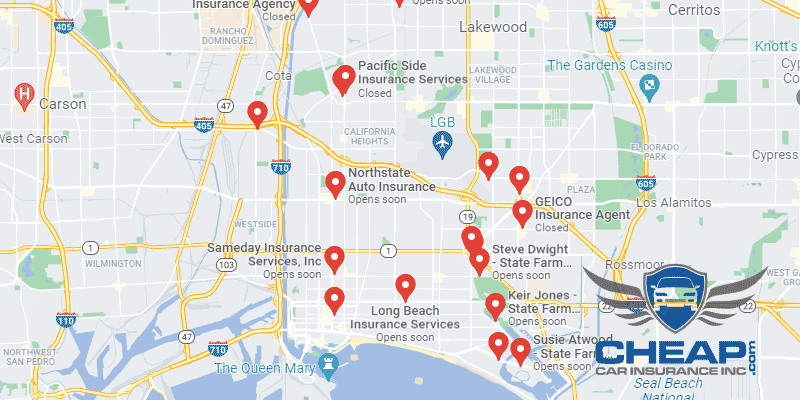

Cheap Auto Insurance in Long Beach, CA

Needing cheap auto insurance in Long Beach, CA? With CheapCarInsuranceinc.com, it’s only a click away. What you need to do is key in your local zip code in the search box down the page – it’s so easy!

Everything about Long Beach centers around its deep-water port. For many years, this shipping and distribution hub has been an integral part of the US economy. In addition to trade, Long Beach has thriving petroleum and manufacturing industries.

- Fun fact: There must not be many Beyoncé fans in Long Beach, because this city is #20 on the list of “Top 101 cities with the largest percentage of unmarried partner households (population 50,000+)”. Read up on Long Beach by clicking here.

Coverage Requirements - Auto Insurance in Long Beach California

Driving legally in Long Beach requires:

| Coverage | Requirements | Most Common |

| Liability Bodily Injury | 15,000/30,000 | 100,000/300,000 |

| Liability Property Damage | 5,000 | 100,000 |

| Bodily Injury - Motorist Uninsured | Not required | 20,000/40,000 |

| Not required Coverage | Medical Payments Coverage | 5,000 |

| Collision Coverage | Not required Coverage | 700 Insurance deductible |

| Comprehensive | Not required | 250 deductible |

When the chart above looks a bit strange, it is because California car insurance laws and regulations don’t always require that you buy more than Liability coverage, or in as high amounts as other states. But although bare minimum state Liability coverage seems attractively cheap, it might be better to protect yourself by spending a little bit more on your coverage.

Your typical California Motorist is probably having to pay around $164 every month in car insurance premiums. However, residing in Long Beach provides you with a definite advantage – you are able to really find rates as little as $70/mo* or even more should you act rapidly!

Most motorists could possibly get a reasonably low quote in Long Beach from either Allstate, Nationwide, or Hartford. But bear in mind that particular companies charge either drastically more (or delightfully less) for multiple conditions according to age, credit rating, as well as your driving history. Be sure that you seek information into each company prior to deciding to switch.

Companies that supply automobile insurance policies evaluate numerous elements while calculating insurance rates, especially driving experience, zip code, type of vehicle owned, miles driven each year, and current insurance coverage and limits. Also take into account that premiums for California car insurance differ from one company to another. To find out if you are still receiving the lowest-cost cost, examine cheap Long Beach motor vehicle insurance premiums over the internet.

Most Car Insurance Facts to know in Long Beach CA

You might feel slightly hopeless once your automobile insurance company is calculating your quote; after all, almost all of the elements that they compute aren’t things you will be able to modify or control. Fortunately, however, there are various things which you may be qualified to modify for greater discounts, including:

- Your Zip Code

The place you store your vehicle each night will likely have a significant influence on your automobile insurance rate. Usually, automobile insurance is cheaper in outlying regions merely because a lesser number of cars and trucks indicates a reduced likelihood that you’re going to get into a wreck with some other car. The population of Long Beach is 469,428 plus the common household income is $52,116.

- Automobile Accidents

California is a very car-friendly state; but because there are so many drivers on the road, there are an increased number of accidents as well. However, you could potentially avoid the increased rates that are common in cities with high accidents if you qualify for a safe driving discount. Your insurance agent will have more information.

- Car Thieving in Long Beach

Just about all insurance agencies are worried regarding auto theft; this is especially valid for drivers who reside in larger cities. The higher the number of people, the greater the chance that you may have to file an automobile burglary claim. In recent years, there were 2,355 stolen cars in Long Beach. And since this means auto theft is on the rise, you might want to either add or increase your Comprehensive coverage.

- Your Credit Score

California is one of three states in the entire country where Automobile insurance companies are not permitted to alter your rates based on your credit score. This is good for anyone who has less than perfect credit; however, insurance companies will charge drivers with perfect credit a little bit more to offset the money they aren’t allowed to charge motorists with poor credit.

- Your Age

Surprisingly, youthful motorists are billed a few of the greatest rates around – even greater than adult motorists with a bad credit score or perhaps a Drunk driving on their own record. But when you are 25 or under, you can test to reduce a few of these exorbitant rates with a decent Student discount, or if you take some Driver’s education courses.

- Your Driving Record

Have you ever heard of Accident Forgiveness discount rates? Essentially, for those who have a small accident or certain other non-significant citations in your record, your provider will not factor a number of them in when calculating your premiums. Although not all information mill offering these discount rates, so make sure to check around.

- Your Vehicle

It doesn’t matter what you drive, the fee for your monthly fees are more carefully associated with just how much coverage you buy. This is actually the primary reason why luxury vehicles cost a lot more to pay for. You need to buy multiple various kinds of coverage, and you’ve got to make certain the amounts are sufficient to pay for all potential costs for repair or substitute.

Minor Car Insurance elements in Long Beach

Here are some more ways you can lower your rate if you live in Long Beach:

- Your Marital Status

Have you ever heard of bundling discount rates? They come, and a few significant savings together, by buying multiple insurance plans in the same company and “bundling” them together. This method is simple for married people, for apparent reasons. Also it is not restricted to car insurance, either!

- Your Gender

Should you ask each provider in your town whether women or men should pay greater rates for his or her auto policy, each and every company will probably provide you with a different answer. Many don’t charge different rates whatsoever individuals who still do, however, usually charge a really small premium.

- Your Driving Distance to Work

Like many California cities, navigating the roads may be an arduous challenge for most drivers. Average commute times generally last between 30-35 minutes, although slightly shorter commutes of 15-25 minutes are popular. Around 73% of drivers rely upon their own vehicle for getting around, while 13% carpool.

If you’re able to possibly cure it, don’t register your vehicle, truck, or van like a “business” vehicle. You will be searching at 10-12% greater premiums consequently. Also, don’t lose any sleep over the number of miles you drive every year. Even high mileage (or perhaps a drastic reduction) is only going to improve your payment per month with a couple of percentage points.

- Your Coverage and Deductibles

We spoke about deductibles earlier – fundamental essentials mandatory repayments you have to give insurance companies before they’ll fulfill certain claims, for example Comprehensive or Collision claims. However if you simply raise that deductible. Most providers will decrease your payment per month consequently.

- Education in Long Beach, CA

27% of Long Beach residents have not yet completed all four years of their secondary education, while 19% have gone on to finish their high school diploma. Regrettably, however, not having a higher education means higher insurance rates for most drivers. But it’s never too late to go back to school, and doing so could immensely lower your automobile insurance costs!

California State University operates a satellite campus in Long Beach which is one of the largest campuses in all of California. DeVry University also operates a campus in Long Beach. And for a relevant degree in half the time, there is also the Long Beach City College to consider.

Vehicle insurance is one of the most significant investments you are able to as a customer. You have to be sure to discover a reputable, dependable vendor who’s going to follow through on their claims. A few insurance companies are greater at this than the others, and doing a thorough internet hunt can assist you distinguish the good from the inadequate.

How We Conducted Our Car Insurance Analysis

Sources:

California Department of Insurance

California Division of Financial Institutions

Department of Highway Safety and Motor Vehicles

See How Much You Could Be Saving – Get Instant Quotes