Cheap Auto Insurance in Evansville, IN

Are you looking for cheap auto insurance in Evansville, IN? At CheapCarInsuranceinc.com, you can get the very best insurance rates locally. To find free car insurance quotes from the major providers today, provide your zip code into the quote box on this page.

Evansville has quite the historical past. Back during the height of steamboat popularity, Evansville’s unique location on the Ohio River turned it into a bustling tourist town. Even in modern times the city does on excellent job of blending its historical past with modern business and growth.

- Fun fact: did you know that Evansville is #1 on the list of “Top 50 cities with greatest precentage of females working in industry: Warehousing and storage (population 50,000+)”? Learn more about Evansville.

Coverage Requirements - Auto Insurance in Evansville Indiana

Driving legally in Evansville requires:

| Coverage | Requirements | Most Common |

| Liability Bodily Injury | 25,500/50,500 | 105,000/305,000 |

| Liability Property Damage | 10,000 | 100,000 |

| Bodily Injury - Motorist Uninsured | Not required | 100,000/300,000 |

| Not required Coverage | Medical Payments Coverage | 5,000 |

| Collision Coverage | Not required Coverage | 700 Insurance deductible |

| Comprehensive | Not required | 0 deductible |

While purchasing the minimum legal requirement for auto coverage might seem like the better deal, beware the allure of a cheaper insurance policy with less coverage. With Liability coverage, for example, your insurer will only pay out claims if you are responsible for the accident or incident which damaged your vehicle. Should your car be damaged by any other means, you’re on your own.

As you may already know, average Indiana monthly premiums can be quite high – somewhere in the neighborhood of $100 per month. But even in Evansville, you can find low rates for $34/mo* or less. You just have to know what discounts to look for when you shop around.

Farmers, Nationwide, and Grand Mutual are offering the most competitive rates as reflected in the chart above. But that monthly rate doesn’t show how good their customer service is, or how efficient their claims service can be. Be sure to consider all the elements when shopping for a cheaper Automobile policy.

Auto insurance providers evaluate many elements when figuring out insurance quotes, including marital status, credit score/rating, years of driving experience, education level, and multiple cars and drivers. In addition, premiums change from carrier to carrier. To make sure you’re still receiving the cheapest rate, compare cheap Evansville auto insurance quotes online. And for more information on Indiana car insurance, click here.

Most Car Insurance Facts to know in Evansville IN

elements that many compaines take into account when creating an auto insurance policy. Regrettably, a number of these variables are confusing or impossible to change, such as your gender or where you live. Other variables your car insurance company may consider include:

- Your Zip Code

Your auto insurance rates may differ depending on where you call home. In general, highly populated cities have higher auto insurance rates because the extra amount of drivers on the road increases the likelihood of an accident! The population of Evansville is 120,310 and the median household income is $32,414.

- Automobile Accidents

Evansville has a higher per capita accident Deadlyity rate than other cities in Indiana with a similarly-sized population. These alarming statistics may end up raising your insurance premiums. Talk to your local agent, and see if there are Safe Driver discounts available near you.

- Car Thieving in Evansville

Even in small cities or rural towns, auto theft can still be a problem. In order to make it less of a problem for you, think about installing a passive anti-theft system on your car. Your auto insurance company may reward you with lower rates! In Evansville, there were 420 Car Thieving in 2012. This is almost double what it was in recent years. One good way to protect yourself (although it may be a bit pricey) is to add Comprehensive coverage to your policy.

- Your Credit Score

There are many things which are determined by your credit score – and, for better or for worse, car insurance is one of them. The better your score, the lower your monthly rate will be. Regrettably, motorists with poor credit are charged immensely higher rates, and the chart below shows.

- Your Age

As you can see from the chart below, young teenage drivers get charged immensely higher rates. Their youth, as well as their lack of driving experience, make them much more risky to insure. However, teenage drivers can try to alleviate some of this financial stress by looking into a Good Student discount, or taking additional driver education courses.

- Your Driving Record

Having multiple violations on your record, or having significant violations such as Drunk Driving, will immensely raise your monthly rate. It may make you disqualified to get covered at all depending on the company. But if you only have one or two minor citations in the last few years, look into your provider’s “Accident Forgiveness” policy. Your provider will basically ignore a minor violation when calculating your premiums if you qualify.

- Your Vehicle

If you have a common, inexpensive car, it will be much easier to fix or replace should the worst happen than an expensive, luxury vehicle. And an inexpensive car doesn’t require an extensive, comprehensive insurance policy.

Minor Car Insurance elements in Evansville

The elements below may also have an influence in your monthly premium, although they might be a little harder to control:

- Your Marital Status

Want to know how married couples can save on automobile insurance? By bundling, that’s how. When you and your spouse bundle your policies together, you can get some significant savings. And if you have other forms of insurance – such as homeowners, or renter’s insurance – you can save even more by bundling those as well.

- Your Gender

Worried about being charged more simply because of an uncontrollable factor, such as your gender? Well, don’t worry too much, because most providers these days charge the same rate, regardless of gender. And if you do get charged a higher premium for being male or female, it won’t really change your premium by more than a few dollars per month.

- Your Driving Distance to Work

When commuting to and from work, the average driver in Evansville can expect to be on the road for 16-22 minutes at a time. A good 80% of workers like to drive their own vehicle there, and right around 6-17% get to work by carpooling.

If you can help it, try to avoid registering your car as a business vehicle. On average, those vehicles get charged 10-12% higher rates than vehicles driven for work, school, or even recreationally. Also, yearly mileage is a fairly negligible factor – whether your drive above or below the national average, you may only see a 2-3% fluctuation in your rate.

- Your Coverage and Deductibles

You can get additional forms of coverage added to your policy, or get covered in larger amounts, and still pay a relatively low rate if you raise your deductible. Just remember to put away part of that savings for a rainy day, in case you do ever have to file a claim.

- Education in Evansville, IN

If you live in Evansville and have a higher education, your degree might provide an additional benefit you weren’t aware of. It might just get you a lower price on your car insurance. Your job or annual salary can’t even do that. Most motorists have at least a high school diploma or some equivalent. A smaller number has yet to finish their high school education.

If you live in Evansville and are looking to further your education, you’re in luck. The city is home to multiple two-and four-year institutions for you to choose from. The University of Evansville is a private option for anyone who wants a bachelor’s degree in a variety of fields, while the University of Southern Indiana is a public school. There is also Ivy Tech State College for students who want a quick but specialized education.

Determining your individual financial risk can be very confusing or impossible for the typical insurance shopper. Insurance companies have an advantage over consumers due to their statistics and experiential knowledge. Learn what insurance companies don’t want you to know.

How We Conducted Our Car Insurance Analysis

Sources:

Indiana Department of Insurance

Department of Highway Safety and Motor Vehicles

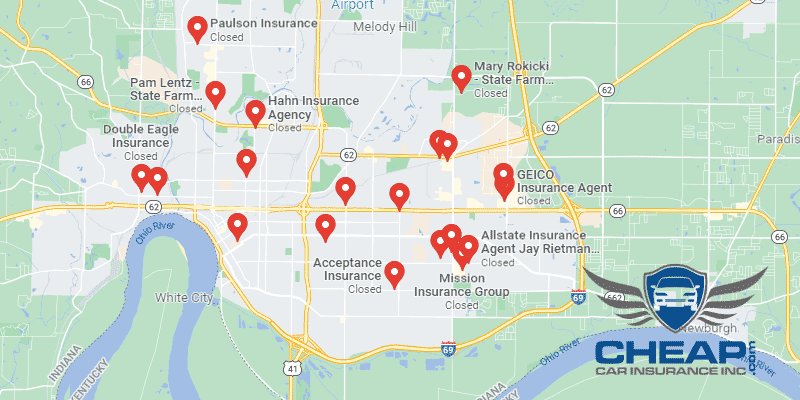

These Companies offer Low Cost Auto Insurance in Evansville, IN – Act Now