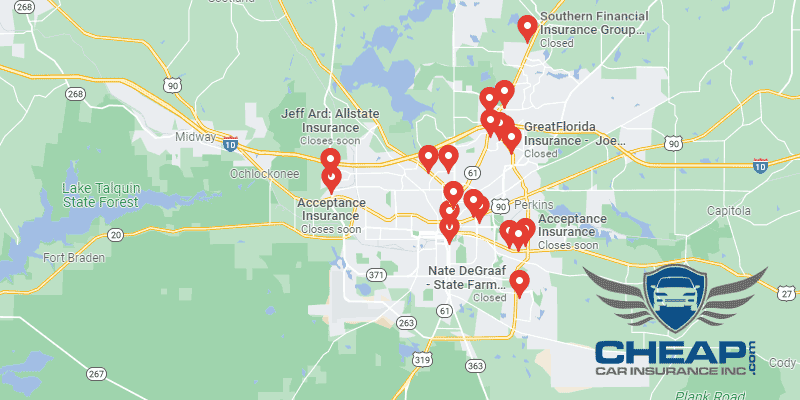

Are you needing cheap auto insurance in Tallahassee, FL? With CheapCarInsuranceinc.com, it’s only a click away. What you need to do is submit your postal code in the search widget down below – it’s that easy!

Tallahassee is named after a Native American word for “land of the old fields”. Before European settlement, the area which is now the state capital of Florida was primarily Apalachee territory. Today, it serves as the central hub of government and educational activities for the entire state and has a predominantly younger population than other Florida cities.

- Fun Fact: Does it feel a little moist out here to you? Because Tallahassee is #2 on the list of “Top 101 cities with the highest maximum monthly morning or afternoon humidity (population 50,000+)”. Learn more about Tallahassee by clicking here.

Coverage Requirements - Auto Insurance in Tallahassee Florida

Driving legally in Tallahassee requires:

| Coverage | Requirements | Most Common |

| Liability Bodily Injury | Not required | 100,000/300,000 |

| Liability Property Damage | 10,000 | 50,000 |

| Bodily Injury - Motorist Uninsured | Not required | 10,000/20,000 |

| Not required Coverage | Medical Payments Coverage | 5,000 |

| Collision Coverage | Not required Coverage | 700 Insurance deductible |

| Comprehensive | Not required | 250 deductible |

Bear in mind that various kinds of vehicles will need various kinds of insurance plans. If you’re driving a mature, used vehicle, you may be fine with only the state-required mandatory minimums. An extravagance vehicle, however, will need a lot more coverage. Even your average-listed sedan, whether it’s new or a few years old, will require better quality coverage.

Most Florida motorists are spending about $153 every month, typically, for his or her Automobile insurance plan. But if you reside in Tallahassee, you will not need to pay such high costs. You are able to get really good coverage for less than $57/mo*!

Between Liberty Mutual, Amica, and Allstate, you might have trouble locating a lower rate in your town. But don’t forget: reduced rates aren’t everything. Yes, the savings is great, but what if their customer support stinks? Or let’s say their claims process is tough and time-intensive? They are essential things to research before you decide to switch providers. However, there are still plenty of ways you can save on car insurance in Florida even more! Just keep reading.

Those who supply vehicle insurance policies evaluate many variables while figuring out insurance rates, especially driving experience, zip code, type of vehicle owned, driving distance to work, and current insurance coverage and limits. Also remember that premiums differ from business to business. To find out if you are still being charged the lowest-cost premium, check cheap Tallahassee automobile insurance price quotes via the internet.

Most Car Insurance Facts to know in Tallahassee FL

You may feel slightly powerless whenever your automobile insurance agency is evaluating your rate; let’s be honest, many of the variables they will calculate aren’t issues you will be able to adjust or control. Fortunately, however, there are still things which you may be in a position to adjust for higher discounts, just like:

- Your Zip Code

The spot where you store your automobile each night will likely have a significant influence on your vehicle insurance rate. Typically, automobile insurance is less expensive in non-urban areas simply because a lesser number of cars and trucks indicates a reduced chance that you’re going to get into a collision with another car. The populace of Tallahassee is 186,411 and the normal household earnings are $39,564.

- Automobile Accidents

The total count of significant accidents in Tallahassee might be a cause for concern with your insurance provider. They will usually increase premiums on everyone who lives within a zip code where the roads are dangerous. But if you are a relatively safe driver, there could be discounts available for you.

- Car Thieving in Tallahassee

Anti-theft technologies tend to be a terrific way to protect yourself from auto thieves. They’re relatively cost-effective, easy to have set up, and once outfitted, call for little effort by you. And best of all, almost all insurance companies will provide you with a discount on your insurance just by having one! Within Tallahassee, there were 440 Car Thieving in 2013.

- Your Credit Score

Your credit rating is among the most significant figures inside your existence. It will settle if or otherwise you are able to qualify or get good rates on the majority of different financial items, as well as your Automobile insurance plan. As you can tell within this chart, there are multiple immensely different rates between motorists with excellent credit, and individuals with a bad credit score scores.

- Your Age

Older motorists, using their years of driving experience, are billed immensely less every month than more youthful ones. Generally, anybody younger than 25 can count on forking out considerably more. However if you simply continue to be in class, you can test to reduce this stress with a decent Student or perhaps a Driver’s Ed discount.

- Your Driving Record

Your driving history is essential for your insurance company – if without other reason of computer gives a lot of companies a reason to drastically lift up your rates for getting minor driving violations inside your the recent past. There are multiple companies, though, that provides you with a rest and provide an “accident forgiveness” discount without having anything too major in your record.

- Your Vehicle

Neglecting to purchase enough coverage is much like going skydiving having a small parachute: once the worst happens, it will not be sufficient to completely safeguard you. Habits costly luxury vehicles want more coverage options, as well as in greater amounts. Hence, the drastic improvement in payments which you’ll see within the chart above.

Minor Car Insurance elements in Tallahassee

And here are more ways you can save, if any of these elements are under your control:

- Your Marital Status

If you and your partner aren’t bundled to the same auto policy, you may be flushing money to waste. Insurance providers like to drum up business by providing couples the chance to bundle their guidelines together.

- Your Gender

Based on most insurance providers, males are not from Mars and ladies aren’t from Venus with regards to car insurance rates. Since there is no hard record data to demonstrate that either gender may be the superior driver, a lot of companies have eliminated the concept of charging women and men different premiums.

- Your Driving Distance to Work

Commuting through Tallahassee is easier than you might think. Even though more than 2/3rds of drivers depend on their own vehicle for commuting alone, almost 15% will probably carpool. This means that average commute times usually only last between 15 and 20 minutes, with some as short as 10 minutes.

Some insurance providers would like you to consider that driving less will decrease your monthly rates. For an extent, this is often true – if one makes some drastic cuts inside your yearly mileage. The issue though is the fact that you’d need to reduce your miles by 5,000 each year or even more simply to visit a modest discount.

- Your Coverage and Deductibles

If you think you are having to pay an excessive amount of for the payments, ask the local agent about raising your deductible. It’s a terrific way to decrease your costs while still maintaining good coverage. Just make certain that you could manage to spend the money for greater deductible should you have to file claims.

- Education in Tallahassee, FL

The lower rates in Tallahassee might be related to its education level (since the higher your education, the lower your insurance rates will be). More than one quarter of residents have at least a bachelor’s degree, which is almost double the state average. Just below that are the number of high school graduates, which make up almost 17% of the population.

Tallahassee is a bit of a college town and home to the main campus of Florida State University. This massive public school offers bachelor’s degrees and more to its 38,000 students in the areas of science, performing arts, and high-tech fields. There is also Florida A&M University which boasts a racially diverse student body, and the Tallahassee Community College for those who wish to pursue a transfer program or an associate’s degree

Automobile insurance is probably the most important investment decision you will make as a buyer. You’ll want to ensure you locate a respectable, accountable supplier that will follow through on their claims. A number of automobile insurance agencies usually are much better at this as opposed to others, and conducting a conscientious internet based investigation can help you split the favorable from the poor.

How We Conducted Our Car Insurance Analysis

Sources:

Florida Office of Insurance Regulation

Florida Department of Financial Services

Department of Highway Safety and Motor Vehicles

Start comparing rates right now. It’ll only take a few minutes, and you can save a lot of money!