Cheap Auto Insurance in South Bend, IN

Are you looking for cheap auto insurance in South Bend, IN? At CheapCarInsuranceinc.com, you can easily find the best insurance rates in your area. To obtain free car insurance quotes from the top providers today, key your zip code into the quote box on this page.

If you are a football fan, then you probably already know that South Bend is the home of the “Fighting Irish”; the University of Notre Dame’s famous football team. South Bend is also one of the more well-known members of the Midwestern US industrial belt.

- Fun fact: Did you know that South Bend is #4 on the list of “Top 101 cities with the highest average snowfall in a year (population 50,000+)”? Learn more about South Bend.

Coverage Requirements - Auto Insurance in South Bend Indiana

Driving legally in South Bend requires:

| Coverage | Requirements | Most Common |

| Liability Bodily Injury | 25,500/50,500 | 105,000/305,000 |

| Liability Property Damage | 10,000 | 100,000 |

| Bodily Injury - Motorist Uninsured | Not required | 100,000/300,000 |

| Not required Coverage | Medical Payments Coverage | 5,000 |

| Collision Coverage | Not required Coverage | 700 Insurance deductible |

| Comprehensive | Not required | 0 deductible |

If you’re thinking about saving money by only purchasing the mandatory state minimums, be careful. If you drive an older, used, inexpensive car, you might be able to get by with minimal coverage. However, if your vehicle is newer, you should really consider purchasing a more robust policy.

Right now, your typical Indiana driver is forking out around $100 per month for their Automobile insurance. If this sounds like you, then we have good news: you can get as low as $30/mo* just for living in South Bend. Keep reading, and we’ll show you some of the best ways to get a lower rate.

If you’re looking for the lowest possible rate, then you’ll want to give Grange Mutual, Nationwide, or Farmers a call. But remember that there is more to insurance than just a low rate. You also have to consider customer service and claims filing when choosing a provider.

Auto insurance companies contemplate multiple elements when establishing insurance quotes, including geography, zip code, where you live, occupation, and how many miles you drive each year. In addition, premiums differ from company to company. To verify you’re still getting the most affordable rate, compare cheap Indiana auto insurance quotes online.

Most Car Insurance Facts to know in South Bend IN

There are many ways that your car insurance rate can be determined. But not all of it is out of your control; there are steps you can take to be able to control which discounts you are entitled to acquire. Listed here are a few of these components in greater detail:

- Your Zip Code

The cheapest car insurance is usually found in cities with a lower population density. Because there are fewer vehicles on the road, there are fewer possibilities for you to get into a major car accident with another driver. The population of South Bend is 100,866 and the median household income is $34,446.

- Automobile Accidents

Sometimes, your insurance rate is altered by elements which are beyond your control. The rate of accidents in your area is one such factor. The chart above shows the most recent statistical data available for South Bend. If you think accident rates are inflating your monthly premiums, ask your provider if they offer any safe driver discounts.

- Car Thieving in South Bend

Finding cheap auto insurance can be confusing if you are at risk for auto theft. Certain popular vehicle models are attractive to thieves, as well as vehicles which are parked often in large cities. The total number of stolen vehicles in South Bend was 285 back in 2012. Because these statistics are so low, you may be able to lower your monthly rate by scaling back your Comprehensive coverage.

- Your Credit Score

Did you know that your credit score is very closely linked to your Automobile insurance rate? It’s so intrinsic, in fact, that having a poor credit score can more than double your monthly premium. So by raising your credit score, you can lower your rates.

- Your Age

Because younger drivers don’t have as much experience on the road as older adults, they are much riskier for insurance companies to cover. Due to this, motorists under the age of 25 get charged exorbitant rates. Thankfully, there are Driver’s Ed and Good Student discounts available.

- Your Driving Record

Accident Forgiveness is a new type of discount which insurance companies have started offering in order to drum up business. For safe drivers with a less than perfect driving record, your Accident Forgiveness discount will ignore at least one minor citation, thereby lowering your rates.

- Your Vehicle

If you’re driving a luxury vehicle, then you’re going to want a luxurious insurance plan to protect it. After all, between theft, vandalism, accidents, severe weather, and the million other terrible things which can happen to your vehicle, do you really want to risk carrying insufficient coverage? Probably not.

Minor Car Insurance elements in South Bend

The elements below may also have an influence in your monthly premium, although they might be a little harder to control:

- Your Marital Status

Did you know that married couples have a special advantage to saving on their Automobile insurance? All they have to do is bundle their policies together under the same company. Many providers reward this action with significant discounts.

- Your Gender

Everyone knows the stereotypes about how a certain gender performs behind the wheel…except for insurance companies, that is. More and more providers are offering identical rates, regardless of gender. And if your provider does charge a difference, it’s little more than a few dollars each month.

- Your Driving Distance to Work

While commuting to work in South Bend, a 18-31 minute commute time is typical while some trips are as high as 41 minutes on average. A little over 75% of drivers like to drive to work in their own car, while somewhere around 6-19% would rather carpool.

Reducing your overall yearly mileage can help you spend less money on gas, and might even reduce the cost of maintenance on your vehicle. Regrettably, it won’t save you more than a few dollars per month on your insurance premiums. But registering it for personal use will, because business vehicles cost 11% more to insure on average.

- Your Coverage and Deductibles

Do you want more coverage that you’re currently forking out for? Then consider raising your deductible. Doing so can give you room to purchase more coverage for about the same monthly premium that you’re forking out now.

- Education in South Bend, IN

Deciding to pursue a higher education has a number of different benefits, even beyond getting a great job with a high salary. One smaller benefit that most people don’t know about is car insurance savings. Believe it or not, auto insurance providers are likely to offer you lower prices if you have a college degree! Almost one-third of South Bend drivers have a high school diploma, while a lesser amount have not yet finished their high school education.

Notre Dame, a catholic-affiliated university, is over 160 years old and has a reputation for both academic excellence as well as athletics. It also has a sister college known as Saint Mary’s. Holy Cross College is a recent addition to the city’s four-year institutions, while the Purdue University Statewide Tech Program offers specialized engineering and computer technology degrees.

Finding affordable auto insurance can be a hassle. There’s a lot of information you need to consider and, figuring out how insurance companies evaluate your potential risk can be complicated. But don’t let the wrong insurance company talk you into purchasing the wrong policy.

How We Conducted Our Car Insurance Analysis

Sources:

Indiana Department of Insurance

Department of Highway Safety and Motor Vehicles

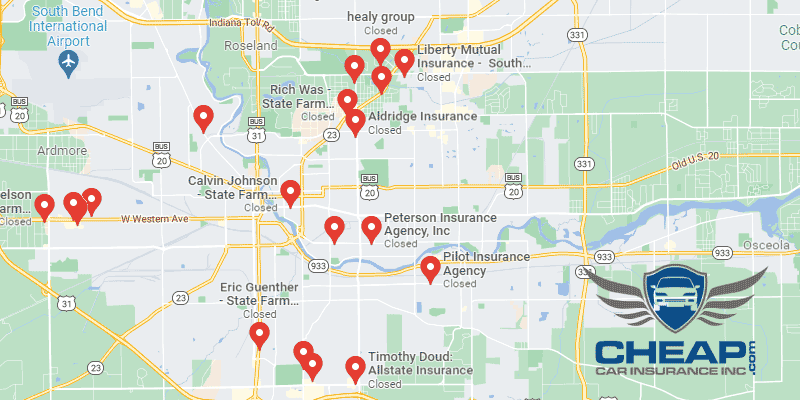

These Companies Offer Cheap Auto Insurance in South Bend, IN – Act Now