Cheap Auto Insurance in San Diego, CA

Are you looking for auto insurance in San Diego? At CheapCarInsuranceinc.com, you’ll find the cheapest insurance rates near you. To get free car insurance quotes from the top rated providers today, key your zip code into the quote box on this page.

San Diego has one of the deepest ports on the west coast, which makes it a prominent city for shipping and US Naval operations. It is also a popular spot for tourism with its California climate and proximity to Mexico. San Diego also possesses fertile land for agriculture.

- Fun Fact: Did you know that San Diego is #4 on the list of “Top 101 biggest cities in 2008”? Learn more about the city of San Diego, CA.

Coverage Requirements - Auto Insurance in San Diego California

In order to drive legally in California, you will need:

| Coverage | Requirements | Most Common |

| Liability Bodily Injury | 15,000/30,000 | 100,000/300,000 |

| Liability Property Damage | 5,000 | 100,000 |

| Bodily Injury - Motorist Uninsured | Not required | 20,000/40,000 |

| Not required Coverage | Medical Payments Coverage | 5,000 |

| Collision Coverage | Not required Coverage | 700 Insurance deductible |

| Comprehensive | Not required | 250 deductible |

Keep in mind, however, that Liability Coverage only pays out claims if the accident is deemed your fault. It won’t cover theft, vandalism, hail damage, or any accidents which aren’t your fault. However, there are strategies you can utilize in order to expand your coverage without forking out an arm and a leg.

Average monthly rates for California drivers are around $164 per month. Luckily for San Diego motorists, it’s possible for drivers in your area to get rates as low as $53/mo* if you know what you’re doing. Keep reading for tips on how to get the best automobile insurance discounts.

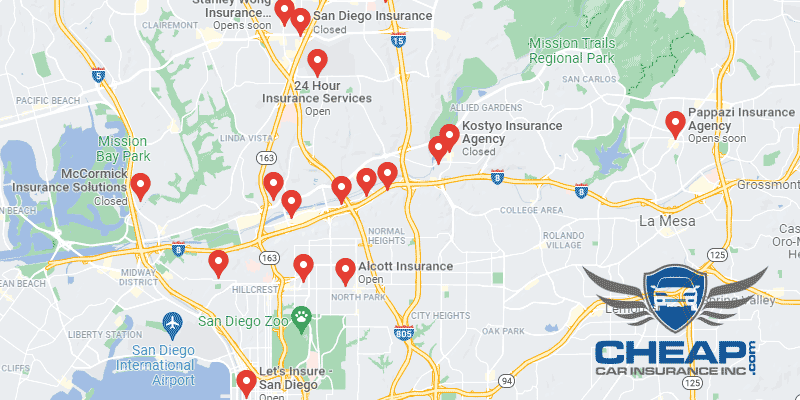

In San Diego, the lowest rates around are coming from Farmers, Allstate, and Hartford. But remember: there’s more to a good Automobile insurance deal than a low rate. You’ll want to make sure your provider has good customer service, as well as a simple claims process, before you settle.

Auto insurance companies consider different variables when establishing insurance quotes, including driving violations, accident claims, type of vehicle owned, miles driven each year, and multiple cars and drivers. In addition, premiums differ from provider to provider. To make sure you’re still receiving the cheapest rate, compare cheap San Diego auto insurance quotes online. Searching for lowest rates on auto insurance in California?

Most Car Insurance Facts to know in San Diego CA

Insurance companies take numerous elements into account when crafting an auto insurance policy. Regrettably, many of these elements are confusing or impossible to change, such as your credit score or where you live. Other elements your car insurance company may consider include:

- Your Zip Code

Your auto insurance rates may differ depending on where you call home. In general, highly populated cities have higher auto insurance rates because the extra amount of drivers on the road increases the likelihood of an accident! The population of San Diego is 1,355,896 and the median household income is $63,456.

- Automobile Accidents

The more accidents which occur in a given area, the higher that insurance rates will likely be in that particular zip code. You can see the accident statistics for the San Diego area in the chart below. Regrettably, there is very little that you as an individual can do about accident statistics in your area.

- Car Thieving in San Diego

Finding cheap auto insurance can be confusing if you are at risk for auto theft. Certain popular vehicle models are attractive to thieves, as well as vehicles which are parked often in large cities. The total number of stolen vehicles in San Diego was 6,143 in 2013. While this is a drop from recent years, you should still think about adding Comprehensive coverage to your policy if you want to protect yourself from theft.

- Your Credit Score

San Diego insurance providers, because they are located in California, are prohibited by law from charging different rates based on your credit score. To be clear, this is only prohibited in California (as well as two other states). Everywhere else, insurance companies can and will charge lower rates for a good credit score, and immensely higher premiums for drivers with poor credit.

- Your Age

The older you are, the more experience you will likely have behind the wheel. With this experience comes lower monthly premiums. That’s why teenage drivers are charged so much more – their lack of experience makes them a much riskier investment.

- Your Driving Record

For motorists with a few blemishes on their driving record, you can lower your monthly premiums by looking for a provider with an “Accident Forgiveness” program. Such discounts can bring your monthly rate down for things like speeding tickets and minor accidents. But if you have a DUI or a Reckless Driving citation on your record, be prepared to see your costs increase dramatically.

- Your Vehicle

The more expensive your vehicle is, the more it will cost to insure. You might be able to get away with minimum coverage amounts on a less expensive vehicle, but you’ll want to invest in more extensive coverage when it comes to luxury vehicles.

Minor Car Insurance elements in San Diego

Of course, there are other elements at play, but they might not make as much of a difference as you’d think:

- Your Marital Status

Want to get some pretty significant discounts on multiple insurance policies? If you’re part of a married couple, you’re in luck. Married spouses can save a ton on bundling their policies together. They can also add homeowner’s or renters insurance to their bundle, for even bigger discounts.

- Your Gender

Thankfully, many insurance companies are phasing out the outdated practice of charging drastically different rates based on gender. Some companies still charge a 2-3% difference, but it depends on the provider whether or not male or female drivers are stressed with this extra expense.

- Your Driving Distance to Work

The general work commute can last well over 20 minutes in San Diego, with nearly 70-83% of all workers choosing to drive to work in their own vehicle. Another 8-12% might carpool with their co-workers.

How much do you think you could save each year by limiting your driving? What if you only drive your vehicle to work or school? Well, you’ll probably save more on gas than you will on lower insurance premiums. However, if your vehicle is registered for business use, prepare for a rate hike as high as 10% or more.

- Your Coverage and Deductibles

If you want to add coverage to your policy but still keep your rates low, talk to your insurer about raising your deductible. Carrying a higher deductible will dramatically lower your rate. The only downside is that, if you do have to file a claim, you will have to pay that deductible before your insurance company will pay the rest.

- Your Education

Will a fancy job get you lower rates on Automobile insurance? Nope. What about a high income? Wrong again; it’s all about your level of education. In San Diego, over 20% of residents have a bachelor’s degree. Below that, there are nearly equal numbers of people who are either working towards a high school diploma, have completed high school, or are working towards a college degree.

With so many universities to choose from, it’s no wonder so many San Diego Motorists have college degrees. The University of California San Diego is on the nation’s top 10 list of best public universities. Also in San Diego, USD (the University of San Diego) is a private, Catholic-run institution.

Regrettably for most insurance companies, a simple internet search can reveal many of their trade secrets. But even with the proper information, it can still be confusing for you as an individual to figure out your risk profile and find low-cost insurance. Make sure you do your due diligence before you commit to your next car insurance policy.

How We Conducted Our Car Insurance Analysis

Sources:

California Department of Insurance

California Division of Financial Institutions

Department of Highway Safety and Motor Vehicles

These Companies Offer Lowest Rates on Auto Insurance in San Diego, CA – Check Out Prices Now! Enter Your State Below To Get Started!