Cheap Auto Insurance in Baltimore, MD

Do you require auto insurance in Baltimore? With CheapCarInsuranceinc.com, you’ll find the cheapest insurance rates close to you. To discover car insurance quotes for free from the most well-known providers today, type your zip code into the quote box on this page.

Baltimore is the largest city in Maryland and also the most conveniently located, as far as transportation is concerned. Not many other eastern seaports also enjoy the benefit of being so far inland that they have easy access to roads and rail. Baltimore has all three, and the city’s history and culture reflect this. Currently, Baltimore is in the middle of multiple restoration projects designed to both modernize certain parts of the city and also preserve historical treasures.

- Here’s a fun fact: were you aware that Baltimore is #19 on the list of “Top 100 biggest cities”?

Coverage Requirements - Auto Insurance in Baltimore Maryland

Driving legally in Baltimore requires:

| Coverage | Requirements | Most Common |

| Liability Bodily Injury | 30,000/60,000 | 100,000/300,000 |

| Liability Property Damage | 15,000 | 50,000 |

| Bodily Injury - Motorist Uninsured | 20,000/40,000 | 100,000/300,000 |

| Medical Payments | Not required | 5,000 |

| Collision | Not required | 250 deductible |

| Comprehensive | Not required | 0 deductible |

You don’t have to look at higher than average state minimums, such as those in Maryland, as a curse. They may be a blessing in disguise. After all, the minimum protects you from accidents you cause, and from financial liability if an uninsured motorist hits you. It’s much better than having no protection at all.

Most Maryland drivers are forking out around $151 on a monthly basis for their Automobile insurance policies. However, living in Baltimore can get you low rates starting at $66/mo*! Keep reading, and we’ll show you how.

Allstate and Cal Casualty all want your business in Baltimore. That’s why they’re trying to out-bid other providers with their lowest rates. But don’t let a cheap price fool you into signing up with a company that doesn’t care about customer service or forking out out claims.

Auto insurance providers evaluate multiple different variables when determining insurance quotes. These include your gender, driving violations, occupation, driving distance to work, and multiple cars and drivers. Also know that premiums vary from provider to provider. To make sure you’re still getting the cheapest affordable rate, you should compare low-cost Baltimore auto insurance quotes right now online.

Most Car Insurance Facts to know in Baltimore MD

There is a variety of various things that can factor into the rate quotes you are offered. While multiple of these details aren’t really something you can do something about, some of them are things which you can change for the better. Here are a few things which can alter your particular car insurance premium:

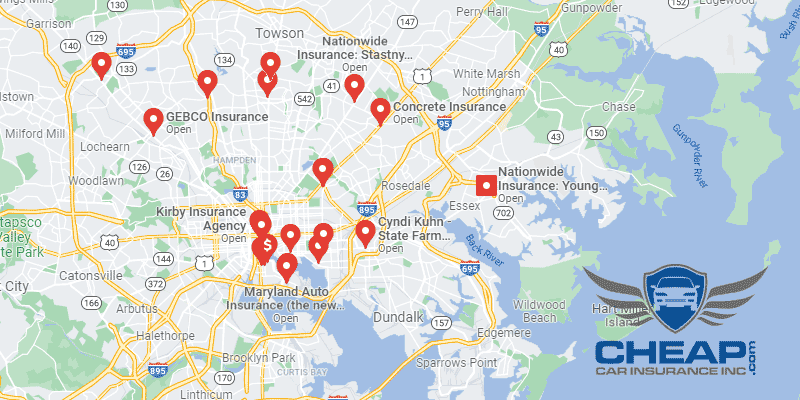

- Your Zip Code

The best low-cost car insurance can normally be found in towns and cities with a low population. Since there are not as many vehicles on the highway, there are also not as many chances for a major accident to happen to you. The total population of Baltimore is 622,104 and the average household income is $42,266.

- Automobile Accidents

The rate of significant accident is Gaithersburg is very low. And, aside from the obvious reasons, this is also good news for motorists like you. When accidents are low in a particular zip code, insurance provider tend to charge everyone lower rates.

- Car Thieving in Baltimore

Even in modest cities or non-urban towns, auto theft can still be an issue. To make it a smaller trouble in your case, think about installing a passive anti-theft system on your car. Your auto insurance provider could compensate you with reduced rates! In Baltimore, there were 4,452 Car Thieving in 2013. Regrettably, the only way to protect your vehicle from theft is to add comprehensive coverage to your policy – and that can get expensive if you don’t have an appropriately-sized deductible.

- Your Credit Score

Many people don’t understand how important their credit rating happens to be when identifying their car insurance rates. For those who have a bad credit score, your rate per month is often as high as double or possibly triple those of someone by having an excellent credit rating.

- Your Age

According to statistical data, the longer you’ve been driving, the less likely you are to get into an accident. That’s why older and more experienced drivers get lower rates. Young people and teenagers, however, have to pay some of the highest rates around, even with helpful discounts based on good grades and driving classes.

- Your Driving Record

The greater number of violations you’ve collected in your record, the greater your chances will be to file claims – that will lead your provider to ask you for greater monthly rates. But when you’ve merely a minor accident in your record, as the agent about Accident Forgiveness discount rates.

- Your Vehicle

Naturally, you will need to pay more for the insurance when you’re covering a costly, luxury vehicle. Such cars are more expensive to exchange or repair, in the event you file claims, and you’ll need not only the condition minimum coverage to be able to safeguard your investment.

Minor Car Insurance elements in Baltimore

Of course, some or all of these elements below might influence your rates too:

- Your Marital Status

Are you married? Do you both drive cars? Do you happen to own your own home together, or do you have renter’s insurance on a really nice apartment? You can combine all of these financial products – assuming you can find an insurance company which offers all of them – and get some significant bundling discounts.

- Your Gender

Gender is one of those things that had a larger influence on your premiums back in the 1950’s than it does today. Some old-fashioned companies do still charge based on gender, though, so the best thing to do is ask questions and try to avoid those companies if at all possible.

- Your Driving Distance to Work

While typical Baltimore commute times can span from 20-25 minutes, it is almost equally likely that you could spend 30-35 minutes getting to and from work each way. Many Baltimore drivers, about 55%, drive their own vehicle in to work each day. However, as many as 35% either carpool or take some other form of public transportation.

If you can avoid listing your vehicle for business on your insurance policy, you should – otherwise you’ll end up raising your rates by 10% or more. Other than that, don’t lose sleep over how many miles you drive, or for what reason – it won’t alter your rates all that much.

- Your Coverage and Deductibles

Your deductible is a flexible way to alter your monthly rate, whether you’re looking for an overall discount or you want to make room in your budget to purchase more coverage. Just remember that if you do raise your deductible, you’ll need to save up a little emergency money, just to keep yourself from being stranded with no car.

- Education in Baltimore, MD

Education is important, even to your auto insurance provider. They are increasingly offering lower rates to drivers with higher forms of education. In Baltimore, the largest percentage of drivers have not yet completed their high school education. A slightly lesser number does have a high school diploma.

There are dozens of different schools which can be found in the immediate Baltimore area for those looking to expand their education. The oldest of which is Towson State University, offering over 90 different degrees on either a bachelor’s or a master’s level. Johns Hopkins, a nationally recognized university, is also located in Baltimore. Additionally, prospective students may want to look into the Maryland Center for Career and Technology Education Studies for a specialized, fast-track degree.

Determining your individual financial risk could be very hard or impossible for the standard insurance shopper. Insurance companies have an edge on consumers due to their statistics and experiential knowledge. Learn what insurance companies don’t want you to know.

How We Conducted Our Car Insurance Analysis

Sources:

Maryland Insurance Administration

Department of Highway Safety and Motor Vehicles

You should calculate YOUR auto insurance risks right now by entering your Zip Code into the calculator below.