Cheap Auto Insurance in Chicago, IL

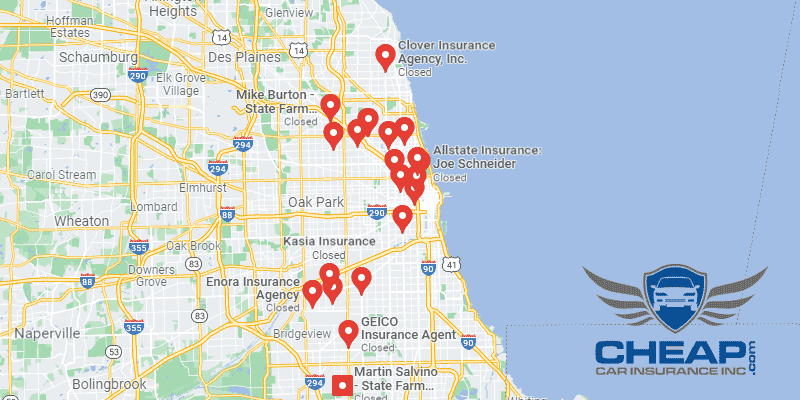

Are you in need of cheap auto insurance in Chicago? With CheapCarInsuranceinc.com, it can become a reality. Here, you can compare insurance quotes from multiple companies with no more effort than entering your zip code.

Chicago is ranked as the 3rd largest city (by population) in the country. Due to its massive population and status as an industry hub, it’s practically the capital of the American Midwest. It also holds a special place globally, with O’Hare International being deemed “The Busiest Airport in the World” The city itself is ranked #7 on the Global Cities Index.

- Do you feel safe when you walk the streets? Because Chicago is also ranked #3 for “Top 101 cities with the highest number of police officers in 2006 per 1000 residents (population 50,000+)”. Learn more about The Windy City here.

Coverage Requirements - Auto Insurance in Chicago Illinois

Driving legally in Chicago requires:

| Coverage | Requirements | Most Common |

| Liability Bodily Injury | 20,000/40,000 | 100,000/300,000 |

| Liability Property Damage | 15,000 | 100,000 |

| Bodily Injury - Motorist Uninsured | Not required | 20,000/40,000 |

| Not required Coverage | Medical Payments Coverage | 5,000 |

| Collision Coverage | Not required Coverage | 700 Insurance deductible |

| Comprehensive | Not required | 250 deductible |

Just remember that, although limiting your coverage to Liability only can save you money from month to month, it leaves room for many very expensive things to happen to your car. Weather damage, theft, or accidents which are not your fault could leave you with a large repair bill.

It’s relatively inexpensive (around $114/month) for most motorists to get insured within the state of Illinois. However, Chicago denizens can get rates as low as $45/mo* if they know how and where to look. We’ll explain this in detail below.

Hartford, Nationwide, and Farmers seem to be offering some good deals right now in Chicago. But before you switch to a new insurance company, find out some information about the company itself. After all, a low rate doesn’t look so attractive if you find out that you don’t like the way they do business.

Do you know how many metrics insurance companies use to determine your quote? Well, there isn’t an exact number. The questions they ask depend on your personal history, state laws, and industry regulations. But we’ll go over some of the biggest determining elements below. For more information on Illinois car insurance, click here.

Most Car Insurance Facts to know in Chicago IL

In nearly every state, the elements listed below can have a significant influence on how much you pay for your insurance coverage each month. And these elements are:

- Your Zip Code

The larger the city which you call home, the more likely you are to pay higher rates for your insurance each month. It’s all about probability. The more cars and drivers that share the road with you, the more probable it is that you will get into an accident. The city of Chicago is called home by 2,718,782 people, with an estimated average household income of $47,099.

- Automobile Accidents

Any city with a high rate of auto accidents is likely to be more expensive to drive around in, with regard to insurance. Regrettably, for Chicago, the accident rates are alarmingly high (as the chart shows). However, if your driving record is accident-free, you might want to ask about a safe driver or a defensive driving course discount.

- Car Thieving in Chicago

Auto theft is a problem in large cities, and Chicago is no exception. There were 12,636 vehicles reported stolen in 2013 alone. If you’re worried about auto theft, make sure you get an anti-theft device installed in your vehicle. Not only will this deter thieves, but you can get an insurance discount from most companies. If you have the extra money to spend, try adding Comprehensive coverage to your policy. It’s the only coverage which pays out when you file a stolen vehicle claim.

- Your Credit Score

Illinois is one of many states in the country which legally permits your insurer to adjust your rate based on your credit score. Like most things in life, people with excellent credit scores are eligible for some major discounts on their insurance rates. Having poor credit, Regrettably, can double your monthly premium (or more).

- Your Age

The younger you are, the less experience you are likely to have behind the wheel. This, statistically speaking, makes you more likely to get into an accident. For this reason, younger people (and teenagers especially) are charged drastically higher rates. But there is hope, in the form of “Good Student” and Driver’s Ed discounts.

- Your Driving Record

A few minor driving blemishes on your record, even something as minor as a speeding ticket or a fender-bender, will raise your monthly premiums. But that doesn’t necessarily make you a risky driver, and insurance companies are starting to realize this. That’s why more providers are offering “Accident Forgiveness” discounts to drivers with relatively clean records.

- Your Vehicle

Luxury vehicles are more expensive to insure than regular ones, but not necessarily for the reasons you’d think. In order to protect such an expensive investment, you need to invest in more diverse insurance coverage, and in higher amounts. These “Cadillac Plans” are naturally more expensive, but necessary if you don’t want to foot the bill for repairing replacing an expensive vehicle.

Minor Car Insurance elements in Chicago

The elements below may also have an influence in your monthly premium, although they might be a little harder to control:

- Your Marital Status

Being married presents a special opportunity to bundle your insurance policies. Married couples have the option to bundle their auto policies together (under the same company, of course). And if your insurer sells multiple types of insurance, you can bundle them all together for even bigger discounts.

- Your Gender

Believe it or not, being born a specific gender does not make you more likely to get into an accident, all other elements being equal. That’s why more and more companies these days are charging men and women the same rates.

- Your Driving Distance to Work

Despite having an intricate highway system, it can still take a while to get to work for Chicago residents. The average Commute can last anywhere from 19-47 minutes, primarily because most workers drive alone to the office each day. Carpoolers only make up 1-24% of drivers, with the average somewhere around 13%.

Many insurance companies will ask you questions about your driving habits, such as how many miles you drive yearly, your purpose for being on the road, and whether your vehicle is for personal use or business. Of all those, business vehicles are the most expensive to insure – yielding rate hikes of 10% or more.

- Your Coverage and Deductibles

As mentioned above, the more coverage you buy, the higher your premiums will be. But you can lower your premiums and increase your coverage by lowering your deductible. This is a great way to save money month-to-month. Just make sure you have enough cash on hand in case you do need to pay that higher deductible.

- Education in Chicago, IL

Think having the right job or a high salary will get you insurance discounts? Well, they might, but they won’t come as close to saving you money as having a higher education will. Most of the Chicago population stopped at their HS diploma or GED, while another 20% have gone on to earn a bachelor’s degree.

Chicago is home to dozens of prestigious universities, many of them known for their advancements in the sciences and research. The University of Chicago can boast 70 Nobel Laureates which have graced its halls. The University of Illinois also has a campus in Chicago, with more than 25,000 students pursuing everything from bachelors to doctoral degrees in a variety of subjects.

Getting the best insurance rates can be a challenge. But with a quick online comparison tool, like the one below, you can shop among top companies and get competitive quotes in minutes.

How We Conducted Our Car Insurance Analysis

Sources:

Illinois Department of Insurance

Illinois Department of Financial and Professional Regulation

Department of Highway Safety and Motor Vehicles

You’ve got nothing to lose – enter your zip code now for low rates on your Automobile insurance!