Cheap Auto Insurance in Austin, TX

In the market for cheap auto insurance in Austin, TX? With CheapCarInsuranceinc.com, even you could get the lowest priced insurance premiums for your area. In order to obtain free car insurance rates available from the best providers right away, key your local zipcode into the quote box here.

Austin serves as both the capital of Texas and one of the state’s most livable cities. It has won numerous awards, including theMen’s Journal for being one of the “best places to live” within the United States. These praises are mostly to Austin’s striking balance of educational opportunity, culture, natural beauty, low crime rate, and economic success.

- Fun fact: they say everything is bigger in Texas…which must be why Austin is #17 on the list of “Top 100 biggest cities”! Learn more about Austin by clicking here.

Coverage Requirements - Auto Insurance in Austin Texas

Driving legally in Austin requires:

| Liability Bodily Injury | 30,000/60,000 | 30,000/60,000 |

| Liability Property Damage | 25,000 | 25,000 |

| Bodily Injury - Motorist Uninsured | Not required | 30,000/55,000 |

| Medical Payments | Not required | 2,500 |

| Collision | Not required | 500 deductible |

| Comprehensive | Not required | 500 deductible |

Are you worried about auto theft, vandalism, or getting hit by an uninsured driver? If so, then you’re going to need more than just the Liability requirements listed in the middle column above. Take a closer look at the right side of the table if you want to know what types and amounts of coverage you should be shopping for.

Here’s something you might not know about Texas Car Insurance: the average motorist on the road right now is forking out around $135 each month, and that’s just for basic coverage. However, Austin residents can get quality insurance for as low as $88/mo* of you let us show you how to shop around for the best deal.

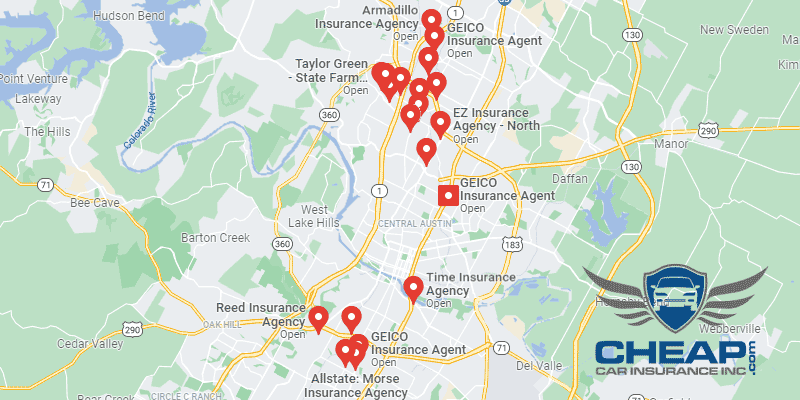

Between Encompass and Texas Farm Bureau, it’s hard to find a provider in Austin who is willing to offer the average driver a lower rate. But we emphasize the word “average”. If there is something unique about your driver profile, such as poor credit or a storied accident history, you may not be able to get such good rates from them.

Companies that underwrite auto insurance coverage evaluate multiple elements while calculating insurance rates, especially marital status, how many accident claims you’ve filed in the past, occupation, miles driven each year, and multiple cars and drivers. Also, premiums could alter from between companies. To confirm that you’re still receiving the lowest-cost premium, do a comparison of cheap Texas auto insurance premiums online.

Most Auto Insurance Facts to know in Austin

Each time your automobile insurance agency prepares to create your plan, they take lots of aspects under consideration. Some, such as your car’s make/model or your specific location, usually are improbable to modify. Here are various additional examples:

- Your Zip Code

Cheap auto insurance is normally associated with towns having a smaller population density. Since there are a lesser number of vehicles cruising the road, you will find a lot fewer chances to get involved in a significant wreck with a different individual. The populace of Austin is 885,400 and also the typical family income is $56,351.

- Automobile Accidents

On a per capita basis, your risk of getting into a Deadly accident in Austin are much lower than in many other Texas cities. However, overall, those numbers in the chart below are still high. And it’s likely that insurance rates in your area are artificially inflated because of the enhanced risk. Try asking your insurance agent if you qualify for any Safe Driving discounts that your provider may offer to try and offset the extra expense.

- Car Thieving in Austin

If your truck, car, or SUV presents a higher risk for auto theft, obtaining cheap auto insurance might be stresssome for you. multiple trendy car or truck models tend to be hard for criminals to resist, and vehicles that are left typically in huge urban centers are exceptionally vulnerable. The full number of vehicles stolen in Austin rose slightly to 2,169 during 2013. This means that the rate of theft is Austin is slowly decreasing from previous years. However, you might want to consider having some Comprehensive coverage on your policy just in case, even if you’re carrying it with a high deductible.

- Your Credit Score

There are many states in the union where having a poor credit score will severely increase your monthly premiums. Regrettably, Texas is one of those states, as you can see by looking at the chart below. Some providers, like Allstate, consider poor credit such a risk that they won’t sell you insurance at all. Other, more understanding providers, like Mercury, only increase your premiums by a moderate amount.

- Your Age

If you’re a parent with a teenage driver, or a young student trying to find insurance on your own, it’s going to be a very expensive struggle. But getting good grades and taking driving education courses will get you some helpful discounts.

- Your Driving Record

Your driving record is very important to Texas insurance providers – perhaps more so than in other states. For the best rates, try to keep significant violations off your record, and shop around for an insurance company willing to offer “accident forgiveness” discounts.

- Your Vehicle

Ask any insurance agent, and they’ll all probably tell you the same thing: it’s too big of a financial risk to purchase less coverage than your vehicle is worth. Legally, under certain circumstances, it might be possible. But odds are that your insufficient coverage won’t pay out on any claims, and you will be 100% responsible for any and all expenses.

Minor Car Insurance elements in Austin TX

You might also find some savings (or avoid some expensive penalties) by forking out attention to the elements below:

- Your Marital Status

Married couples, unlike single drivers, have the option to bundle their policies together. Also, if your insurance company offers many different types of financial products, you can add those to the total bundle for even more savings from your insurance company.

- Your Gender

If you ask six different insurance companies whether men or women should be charged more for automobile insurance, you’ll likely get seven different answers. This is because there doesn’t exist any scientific data which shows one gender is riskier than the other. Many providers don’t even factor gender into their overall rate calculations anymore.

- Your Driving Distance to Work

Commute times can vary wildly for drivers in Austin. Most of the time, residents can anticipate spending about 16 to 18 minutes behind the wheel each way. However, trips as long as 24 minutes or as short as 14 minutes are also fairly common. Less than 75% of motorists will be using their own truck, car, or SUV in order to get around, while around 3-10% will likely carpool.

How many miles do you think you would have to cut out of your daily commute in order to get a discount on your monthly premium? Five? Ten? The answer is actually closer to 15-20 miles per day. And that’s only for a moderate discount of 3-5%.

- Your Coverage and Deductibles

Drivers who wish to reduce their monthly payments might want to consider raising their deductible. But you have to do some prep work first. Make sure you have the money for your premium in a savings account or other safe place. After all, you don’t want to get stuck without a vehicle if the worst happens and you can’t afford to pay that higher deductible.

- Education in Austin, TX

Austin is a phenomenally well-educated city, with more than 25% of its residents owning college degrees. 17% have not yet gone beyond their high school diploma. However, if you are one of these well-educated drivers, there’s good news! You are eligible to be offered a lower rate on your auto insurance policy.

Austin has multiple colleges and universities to be proud of, the largest of which is the University of Texas at Austin. It is especially well known as a research institution and as one of the biggest schools in the entire country. Alternatively, students looking for a smaller school might want to look into St. Edward’s University, Austin Community College, or the Concordia University at Austin.

You shouldn’t allow an unsatisfactory auto insurance company to persuade you into buying an auto insurance policy which is not good for you. Yes, the quantity of information needed in order to guesstimate your own personal risk profile will be frustrating, however comparison web sites such as this might help make your search less complicated. Simply key in just a few details below, and then we’ll take it from there.

How We Conducted Our Car Insurance Analysis

Sources:

Department of Highway Safety and Motor Vehicles

Are you ready to compare rates? Discover how much it can save you!