Cheap Auto Insurance in Louisville, KY

In the market for auto insurance in Louisville? At CheapCarInsuranceinc.com, you can find the cheapest insurance rates in your town. To receive free car insurance quotes from the top providers today, input your zip code into the quote box on this page.

If you’ve ever had a mint Julep or watched the Kentucky Derby, then you are probably familiar with the city of Louisville. Both economically and socially, the city is a reflection of traditional customs acclimating to the modern world. A recent $2 billion investment project has fueled an architectural renaissance to improve the downtown area. There is also a flourishing community of artists living in Louisville.

- Fun fact: Did you know that Louisville is #18 (40207) on the list of “Top 101 zip codes with the most beauty salons in 2005”? Learn more about Louisville, KY.

Coverage Requirements - Auto Insurance in Louisville Kentucky

Driving legally in Louisville requires:

| Coverage | Requirements | Most Common |

| Liability Bodily Injury | 30,000/55,000 | 100,000/300,000 |

| Liability Property Damage | 10,000 | 50,000 |

| Bodily Injury - Motorist Uninsured | Not required | 100,000/300,000 |

| Medical Payments | Not required | 100,000 |

| Collision | Not required | 500 deductible |

| Comprehensive | Not required | 500 deductible |

Liability coverage may be adequate on much older cars, or a vehicle you aren’t currently financing which can be replaced easily and cheaply. But for most drivers, this isn’t the case. That’s why you should pay close attention to the “most common” column on the far right.

How much are you forking out each month on your insurance premiums? If your answer is somewhere close to $125 per month, then you’re right on par with most Kentucky auto insurance costs. However, living in Louisville can get you rates as low as $64/mo* or less – and we’re ready to show you how.

If getting the absolute lowest rate is important to you, then you should give State Auto, Nationwide, or the Kentucky Farm Bureau a call. But make sure you keep other elements in mind, like customer service or their claims process. A low monthly premium could be too good to be true if that’s the only good thing your provider has to offer.

Auto insurance companies contemplate different variables when determining insurance quotes, including driving experience, accident claims, occupation, driving distance to work, and multiple cars and drivers. Additionally, premiums vary from carrier to carrier. To find out whether you’re still getting the most favorable rate, compare cheap Louisville auto insurance quotes online.

Most Car Insurance Facts to know in Louisville KY

There is a wide array of various things which could factor into the rate quotes you receive. Even though many of these things aren’t really anything you can do something about, a few of them are elements which you can change for the better. Here are a few elements which might affect your car insurance premium:

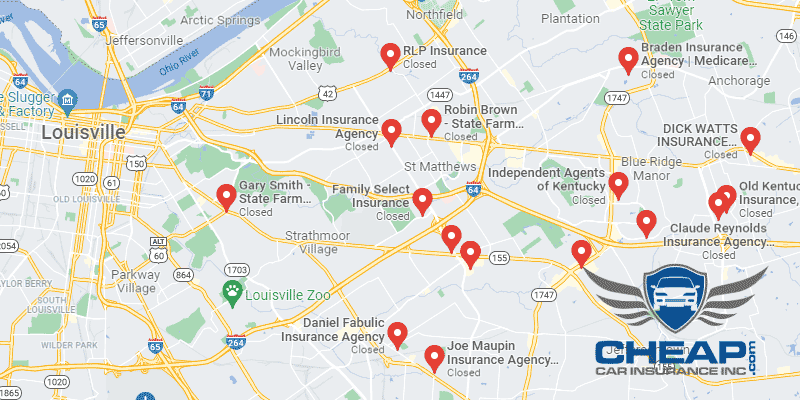

- Your Zip Code

Where you park your car each night will have a major impact on your auto insurance rate. Generally, car insurance is cheaper in rural areas because fewer cars means a smaller chance that you will get into a collision with another vehicle. The population of Louisville is 262,764 and the median household income is $34,714.

- Automobile Accidents

There are more than a quarter of a million people living in Louisville, Kentucky. This explains in part why accident statistics are so high for the area, but it isn’t the only contributing factor. Regrettably, these high numbers might be contributing to higher monthly premiums for you. Talk to your insurance agent about Safe Driver discounts, and ask if and how you can qualify for one.

- Car Thieving in Louisville

Even in small cities or rural towns, auto theft can still be a problem. In order to make it less of a problem for you, think about installing a passive anti-theft system on your car. Your auto insurance company may reward you with lower rates! In Louisville, there were 2,173 Car Thieving as recently as 2002. If these high rates of auto theft make you uncomfortable, consider adding Comprehensive coverage on to your policy. It’s pricey, but it just might save you from having to buy a new car.

- Your Credit Score

Drivers with good credit get great premiums, as the chart below shows. For those with poor credit, however, monthly premiums can get very expensive. If you have bad credit, start tracking your score and taking steps to improve it if you want to lower your monthly insurance bill.

- Your Age

If you are a teenage driver, or the parent of one, then the chart below will be especially painful for you to look at. Younger drivers are charged wildly higher rates due to the fact that their lack of driving experience puts them at a higher risk for an accident. Luckily, there are Good Student and Driver’s Ed discounts available to help offset this cost.

- Your Driving Record

Have you heard of “accident forgiveness”? It’s a new type of discount which insurance companies are offering to drivers with a minor blemish or two on their driving record. significant citations, however, will still get you higher monthly premiums – or automatically terminate your coverage at some companies.

- Your Vehicle

Luxury vehicles are more expensive to insure because they require a luxury insurance policy, plain and simple. You could actually insure an expensive, shiny, luxury vehicle for quite cheaply if all you bought were low amounts of Liability coverage. But if anything else happened you your vehicle, you would be 100% financially responsible for replacing it.

Minor Car Insurance elements in Louisville

Of course, there are also these other premium-altering elements:

- Your Marital Status

Married couples have an advantage over singles in that they can bundle their policies together (with the same insurance company, that is). And if you have other insurance policies, like on your home or a boat, you can bundle those too for more discounts.

- Your Gender

Insurance companies aren’t interested in stereotypes. They want cold, hard data. And their data shows that there’s no good reason to charge men and women different monthly premiums based on gender alone. That’s why many companies are moving away from such a practice.

- Your Driving Distance to Work

In Louisville, the typical drive to or from work can take anywhere from 15-20 minutes. Just under three-fourths of all drivers take their own vehicle when traveling to their place of employment. About 4-16% prefer to carpool with their co-workers, but in some areas that carpool average can get as high as 21%.

Even if you try to save money on insurance premiums by slashing your mileage by thousands each year, at best you’ll save 1-3%, on average. Driving recreationally, however, has some savings advantages. This is because business vehicles cost 11-12% more in premiums each month.

- Your Coverage and Deductibles

Deductibles, which are the minor fee you have to pay for your insurer to fulfill a claim on certain types of coverage, immensely influence your monthly premium. Low deductibles will raise your rates, while high deductibles will lower your monthly payment.

- Education in Louisville, KY

A large number of drivers in Louisville have either completed a high school diploma, or have yet to complete their secondary level of education. If you’re one of the Louisville residents weighing the pros and cons of going back to school, consider this benefit: recent trends show that auto insurance providers have been offering lower rates to motorists with higher education degrees. This statistic beats drivers with what are considered “good” jobs, and even motorists who make a hefty salary.

While there are nearly two dozen institutions for higher learning within driving distance of Louisville, three noteworthy schools are located in the heart of the city. These are Spalding University, Bellarmine College, and the University of Louisville, which has a nationally famous engineering school. Spalding specializes in part-time curriculum for busy, working adults, while Bellarmine instructs students in master’s degrees for education, business, nursing, and almost 50 different undergraduate subjects.

Determining your individual financial risk can be very confusing or impossible for the standard insurance shopper. Insurance companies have an advantage over consumers due to their statistics and experiential knowledge. Learn what insurance companies don’t want you to know.

How We Conducted Our Car Insurance Analysis

Sources:

Kentucky Department of Insurance

Kentucky Department of Financial Institutions

Department of Highway Safety and Motor Vehicles

Calculate YOUR auto insurance risks by entering your Zip Code into the calculator below.