Cheap Auto Insurance in Dallas, TX

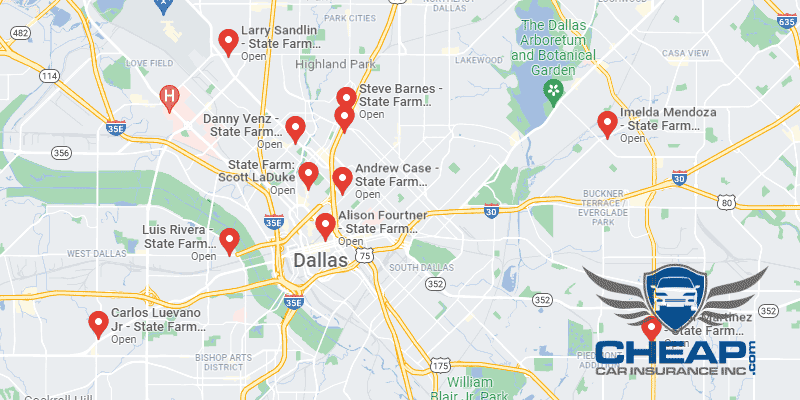

Looking for cheap auto insurance in Dallas, TX? With CheapCarInsuranceinc.com, anyone can get the cheapest priced insurance premiums in their area. To find free car insurance quotes from some of the highest quality providers right now, enter your local zipcode into the quote box in this article.

Despite its close incorporation with the surrounding cities and suburbs, Dallas still maintains an identity and a level of prominence all its own. IT has gone to great lengths to attract northern business down into its Sunbelt climate, and also has a fascinating culture and entertainment industry as well.

- Fun fact: try not to get lost! Because Dallas is #9 on the popular list of “Top 100 biggest cities”. Learn more about Dallas by clicking here.

Coverage Requirements - Auto Insurance in Dallas Texas

Driving legally in Dallas requires:

| Coverage | Requirements | Most Common |

| Liability Bodily Injury | 30,000/60,000 | 30,000/60,000 |

| Liability Property Damage | 25,000 | 25,000 |

| Bodily Injury - Motorist Uninsured | Not required | 30,000/55,000 |

| Not required Coverage | Medical Payments Coverage | 2,500 |

| Collision Coverage | Not required Coverage | 700 Insurance deductible |

| Comprehensive | Not required | 500 deductible |

Sure, the Liability coverage requirements in Texas are higher than they are for most other states, but other than that, the state doesn’t necessarily put an undue stress on its motorists. However, keep in mind that Liability coverage won’t pay out on claims of theft, vandalism, or weather damage, among other scenarios.

Here’s another fact you might not know about Texas Auto Insurance: your average Texan is riding around with a $135/month insurance bill. But your premiums don’t have to be so expensive. In Dallas, there are some good deals right now for as little as $113/mo* or lower! But you have to act now before they’re gone.

As you can see, Nationwide and Texas Farm Bureau are offering some of the lowest rates in town right now. But before you get enticed into switching based on a low rate alone, take a minute to look into the company. After all, they might not offer the same level of customer service or other amenities (such as online payments and account management) that you’re used to.

Organizations that supply auto insurance coverage evaluate many elements when establishing insurance quotes, including marital status, zip code, occupation, how many years you’ve been driving, and current insurance coverage and limits. On top of that, premiums differ from amongst providers. To discover if that you are still forking out the lowest-cost cost, examine cheap Dallas auto insurance costs on the internet.

Most Car Insurance Facts to know in Dallas TX

Obviously, certain elements which influence your car insurance rates cannot be changed, no matter how hard you try. However, there are simple strategies you can follow which will yield excellent savings! For more specific details, consider:

- Your Zip Code

Budget friendly car insurance is normally associated with urban centers having a lower population density. Since there are less vehicles cruising the road, there are a lot fewer chances to get involved in a significant car wreck with a different driver. The population of Dallas is 1,257,676 and the average family income is $41,978.

- Automobile Accidents

Any area where significant accidents are common will automatically see more expensive insurance rates. And, Regrettably for Dallas, significant accidents are quite common. On a per capita basis, the average Dallas driver has a 1 in 4,000 chance of getting into a Deadly accident – which is twice as high as the same statistics for Los Angeles. But, if you have a clean driving record, you could qualify for some Safe Driver discounts.

- Car Thieving in Dallas

Just about all insurance providers are concerned about auto theft; this is especially valid for individuals who live in sizeable cities. The greater the population, the greater the likelihood that you will have to submit an automobile theft claim. Back in 2013, the number of stolen cars in Dallas was down to 7,384. That’s a significant spike from the previous year, and the per capita rate of theft is fairly high, too. To protect your vehicle from theft, make sure that your agent puts some Comprehensive coverage on your policy (if you don’t have it already).

- Your Credit Score

Your credit score in Texas has a very significant influence on how much you will end up forking out for your insurance each month. Many providers will double or even triple your monthly payment if you have bad credit. Mercury, however, is only charging modestly higher rates, even for motorists with poor credit.

- Your Age

Statistically speaking, young teenage drivers will likely get into a car-totaling accident within their first year of driving. For such reasons, insurance companies are reluctant to sell them coverage (and Encompass refuses them outright). But there are Good Student and Driver’s Ed discounts which can help younger motorists get a fairer price.

- Your Driving Record

Texas insurance companies take driving violations very significantly. That’s why you can see such a drastic jump in premiums for DUIs and major accidents. But they are more lenient when it comes to things like speeding tickets. You might even be able to get them to ignore a minor accident from your recent past if they offer any “Accident Forgiveness” discounts.

- Your Vehicle

The more expensive your vehicle is, the more insurance coverage you will have to purchase in order to protect it, period. In a way, this is actually saving you money over the long term. After all, if you were to carry state minimum coverage on a Porsche, for example, you might save a whole lot of money on premiums, but odds are that your coverage won’t pay out any claims if something happens to your vehicle.

Minor Car Insurance elements in Dallas

You can also tweak some of the circumstances below for some possible savings:

- Your Marital Status

Married couples have a greater opportunity to bundle insurance policies than single drivers do. They can bundle their own auto policies together, they can add homeowner’s or RV insurance to their current bundle, or they can even add their teenage children to a family policy for extra savings.

- Your Gender

These days, it seems as though each Automobile insurance provider has a different method for figuring out how to calculate premiums by gender – if gender is even factored into the equation in the first place. Each company operates by its own set of rules when it comes to gender and driving.

- Your Driving Distance to Work

Regrettably, Dallas is one of those cities which suffers from a bad case of gridlock. The average driver usually spends 24 to 38 minutes behind the wheel each trip, and more than 71% of them are driving their own truck or car alone. Almost 9-15% will carpool, while less than 3% take the bus.

There is a significant difference in premiums between vehicles driven for business purposes, and vehicles driven for personal use (work, school, pleasure, etc). And that difference can be anywhere from 12-14% higher for the vehicles which are insured for business.

- Your Coverage and Deductibles

If you’re going to “hack” your monthly premiums by raising your deductible, make sure you do it responsibly. Figure out how much your new premium will be, and make sure you have at least that much saved up in the bank before you alter your policy. Otherwise, you could get caught with your pants down if you need to file a claim but can’t pay the higher deductible amount.

- Education in Dallas, TX

Nearly 30% of Dallas residents have less than a full high school education, while nearly 20% have a diploma hanging on their wall at home. The other 50% of Dallas motorists are receiving lower prices on their auto insurance. If you’re wondering why, the answer is simple: providers often give lower quotes to those drivers who have advanced beyond their secondary education.

A big city like Dallas is bound to have scores of universities to educate is large and ever-expanding population, and local colleges do their best not to disappoint. The University of Texas at Dallas is one of the largest, four-year, public universities in the city. It has seven different schools educating nearly 15,000 students per year, and partners with local schools such as the University of North Texas and Texas Woman’s University. Additionally, you can also join one of the 80,000 students of the Dallas County Community College for a quality degree in less time.

You shouldn’t enable a bad auto insurance provider persuade you into getting a car insurance policy that is not right for you. Indeed, the quantity of related information required in order to approximate your individual risk profile might be overpowering, but comparison web sites similar to this might help make things less complicated. Just simply provide a couple of elements below, and just we shall take over from there.

How We Conducted Our Car Insurance Analysis

Sources:

Department of Highway Safety and Motor Vehicles

Get started comparing rates today. It only takes a couple of minutes, and you’ll save a lot of money!