Cheap Auto Insurance in Oakland, CA

Looking for cheap auto insurance in Oakland, CA? With CheapCarInsuranceinc.com, it’s only a click away. All you need to do is enter your local zip code in the quote widget down below – it’s so simple!

Oakland makes up the eastern part of the San Francisco Bay and has been a major distribution and trade hub for many years. There are also many business and manufacturing industries which operate within Oakland. This city was one of the first to optimize international trade, and because of its strategic location on the Pacific Ocean, performs a lot of trade with many Asian countries.

- Fun fact: Oreo won’t have any trouble selling cookies in Oakland, because this city is #4 on the list of “Top 101 cities with the largest percentage of likely homosexual households (counted as self-reported same-sex unmarried-partner households) (population 50,000+)”. Interested in learning more about Oakland? Click here!

Coverage Requirements - Auto Insurance in Oakland California

Driving legally in Oakland requires:

| Coverage | Requirements | Most Common |

| Liability Bodily Injury | 15,000/30,000 | 100,000/300,000 |

| Liability Property Damage | 5,000 | 100,000 |

| Bodily Injury - Motorist Uninsured | Not required | 20,000/40,000 |

| Not required Coverage | Medical Payments Coverage | 5,000 |

| Collision Coverage | Not required Coverage | 700 Insurance deductible |

| Comprehensive | Not required | 250 deductible |

California car insurance is handled in a slightly different way in California. They don’t force drivers to purchase very high amounts of coverage, and they only legally require Liability coverage as a minimum. But something closer to the coverages and amounts on the far right of the chart are highly recommended if you can afford them.

Are you aware that most California motorists are having to pay around $164 every month to keep their policy? As little as this rate may seem, that you can do better still if you reside in Oakland. Some providers in your town are providing deals as little as $61/mo*!

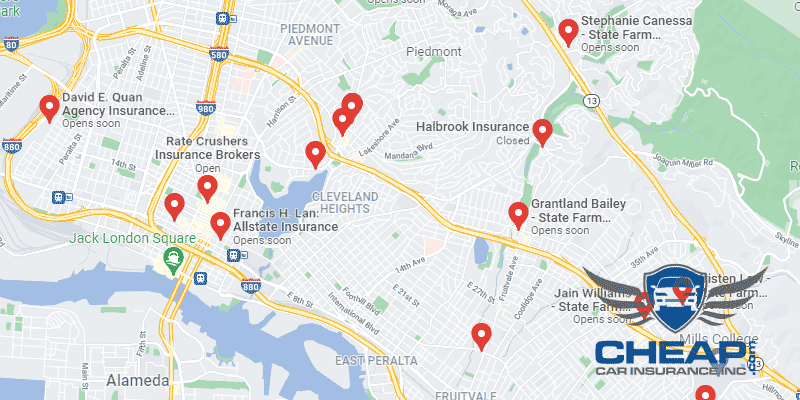

Nationwide and Allstate all want to provide you with the cheapest rates in Oakland. Try not to hurry to the organization providing the cheapest monthly premium without searching into them first. You need to make certain you are receiving targeted customer support additionally to some low payment.

Those who provide you with insurance coverage consider different elements when figuring out insurance prices, such as marital status, driving violations, occupation, miles driven each year, and theft protection devices. Also, premiums could alter from amongst providers. To find out if you are still receiving the cheapest price, look at cheap Oakland vehicle insurance quotes via the internet.

Most Car Insurance Facts to know in Oakland CA

You might feel a little hopeless once your vehicle insurance agency is calculating your insurance quote; after all, most of the elements that they evaluate aren’t items you can easily change or control. Thankfully, however, there are still things which you might be in a position to alter for higher discounts, for example:

- Your Zip Code

Insurance agencies must know your home (or the spot where you are going to be driving a motor vehicle frequently) as a way to estimate the probability of a vehicle accident. Everything boils down to a very simple concept: the greater the population, the greater number of vehicles you will encounter on the road, and also the more possibilities you might have to hit or perhaps be get collided into by a different motor vehicle. The populace of Oakland is in fact 406,253 plus the general family income is $54,394.

- Automobile Accidents

There are lots of people living in California, and a higher than average number of residents own a motor vehicle. This means that there are more drivers on the road – and that leads to more significant accidents happening more frequently. This, in turn, leads to higher premiums for drivers who can’t qualify for safe driving discounts.

- Car Thieving in Oakland

Just about all insurance providers are worried regarding auto theft; this runs specifically true for individuals who reside in large areas. The greater the populace, the greater the probability that you will have to submit an automobile robbery claim. In recent years, there were 6,833 stolen cars in Oakland. The per capita rate of theft is so high that you are taking a major risk by not protecting yourself with Comprehensive coverage.

- Your Credit Score

In Oakland, there are multiple Automobile insurance firms who will not ask you for an excessive amount of a greater premium for getting a bad credit score. However the more you track your spending habits, settle payments promptly, and lower your outstanding credit balances, the greater it can save you by raising your score.

- Your Age

Regrettably, a youthful driver’s insufficient driving experience can make it a lot more nearly impossible to find an inexpensive insurance plan. You can test to relieve the stress by using for special discount rates, like Good Student discount rates or Driver’s Ed discount rates.

- Your Driving Record

Most motorists aren’t perfect. But minor citations, like low-level speeding tickets or minor accidents, can send your insurance costs over the top. Some providers however they are offering motorists a rest by means of an “Accident Forgiveness” discount. Speak to your local agent to find out if your qualify.

- Your Vehicle

The greater costly it will get to correct or replace your automobile, the greater costly your insurance is going to be every month. It’s either that, or else you undertake 100% from the financial stress on your own to exchange or repair your automobile whether it will get stolen or broken.

Minor Car Insurance elements in Oakland

These 5 elements also may help you modify that which you invest in your monthly premium:

- Your Marital Status

Married people possess a great chance to reduce multiple insurance plans. It is because, additionally to bundling your automobile insurance plans into one, you can include other guidelines for greater discount rates – as lengthy as the provider offers multiple guidelines, that’s.

- Your Gender

You will find very couple of firms that still charge different rates for women and men, other conditions being equal. Individuals that do hardly ever charge greater than a 2-4% difference. Also, whether that greater rates are put on males or women can change in one company to a different.

- Your Driving Distance to Work

For such a large California city, Oakland breaks the norm by relying heavily upon mass transit. Only 52% of residents depend upon their own truck or car in order to get around, but they still face massive traffic and an average commute of 30-35 minutes. Around 14% carpool, 5% use the local subway system, and 4% take the bus.

Your insurance professional will probably inquire about the number of miles you drive yearly, and the reason why you drive (be it for college, work, or leisure). Many people think that modifying these 4 elements by driving less might earn them lower premiums. However, a drastic cut of 5,000 miles every year will not help you save greater than 4-5%.

- Your Coverage and Deductibles

Raising your deductible is a fast and simple way to reduce your monthly premium. But when you are going to benefit from this method, make certain in order to save up just a little money to pay for that deductible on the wet day. Should you raise it excessive and also you can not afford to pay for it in case your vehicle is broken or stolen, then it may be some time an email psychic reading your automobile fixed or changed.

- Education in Oakland, CA

More than a quarter of the population (26%) in Oakland has yet to finish their high school education. Conversely, the next most popular form of education is a bachelor’s degree (18% of the population). For those drivers within this highly educated minority, insurance providers often give out lower rates. Contact your insurance agent for details in order to see what discounts your education has entitled you to receive.

Mills College is an interesting university; their undergraduate student body is exclusively female, yet the institution does admit men to its graduate programs. Additionally, half of the satellite campuses of Peralta Community College are within Oakland city limits. And if you want a religious aspect to your education, you can look into Holy Names College.

You shouldn’t let an unsatisfactory insurance agency persuade you into buying an insurance policy that’s not best for you. Sure, the total amount of related information required in order to determine your own personal risk profile will be overpowering, but comparison web pages such as this might help make your search a lot easier. Just key in just a few specifics below, and then we’ll take over from there.

How We Conducted Our Car Insurance Analysis

Sources:

California Department of Insurance

California Division of Financial Institutions

Department of Highway Safety and Motor Vehicles

Free Quotes in Under 10 Mins & Save Avg $543*