Cheap Auto Insurance in Lexington, KY

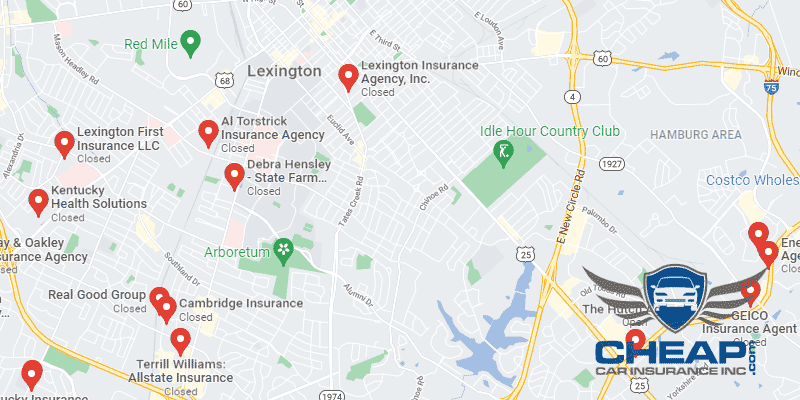

Do you need auto insurance in Lexington? At CheapCarInsuranceinc.com, you can easily find the very best insurance rates near you. To find free car insurance quotes from the top providers today, type your zip code into the quote box on this page.

Lexington is the second largest city in the entire state of Kentucky right behind Louisville. Like many cities in the area, the horse breeding industry is a major player in Lexington. It is even referred to as the “Horse Capital of the World”. Lexmark, the popular printer company, is also headquartered in Lexington.

- Fun fact: Did you know that Lexington is #7 on the list of “Top 50 cities with greatest precentage of females working in industry: Petroleum and petroleum products merchant wholesalers (population 50,000+)”? Learn more about Lexington, KY.

Coverage Requirements - Auto Insurance in Lexington Kentucky

Driving legally in Lexington requires:

| Coverage | Requirements | Most Common |

| Liability Bodily Injury | 30,000/55,000 | 100,000/300,000 |

| Liability Property Damage | 10,000 | 50,000 |

| Bodily Injury - Motorist Uninsured | Not required | 100,000/300,000 |

| Medical Payments | Not required | 100,000 |

| Collision | Not required | 500 deductible |

| Comprehensive | Not required | 500 deductible |

Kentucky state minimum requirements are right on par with mandated minimums in other states. Just keep in mind that Liability coverage is quite limited. If the accident is not your fault, or you get struck by an uninsured motorist, your insurance might not pay a dime on your claim.

Kentucky Automobile insurance costs might run as high as $125 per month for the average driver. Lexington motorists are lucky, however, because they can get insured for as little as $46/mo*. Act quickly, because these low rates might not last much longer.

The Kentucky Farm Bureau, State Auto, and Nationwide are all offering competitive quotes for Automobile insurance in Lexington. But don’t make a hasty switch on low premiums alone. Sometimes, it’s worth a few extra dollars per month to make sure you’re with a company that cares about customer service and quick, efficient claims processing.

Auto insurance carriers evaluate different variables when calculating insurance quotes, including gender, zip code, occupation, miles driven each year, and theft protection devices. Additionally, premiums differ from carrier to carrier. To verify you’re still being charged the most favorable rate, compare cheap Kentucky auto insurance quotes online.

Most Car Insurance Facts to know in Lexington KY

Insurance companies take multiple variables into account when creating an auto insurance policy. Regrettably, many of these variables are confusing or impossible to change, such as your driving experience or where you live. Other variables your car insurance company may consider include:

- Your Zip Code

Where you park your car each night will have a major impact on your auto insurance rate. Generally, car insurance is cheaper in rural areas because fewer cars means a smaller chance that you will get into a collision with another vehicle. The population of Lexington is 305,428 and the median household income is $47,535.

- Automobile Accidents

Accident statistics for the Lexington area aren’t great, but based on the total population, it could be worse. Also, areas with high rates of accidents may end up charging higher than average premiums. Ask your insurer if this is influencing your premiums, and if there are any safe driver discounts you might qualify for.

- Car Thieving in Lexington

Living in a large city (Especially one with a high crime rate) will increase your risk of being a victim of auto theft. If your general location has high rates of theft and claims, you can expect to pay more for auto insurance to offset these costs. To protect yourself and your investment from theft, think about installing a passive anti-theft system in your car. Back in 2012 there were 975 stolen cars in the Lexington area. If you’re worried about auto theft, talk to your insurance agent about Comprehensive coverage. It might raise your premiums immensely, but it could also be worth it in the long run.

- Your Credit Score

Are you aware of how high (or low) your credit score is? Because your insurance company is. In most states, they can’t calculate your monthly premiums without it. And if your credit is poor, you could end up forking out some significantly high premiums as a result.

- Your Age

As you can see in this chart, Teenage motorists have an exceptionally tough financial stress when it comes to forking out insurance premiums. However, such high rates are usually charged while Teenage motorists are still in school. Because of this, there are Good Student and Driver’s Ed discounts which students can take advantage of.

- Your Driving Record

Having multiple tickets and/or accidents on your driving record can send your insurance rates sky high. And having a significant offense, like a DUI, can get your coverage dropped completely by certain companies. However, some providers are willing to lower your rates based on Accident Forgiveness discounts – ask your agent if you qualify.

- Your Vehicle

Luxury vehicles aren’t just expensive to buy – they’re also expensive to insure. After all, if you carry the state minimum coverage on a vehicle with a six figure price tag, you’re going to be left with thousands of dollars in bills if you have to file a claim, even if your provider pays out the maximum amount.

Minor Car Insurance elements in Lexington

Of course, there are also these other premium-altering elements:

- Your Marital Status

Are you newly married, and trying to save money? Well, you can bundle your insurance policies together and get some pretty substantial discounts. As long as your insurance company offers multiple types of products, you can bundle car, home, boat, motorcycle, RV insurance, and much more.

- Your Gender

Did you know that, for most insurance companies, charging men and women wildly different premiums is a thing of the past? Well, in recent years, many companies have abandoned the practice altogether. Those that still do it only charge minimally different rates.

- Your Driving Distance to Work

The average work commute in Lexington varies between 15-25 minutes. In order to get to work, more than 75% of drivers like to take their own vehicle. Anywhere from 4-29%% of residents might choose to carpool with their co-workers.

If possible, make sure your vehicle is insured for personal use (driving to work, school, or for recreational reasons). This is because business vehicles will cost around 10-11% more to insure. Also, feel free to drive as many miles as you need to. Trying to save money by limiting mileage will only net you a 2-3% discount, optimistically.

- Your Coverage and Deductibles

Living in a city like Lexington, with low rates of accidents and auto theft, means you probably won’t be making any Comprehensive or Collision claims any time soon. So why not raise your deductible? It’ll help you keep your coverage and lower your monthly rate at the same time.

- Education in Lexington, KY

Lexington is nationally renowned as placing in the top 10 highest educated cities. More than 20% of residents have a college degree, while a similar percentage has a high school diploma or similar equivalent. Those who do have a college degree will undoubtedly see many benefits from their education, and one of those is a lower rate on their car insurance. Believe it or not, it’s even better at getting you discounts than having a prestigious job or a lucrative salary.

Lexington didn’t become one of the top educated cities in the US by lacking in universities. There are two major four-year public universities: The University of Kentucky, the most notable university in the state, as well as Transylvania University, the oldest college in Kentucky. For a more specialized type of education, you can also look into MedTech College or Bluegrass Community and Technical College.

Locating affordable auto insurance can be a hassle. There’s a lot of important information to consider, and figuring out how insurance companies assess your potential risk can be complicated. But don’t let the wrong insurance company talk you into buying the wrong policy.

How We Conducted Our Car Insurance Analysis

Sources:

Kentucky Department of Insurance

Kentucky Department of Financial Institutions

Department of Highway Safety and Motor Vehicles

Calculate YOUR auto insurance risks by entering your Zip Code into the calculator below.