Cheap Auto Insurance in Naperville, IL

Trying to find cheap auto insurance in Naperville? It isn’t nearly as hard as you think. With the help of CheapCarInsuranceinc.com, you can quickly and easily get multiple Automobile insurance quotes. It’s the simplest way to compare rates and get the lowest premiums.

Naperville is a very popular Chicago suburb located partly in DuPage and also in Will counties within the state of Illinois. Money magazine voted it the second-best US city to live in back in 2006, and ranked very high on USA Today’s “Safest Cities” list. It’s also one of the wealthiest cities in the entire Midwestern region of the United States.

- Fun Fact: No wonder Naperville is one of the wealthiest cities, since it’s #1 on the list of “Top 50 cities with greatest precentage of males in occupations: Management, business, and financial occupations: (population 50,000+)”. Learn more about Naperville

Coverage Requirements - Auto Insurance in Naperville Illinois

Driving legally in Naperville requires:

| Coverage | Requirements | Most Common |

| Liability Bodily Injury | 20,000/40,000 | 100,000/300,000 |

| Liability Property Damage | 15,000 | 100,000 |

| Bodily Injury - Motorist Uninsured | Not required | 20,000/40,000 |

| Not required Coverage | Medical Payments Coverage | 5,000 |

| Collision Coverage | Not required Coverage | 700 Insurance deductible |

| Comprehensive | Not required | 250 deductible |

Liability insurance may be a good and economical way to insure an older, easily replaceable vehicle. But if you have a newer automobile, you may want to think about additional coverage. After all, Liability won’t pay out on claims on things like weather damage or accidents which aren’t your fault.

Typical Illinois motorists pay about $114 per month for their Automobile insurance. However, Naperville drivers can get insured for as low as $29/mo* if they act quickly. Below, we’ll go over some strategies for saving money on Automobile insurance for Naperville residents.

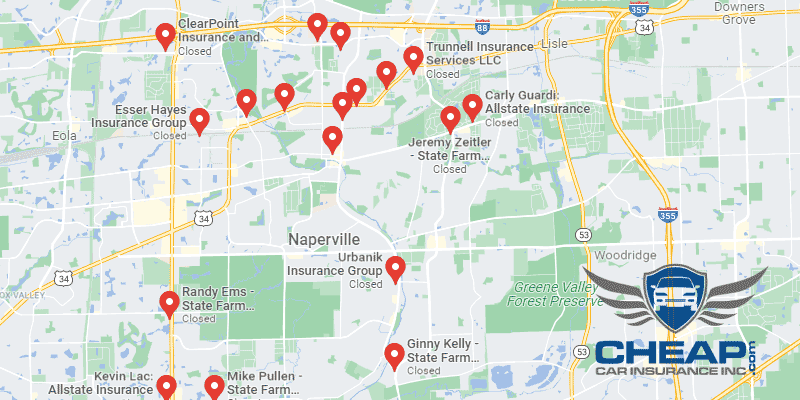

Hartford, Farmers, and Mercury are offering some very competitive rates right now in the Naperville area. But what else do they have to offer? You’re going to want to find a company which offers great customer service, as well as a simple and easy-to-navigate claims process.

There are more variables which automobile insurance companies take into account than most auto insurance shoppers are aware of. Below, we’ll discuss many of those elements in detail, as well as what you can do to get yourself the most favorable rate. Learn more about Illinois car insurance here.

Most Car Insurance Facts to know in Naperville IL

If you know how insurance providers are evaluating your rate, you can take steps to make sure you get the best possible monthly premiums. Here are some of the most influential elements which determine your Automobile insurance rate:

- Your Zip Code

Living in a large city and sharing the road with other drivers can increase your insurance rates. The higher number of drivers on the road increases the likelihood that you might get into a wreck. In Naperville, there are 144,864 residents with an estimated average household income of $105,882.

- Automobile Accidents

Areas with low levels of accidents tend to have lower insurance rates. Even if you live in a fairly populated city, the lower accident statistics will be taken into account when your insurer calculates your monthly rate.

- Car Thieving in Naperville

Auto theft is a real concern in certain areas, but there are ways to protect yourself against it. For one, you can install an anti-theft device to scare off would-be thieves and even get automobile insurance discounts. You can also add Comprehensive coverage to your policy, which pays out claims on theft (but costs more). There were 34 reported thefts in 2013 in Naperville, which means that thefts are actually declining from recent years.

- Your Credit Score

Your credit score is a little known – yet highly influential – impact on how much you get charged for insurance. Take a look at the chart below. Notice how poor credit scores are charged double (or more than double) that of people with flawless credit. If you can take steps to improve your credit score, you can also lower your auto insurance premiums.

- Your Age

Are you a young driver trying to find an affordable policy? Or are you a parent trying to get affordable insurance for your teenage driver? Either way, it’s going to be a confusing search. Younger drivers get charged much higher rates because of their lack of driving experience. However, there are Good Student and Driver’s Ed discounts which can help you get a fair rate.

- Your Driving Record

Most drivers have one or two minor violations on their record which are driving up their insurance rates. But there may be a way to get some of those violations waived by your insurer if you ask them about their accident forgiveness policy. It’s a new type of discount that many providers are offering their customers, and it could immensely lower your premiums.

- Your Vehicle

Luxury vehicles are much more expensive to insure than your typical sedan. The reason? The extra coverage you have to purchase in order to properly protect your investment adds up. After all, you can’t insure a 6-figure vehicle with Liability coverage alone.

Minor Car Insurance elements in Naperville

The elements below may also have an influence in your monthly premium, although they might be a little harder to control:

- Your Marital Status

Are you married? Then talk to your spouse about bundling your policies together. The more bundling you can do, the more discounts you can get – and the more money you can save. If your insurer sells more than just car insurance, you can bundle additional policies to the same account.

- Your Gender

Companies are increasingly phasing out the practice of charging men and women immensely different rates for Automobile insurance policies. multiple of the major providers are now charging both genders the same rate, all other elements being equal. Those who charge different rates only vary their prices by a few dollars per month.

- Your Driving Distance to Work

Commuting to work in Naperville can take a little while. Average commutes last between 26-34 minutes, with carpoolers only making up 2-9% of drivers. The extra traffic from people driving alone might explain the long commute times.

Limiting your mileage might sound like a good way to lower your insurance rates, but in reality the discounts aren’t more than one or two percentage points cheaper. In fact, the only real factor is whether or not you drive your vehicle for business – business vehicles cost around 11-12% more to insure.

- Your Coverage and Deductibles

A good strategy for lowering your insurance premiums, especially if you are a especially careful driver, is to raise your deductible. Assuming you never have to file a claim, you can save a good deal of money each month. But it’s a good idea to take some of that savings and put it away, in case you ever do have to file a claim on your vehicle.

- Education in Naperville, IL

In case you didn’t know, getting a higher education can get you lower rates on car insurance. Yes, it’s true; it’s more effective than having a prestigious job or a high salary. Nearly 36% of Naperville residents already have a bachelor’s degree, which could help explain why rates are so low in the area.

North Central College is located within the Naperville city limits, and has more than 3,000 students currently enrolled. They offer bachelor’s as well as master’s degrees in a variety of subjects. Additionally, there are scores of universities all located within 5-15 minutes’ driving distance of Naperville.

For some, searching for affordable insurance can be a nightmare. But with the help of CheapCarInsuranceinc.com, you have dozens of free quotes from major insurance companies at your fingertips. All you need to do is enter your zip code below.

How We Conducted Our Car Insurance Analysis

Sources:

Illinois Department of Insurance

Illinois Department of Financial and Professional Regulation

Department of Highway Safety and Motor Vehicles

Stop forking out high monthly premiums – let AutoInsuranceEZ help you get affordable rates today!