Cheap Auto Insurance in Gary, IN

Are you looking for cheap auto insurance in Gary, IN? At CheapCarInsuranceinc.com, you will find the very best insurance rates in your city. To receive free auto insurance quotes from the top providers today, enter your zip code into the quote box on this page.

Once known as “Steel City”, this former steel production capital has decreased output in recent years. However, the local economy has diversified into other industries. For one, a recent redevelopment project has spent millions of dollars in order to attract tourism to the Lake Michigan area. The city is also located near a number of protected parkland and other tourist attractions for nature lovers.

- Fun fact: Did you know that Gary is #1 on the list of “Top 101 cities with the most bridges per 100,000 population (pop 50,000+)”? Learn more about Gary, IN.

Coverage Requirements - Auto Insurance in Gary Indiana

Driving legally in Gary requires:

| Coverage | Requirements | Most Common |

| Liability Bodily Injury | 25,500/50,500 | 105,000/305,000 |

| Liability Property Damage | 10,000 | 100,000 |

| Bodily Injury - Motorist Uninsured | Not required | 100,000/300,000 |

| Not required Coverage | Medical Payments Coverage | 5,000 |

| Collision Coverage | Not required Coverage | 700 Insurance deductible |

| Comprehensive | Not required | 0 deductible |

Certain vehicles require more coverage than others. If you’re driving around in a used Ford Tempo, for example, it’s probably a waste of money to add anything other than the legal state minimum to your policy. But if you’re driving around in a brand new vehicle, consider adding things like comprehensive or collision.

In general, Indiana motorists are forking out around $100 per month for their auto policies. But, by virtue of living in Cary, you can get that even lower. In fact, some drivers are eligible for rates as low as $43/mo*. Keep reading if you’d like to find out how.

Farmers and Nationwide are fighting a bidding war for the lowest rates in Gary right now. But do those low rates come with a higher standard of customer service? Or a simple and stress-free claims filing process? These are important questions to ask before you decide to switch providers.

Auto insurance providers consider different elements when calculating insurance quotes, including driving experience, where you live, occupation, driving distance to work, and multiple cars and drivers. In addition, premiums change from company to company. To find out whether you’re still getting the most favorable rate, compare cheap Gary auto insurance quotes online.

Most Car Insurance Facts to know in Gary IN

There are multiple ways that your car insurance rate can be calculated. But not all of it is out of your control; there are actions you can take in order to impact which discounts you are eligible to get. Listed below are some of these elements in greater detail:

- Your Zip Code

The cheapest car insurance is usually found in cities with a lower population density. Because there are fewer vehicles on the road, there are fewer possibilities for you to get into a major car accident with another driver. The population of Gary is 78,450 and the median household income is $26,286.

- Automobile Accidents

If you live in an area with fewer accidents, you will likely get a lower monthly rate without having to lift a finger. The most recent statistical data for accidents in Gary is shown in the chart above. Considering the sizeable population of the city, it looks like you’re eligible for lower premiums.

- Car Thieving in Gary

Living in a large city (Especially one with a high crime rate) will increase your risk of being a victim of auto theft. If your general location has high rates of theft and claims, you can expect to pay more for auto insurance to offset these costs. The total number of stolen vehicles in Gary was 732 back in 2013. Per capita, theft rates are alarmingly high. Make sure you talk to your insurance agent about adding Comprehensive coverage to your policy.

- Your Credit Score

Your credit score is a much bigger factor than most drivers realize when it comes to calculating your rates. In the chart below, you can see that some companies will double – or even triple – your monthly premium based on a poor credit score.

- Your Age

Are you a teenage driver? Getting your own vehicle and hitting the open road is a fun and exciting time…until you get your insurance bill, that is. Thankfully, if you get good grades and take specific driving courses, there are discounts available to you. Contact your insurance agent for more information.

- Your Driving Record

Have you heard of “Accident Forgiveness”? It’s a relatively new type of discount which more providers are beginning to adopt. Essentially, if you have a mild infraction on your driving record, like a minor accident or a speeding ticket, your insurer won’t factor that incident in when calculating your premiums. It’s a great way for a less-than-perfect driver to save money.

- Your Vehicle

Luxury vehicles cost more to insure not just because they’re more expensive, but because of all the coverage they require in order to be fully protected. After all, it would be a silly and expensive risk to insure a Porsche or a Ferrari with Liability coverage alone.

Minor Car Insurance elements in Gary

The elements below may also have an influence in your monthly premium, although they might be a little harder to control:

- Your Marital Status

Are you currently taking advantage of bundling discounts with your spouse? If you’re not, well, you should be. Bundling your auto policies together under the same company can yield some significant savings each month.

- Your Gender

Most providers don’t even really factor gender into the equation anymore when calculating premiums. For those that do, the difference is little more than 1-2%. And whether that difference favors women or men varies from company to company.

- Your Driving Distance to Work

Getting to and from work in Gary might take as long as 12-21 minutes per commute. A little over 70% of drivers take their own vehicle to work, and between 9-19% like to carpool with their co-workers.

Did you know that business vehicles are 10% more costly to insure than personal use vehicles? Additionally, your overall yearly mileage doesn’t matter as much as you might think. At best, you’d save maybe 2-3% by driving fewer than 6,000 miles per year.

- Your Coverage and Deductibles

Sick of forking out such high premiums each month? Then contact your agent and ask them to raise your deductible (assuming it is currently low). A higher deductible is one of the quickest and easiest ways to lower your monthly payments.

- Education in Gary, IN

The majority of drivers in Gary either have a high school diploma or less than a full high school education. For many of these people, going back to school will give them more than just a competitive edge in their future careers; it will also save them money on future car insurance rates! Yes, even more than having a prestigious job or a well-paid salary.

Indiana University has eight different campuses within the state of Indiana, and the Northwest campus services the city of Gary. You can choose from an associates, a bachelor’s, or a master’s degree in almost 100 different programs. Ivy Tech State College also has a Campus in Gary, as well as the Purdue University Calumet.

Determining your individual financial risk can be very confusing or impossible for the typical insurance shopper. Insurance companies have an advantage over consumers due to their statistics and experiential knowledge. Learn what insurance companies don’t want you to know.

How We Conducted Our Car Insurance Analysis

Sources:

Indiana Department of Insurance

Department of Highway Safety and Motor Vehicles

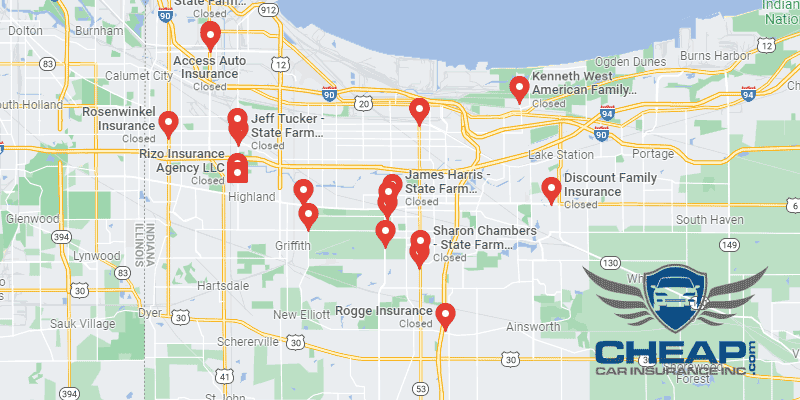

These Companies Offer Cheap Auto Insurance in Gary Indiana