Cheap Auto Insurance in Aurora, IL

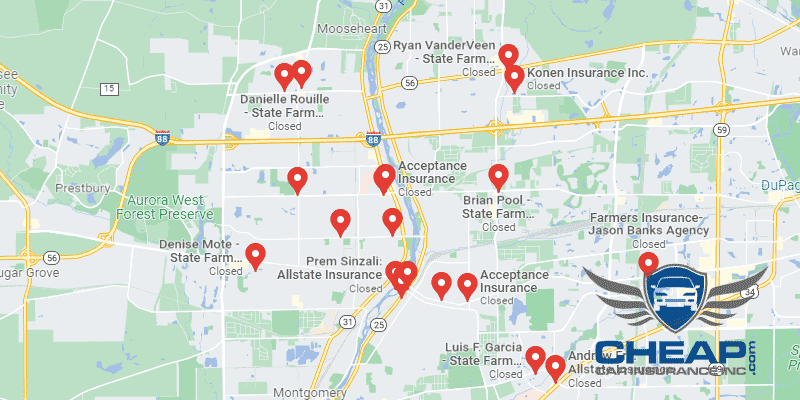

Do you need to find cheap auto insurance in Aurora? Well, you’re in luck, because you’ve just discovered CheapCarInsuranceinc.com – the leading Automobile insurance comparison website. All you need is your zip code, and you can unlock access to some of the lowest insurance rates available today.

Aurora, also known as “The City of Lights”, has been making some impressive strides since the 1960’s. It started out as a manufacturing town, but over the past 50 years has become one of the fastest growing cities in the United States.

- Fun Fact: Guess what? Aurora ladies are rubber, and you are glue, because Aurora is #4 on the list of “Top 50 cities with greatest precentage of females working in industry: Plastics and rubber products (population 50,000+)”. Learn more about Aurora here.

Coverage Requirements - Auto Insurance in Aurora Illinois

Driving legally in Aurora requires:

| Coverage | Requirements | Most Common |

| Liability Bodily Injury | 20,000/40,000 | 100,000/300,000 |

| Liability Property Damage | 15,000 | 100,000 |

| Bodily Injury - Motorist Uninsured | Not required | 20,000/40,000 |

| Not required Coverage | Medical Payments Coverage | 5,000 |

| Collision Coverage | Not required Coverage | 700 Insurance deductible |

| Comprehensive | Not required | 250 deductible |

If you drive a fairly affordable car, then you could save money on your premiums by limiting your insurance coverage to just the mandatory state minimums. But Liability doesn’t pay out on every single claim. If anything happens to your vehicle which is not deemed your fault, you’ll have to pay out of pocket – and that can get very expensive, very quickly.

The average Illinois motorist might get saddled with a $114 monthly premium just for driving around within their state. However, Aurora motorists have the opportunity to get their vehicle insured for as little as $32/mo*. All you have to do is ask the right questions, and you can find a great insurance company willing to offer you a low rate.

If all you’re looking for is the lowest possible monthly premium, you might not want to look beyond Hartford, Farmers, or Allstate. Keep in mind, however, that a low premium isn’t everything. What about a company’s customer and claims services? You need to do your research on those elements, too.

The fact that you live in Illinois, and the city of Aurora, will drastically change your rate compared with other states and towns. There are other elements too, which are listed below, which can alter your premiums further. For more info on Automobile insurance in Illinois, click that link.

Most Auto Insurance Facts to know in Aurora IL

Most people aren’t completely aware of all the elements which your insurer will evaluate in order to calculate your premiums. But we’ll discuss some of the bigger ones below:

- Your Zip Code

Most of your premium comes from calculating how likely you are to get into an accident. Your zip code helps determine this based on the total population of where you live (and, more importantly, drive). The higher the population, and the more motorists who share the road with you, the higher the likelihood of an accident. There are 199,963 people living in Aurora today, with an estimated average household income of $60,809.

- Automobile Accidents

Local accident statistics are also a reliable predictor of the likelihood of an accident. If your area is prone to frequent and significant accidents, you will likely see higher premiums as a result. Aurora drivers can rest easy since, as the chart shows, significant accidents are infrequent in the area.

- Car Thieving in Aurora

Comprehensive coverage is the only type of insurance which pays out if your car is reported stolen. But it is also very expensive, as you can see, so most drivers opt to discourage theft with an anti-theft device instead. These devices will also help lower your insurance premiums, since many companies give discounts for them. Aurora had 111 Car Thieving in 2013, which is a decline from recent years.

- Your Credit Score

In Illinois, like in many other states, it is legal for insurance companies to assign you a higher or lower premium based on your credit history. Drivers with excellent credit, as you can see in the chart, are charged substantially lower rates than those who have blemishes on their credit report.

- Your Age

With age comes experience. This is just as true for driving as it is most other things in life. And for many insurance providers, that experience means you are less likely to get into an accident, thus rewarding you with lower monthly premiums.

- Your Driving Record

A speeding ticket here or a fender-bender there doesn’t necessarily make you a bad driver, but it can (and often will) immensely raise your rates. If you have a minor offense or two on your record, ask your insurance agent about “Accident Forgiveness” discounts. You could end up saving a lot of money if you are eligible.

- Your Vehicle

If you’re driving around in a used clunker or a relatively inexpensive, popular sedan, it isn’t urgently necessary to purchase a “Cadillac Plan” from your insurance provider. If you are in fact driving a Cadillac or other luxury vehicle, however, you will need more coverage. And more coverage costs money, as the chart clearly shows.

Minor Car Insurance elements in Aurora

The elements below may also have an influence in your monthly premium, although they might be a little harder to control:

- Your Marital Status

If your insurance company sells many different types of insurance (not just Automobile), you can bundle multiple policies together for great discounts. And married couples can take even further advantage of this practice by bundling their auto policies with the same company.

- Your Gender

Data shows that there is no statistically significant difference between male and female drivers. Therefore, most insurance companies have no reason to charge one gender more than the other, and many have abandoned the practice all together. Those who still do rarely charge more than a 2-3% difference.

- Your Driving Distance to Work

Since Aurora is a suburb of Chicago, it can take a little time for workers to get where they need to go. The average commute ranges between 21-31 minutes, and carpoolers make up 3-27% of drives on the road (although the average is around 14%).

Do you drive thousands of miles each year? Are you mostly driving for business, or pleasure? Insurance companies are asking these questions more and more these days. But no matter how much you drive or why, your monthly premium will only fluctuate a few dollars – unless you’re driving a business vehicle. Business vehicles can cost 10-12% more to insure than personal vehicles.

- Your Coverage and Deductibles

Did you know that you can lower your monthly rates (or get more coverage for the same price you’re forking out now) by raising your deductible? If you are confident that you won’t be filing claims any time soon, you can get a better value this way. But make sure you have enough saved up for if the worst happens.

- Education in Aurora, IL

Some people believe that having a certain type of job or a high salary will get them better deals on automobile insurance. But do you know what works even better? Getting a higher education. Insurance companies give out big discounts for college degrees. One-fifth of the population of Aurora has a bachelor’s degree hanging on their wall, while most have not yet completed their high school education.

Aurora University is home to more than 4,000 eager, young students pursuing a variety of undergraduate as well as graduate degrees. They also have a Division III athletic program. And for a reputable degree at an affordable price, check out Waubonsee Community College.

Insurance shopping has been confusing and confusing in the past – but no longer. Enter your zip code below for the lowest available rates near you!

How We Conducted Our Car Insurance Analysis

Sources:

Illinois Department of Insurance

Illinois Department of Financial and Professional Regulation

Department of Highway Safety and Motor Vehicles

Enter your zip code here & now for the lowest rates in Aurora today!