Cheap Auto Insurance in Owensboro, KY

Do you need auto insurance in Owensboro? At CheapCarInsuranceinc.com, you could find the very best insurance rates in your town. To acquire free car insurance quotes from the top providers today, input your zip code into the quote box on this page.

Owensboro, KY was named after a famous American Colonel, Abraham Owen, who fought in the US military in the late 1700’s and early 1800’s. In the past, Owensboro, KY was the #1 location for wagon manufacturing in the entire country. It is located in the northwestern part of the state, and is only a short driving distance away from one of the biggest cities in Indiana: Evansville.

- Fun fact: Did you know that Owensboro is #1 on the list of “Top 50 cities with greatest precentage of males working in industry: Utilities (population 50,000+)”? Learn more about Owensboro, KY.

Coverage Requirements - Auto Insurance in Owensboro Kentucky

Driving legally in Owensboro requires:

| Coverage | Requirements | Most Common |

| Liability Bodily Injury | 30,000/55,000 | 100,000/300,000 |

| Liability Property Damage | 10,000 | 50,000 |

| Bodily Injury - Motorist Uninsured | Not required | 100,000/300,000 |

| Medical Payments | Not required | 100,000 |

| Collision | Not required | 500 deductible |

| Comprehensive | Not required | 500 deductible |

Think you can save money with Liability coverage only? Well, maybe…if you’re a very careful driver. But you can’t always have total control over what happens on the road. And for any accident that isn’t your fault, you may have to endure a large financial stress in order to get everything taken care of.

Your typical motorist might be forking out as high as $125 or more per month for Auto insurance in Kentucky. However, you can lower your rates in Owensboro down to $34/mo* if you act now. We’ll show you how to get the best rates in your area.

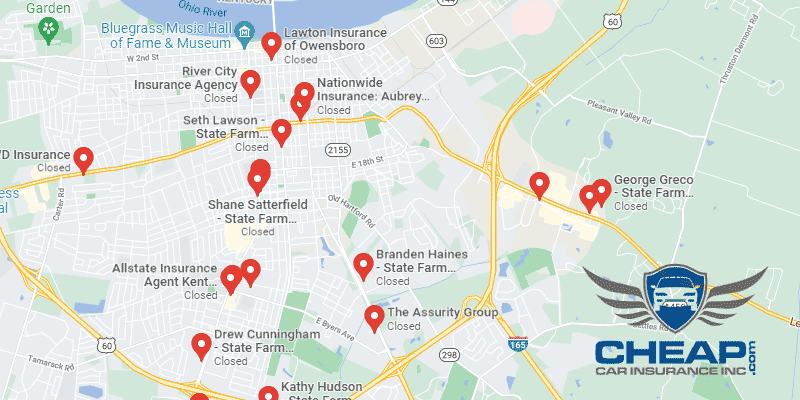

Interested in the lowest possible rate? Then talk to Hartford, Kentucky Farm Bureau, or Nationwide. Those three are offering some of the lowest possible rates in Owensboro right now. However, keep in mind that low rates aren’t everything. It might be worth a little extra in premiums each month for a provider who carries the whole package – including good customer service and an excellent claims service.

Auto insurance companies contemplate numerous elements when figuring out insurance quotes, including driving experience, geography, credit score/rating, driving distance to work, and business use of the vehicle. Also keep in mind that premiums differ from carrier to carrier. To make sure you’re still being charged the cheapest rate, compare cheap Owensboro auto insurance quotes online.

Most Car Insurance Facts to know in Owensboro KY

There are numerous ways your car insurance rate may be estimated. But not all of it is out of your control; there are things you can do to be able to control what discounts you are entitled to receive. Listed below are a few of these components in greater detail:

- Your Zip Code

The cheapest car insurance is usually found in cities with a lower population density. Because there are fewer vehicles on the road, there are fewer possibilities for you to get into a major car accident with another driver. The population of Owensboro is 58,416 and the median household income is $40,132.

- Automobile Accidents

Given the size and population of Owensboro, the accident statistics in the chart below are fairly low for the area. This is good news, because it means that Owensboro drivers get charged lower monthly rates on average, when compared to other cities.

- Car Thieving in Owensboro

Finding cheap auto insurance can be confusing if you are at risk for auto theft. Certain popular vehicle models are attractive to thieves, as well as vehicles which are parked often in large cities. The total number of stolen vehicles in Owensboro was 106 back in 2013. This is a very low per capita rate of auto theft. Therefore, adding expensive Comprehensive insurance to your policy might not be all that necessary in Owensboro.

- Your Credit Score

Any steps you take to raise your credit score will also lower your monthly premiums, too. Most insurance companies put a lot of weight behind how good your credit rating is. As you can see in the chart, it can make a real impact on your monthly payment.

- Your Age

As you can see from the chart, older drivers get to benefit from having years of experience behind the wheel by forking out lower monthly rates. But if you’re a young driver, don’t worry. There are great education-related discounts, especially for students who get good grades and take driving courses.

- Your Driving Record

Got a few minor tickets that are still driving up your rates? Ask around about Accident Forgiveness. Some companies are willing to overlook minor infractions on your record and give you a lower rate if you don’t have anything too severe in your history, like Reckless Driving or a DUI.

- Your Vehicle

Luxury vehicles cost more to insure because, in order to protect that investment properly, you need to buy lots of different coverage types and in large amounts. And the more insurance you buy, the more you have to pay in premiums each month to maintain that coverage.

Minor Car Insurance elements in Owensboro

Of course, there are also these other premium-altering elements:

- Your Marital Status

If you’re married, odds are you are already taking advantage of bundling discounts. But if you aren’t, you definitely should be! Bundling your policies together will net you some pretty big savings. It’s your insurance company’s way of saying ‘thank you’ for trusting them with your business.

- Your Gender

According to most insurance companies, there is hardly any difference at all between the way men and women drive. Therefore, there is very little difference between how much insurance companies will charge either gender for their monthly premiums.

- Your Driving Distance to Work

The typical work commute can last anywhere from 12-18 minutes in Owensboro. The vast majority of drivers – nearly 85% – prefer to drive their own vehicle in order to get to work. Between 6-21% choose to carpool.

Did you know that business vehicles cost 10-11% more on average to insure than personal-use ones? Also, the monthly premium cost between diving 5,000 miles per year and 15,000 miles per year isn’t as big as you think. Slashing your total mileage may only save you about 3-4% on premium costs.

- Your Coverage and Deductibles

Has your provider clearly explained your deductible to you? If not, here’s what you need to know: they are the small (or sometimes large) fees you must pay your insurer before they will make good on a Comprehensive or Collision coverage claim. The higher your deductible, the lower your monthly rate (and vice versa). If you’re planning to raise your deductible in order to save money, make sure you save up a little extra money just in case you need to file a claim.

- Education in Owensboro, KY

For many cities, drivers who have advanced their education by earning a college degree will likely be offered a lower rate on their auto insurance. This is true, usually regardless of your employment status or yearly salary. In Owensboro, more than 30% of residents have obtained a high school diploma or some equivalent. Another 20% have not yet finished their high school education.

Owensboro has multiple private and public options to choose from when it comes to higher education. Both Western Kentucky University and Daymar College own and operate campuses nearby. There are also two four-year private schools, Kentucky Wesleyan College and Brescia University. But if you’re looking for more of a specialized degree, look no further than Owensboro Community and Technical College.

Regrettably for most insurance companies, an easy search on the internet can uncover many of their business secrets. But even with the correct information, it can still be confusing for you as an individual to figure out your risk profile and get low-cost insurance. Be sure to do your due diligence before you commit to your next car insurance policy.

How We Conducted Our Car Insurance Analysis

Sources:

Kentucky Department of Insurance

Kentucky Department of Financial Institutions

Department of Highway Safety and Motor Vehicles

Calculate YOUR auto insurance risks by entering your Zip Code into the calculator below.