Cheap Auto Insurance in Covington, KY

Are you looking for auto insurance in Covington? At CheapCarInsuranceinc.com, you could find the very best insurance rates locally. To obtain free car insurance quotes from the leading providers today, just enter your zip code into the quote box on this page.

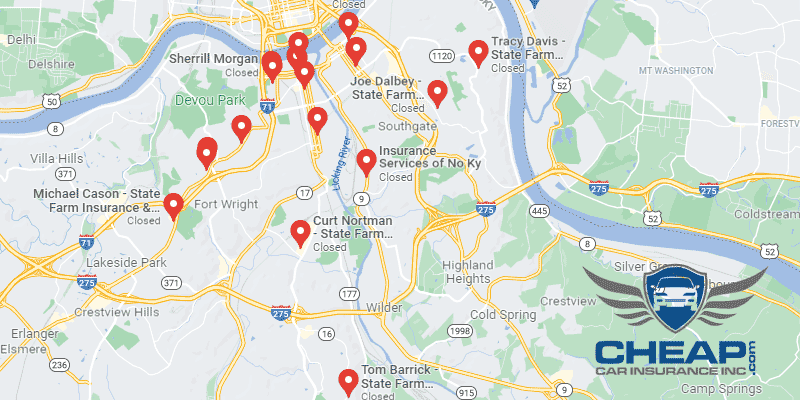

Covington is a suburban city nestled in the northern part of Kentucky. It is immediately adjacent to the Ohio River and directly south of Cincinnati, Ohio. It is the 5th largest city within the state of Kentucky, and is well known for having a large number of historic churches.

- Fun fact: Did you know that Covington is #73 (41016) on the list of “Top 101 zip codes with the largest percentage of Alsatian first ancestries (pop 5,000+)”? Learn more about Covington, KY.

Coverage Requirements - Auto Insurance in Covington Kentucky

Legally driving in Covington requires:

| Coverage | Requirements | Most Common |

| Liability Bodily Injury | 30,000/55,000 | 100,000/300,000 |

| Liability Property Damage | 10,000 | 50,000 |

| Bodily Injury - Motorist Uninsured | Not required | 100,000/300,000 |

| Medical Payments | Not required | 100,000 |

| Collision | Not required | 500 deductible |

| Comprehensive | Not required | 500 deductible |

Keep in mind that the column in the middle is just the state mandatory minimums, and not the best type of coverage you can purchase for yourself. This is especially true if you have a newer car, if you are still making payments on your vehicle, or if replacing/repairing it in the event of a major accident would be too large of a financial stress for you.

As a Covington driver, you have access to monthly premiums as low as $42/mo* right now. That sure beats the average monthly cost of $125 for the rest of Kentucky, doesn’t it? However, if you don’t act quickly, you may lose out on a great deal. Keep reading for more info.

Hartford, Nationwide, and the Kentucky Farm Bureau are currently in a bidding war for your business. But don’t make any changes to your policy on your provider based on cheap premiums alone. Make sure they have good ratings for customer service and claims filing, too.

Auto insurance providers contemplate various variables when assessing insurance quotes, including marital status, driving violations, credit score/rating, miles driven each year, and current insurance coverage and limits. In addition, premiums vary from provider to provider. To find out whether you’re still getting the most favorable rate, compare cheap Kentucky auto insurance quotes online.

Most Car Insurance Facts to know in Covington KY

There are lots of ways in which your car insurance rate can be calculated. But not all of it is out of your control; there are things you can do in order to impact which discounts you are entitled to get. Listed below are some of these elements in greater detail:

- Your Zip Code

The cheapest car insurance is usually found in cities with a lower population density. Because there are fewer vehicles on the road, there are fewer possibilities for you to get into a major car accident with another driver. The population of Covington is 40,956 and the median household income is $35,020.

- Automobile Accidents

As you can see in the chart below, the accident statistics for Covington, Kentucky are quite low. This is good news for the majority of drivers, because living in a city with such safe roads means that insurance premiums in your area are automatically lower on average than they are in neighboring cities.

- Car Thieving in Covington

Living in a large city (Especially one with a high crime rate) will increase your risk of being a victim of auto theft. If your general location has high rates of theft and claims, you can expect to pay more for auto insurance to offset these costs. The total number of stolen vehicles in Covington was 158 back in 2013. This is a thankful drop from recent years. If you don’t feel your car is a likely target for theft, you might be able to reduce your monthly payment by reducing your Comprehensive coverage.

- Your Credit Score

Having a bad credit score will negatively impact your life in many ways, and your monthly auto insurance premiums are just one of them. Some motorists are forking out double or more each month compared to people with flawless credit. Regrettably, the only way to fix this is to take on the arduous task of raising your credit score.

- Your Age

Are you a teenage driver who is about to purchase car insurance for the first time? If so, the numbers in the chart below probably look very scary to you. Luckily, there is hope. If you are still in school and getting good grades, there are some lucrative Good Student discounts you may qualify for. You can also get a Driver’s Ed discount with a driver training course.

- Your Driving Record

Having a pristine driving record will, of course, get you the lowest rates around town. But not all drivers are perfect, and insurance companies are beginning to understand this. That’s why Accident Forgiveness discounts are becoming more popular among providers.

- Your Vehicle

Who would risk insuring a luxury vehicle with Liability coverage only? Most people would not take such a gamble, no matter how much they could save on insurance premiums. This is why luxury vehicle insurance tends to cost so much more. You have to buy more coverage, and in greater amounts, in order to protect your vehicle completely.

Minor Car Insurance elements in Covington

Of course, there are also these other premium-altering elements:

- Your Marital Status

Anyone can take advantage of policy bundling discounts. However, married couples can benefit twice as much. Just bundling your auto policy with that of your spouse can save you a lot of money each month. And the more policies you bundle, the more you can save.

- Your Gender

Some insurance companies charge women a few dollars more per month, and other providers charge higher rates for male policy holders. Many providers these days, however, don’t charge different rates at all based on gender.

- Your Driving Distance to Work

When living and working in Covington, you can expect your commute time to last anywhere from 16-24 minutes on average. Over 70% of employees drive their own car into work by themselves, while more than 2-19% choose to carpool with their co-workers.

Reducing your mileage each year may seem like a great way to save money on insurance, but at best you’ll only be saving 3-4%, and you’ll have to shave thousands of miles off your odometer in order to achieve that. For real savings, stick to using your vehicle for personal use only. Business vehicles cost 11% more to insure, on average.

- Your Coverage and Deductibles

Did you know that raising or lowering your deductible will drastically alter your monthly rate? Raising your deductible will get you savings, but it will also leave you with a larger bill if the worst happens. Lowering your deductible will result in higher monthly premiums.

- Education in Covington, KY

Lately, insurance providers have started offering lower rates to drivers who have achieved a higher form of education. It actually matters more than your job status or annual salary. Many drivers in Covington could benefit from this by going back to school; nearly two-thirds of motorists have either a high school diploma or less than a high school education.

In Covington proper, there are two technical schools for students looking to earn a specialized degree. The Gateway Community and Technical College has a campus in Covington, and the Northern Kentucky Technical College is also located nearby. Within immediate driving distance is Cincinnati, Ohio, home to a variety of major institutions for higher learning.

Regrettably for most insurance companies, an easy search on the internet can uncover many of their business secrets. But even with the correct information, it can still be confusing for you as an individual to figure out your risk profile and get low-cost insurance. Be sure to do your due diligence before you commit to your next car insurance policy.

How We Conducted Our Car Insurance Analysis

Sources:

Kentucky Department of Insurance

Kentucky Department of Financial Institutions

Department of Highway Safety and Motor Vehicles

Calculate YOUR auto insurance risks by entering your Zip Code into the calculator below.