Cheap Auto Insurance in Frederick, MD

Are you looking for cheap car insurance in Frederick, Maryland? With CheapCarInsuranceinc.com, you’ll find the cheapest insurance rates close to you. To get a few free auto insurance quotes from some of the major providers today, provide your local zip code in the box at the end of this page.

Frederick is a city of moderate size located near the Maryland/West Virginia border. It is also home to Ft. Detrick, a US Army base and the largest employer in all of Frederick County. In the past, Frederick served as a prominent location for many events relating to the American Civil War. Today, it is a popular spot for biomedical research and downtown gentrification.

- Fun fact: if you go to Frederick, bring your sunscreen! Frederick is #20 on the list of “Top 101 counties with the highest percentage of residents that had a sunburn in the past 12 months”! You can learn more about Frederick, MD by clicking here.

Coverage Requirements - Auto Insurance in Frederick Maryland

Driving legally in Maryland is easy, as long as you have the minimum coverage:

| Coverage | Requirements | Most Common |

| Liability Bodily Injury | 30,000/60,000 | 100,000/300,000 |

| Liability Property Damage | 15,000 | 50,000 |

| Bodily Injury - Motorist Uninsured | 20,000/40,000 | 100,000/300,000 |

| Medical Payments | Not required | 5,000 |

| Collision | Not required | 250 deductible |

| Comprehensive | Not required | 0 deductible |

Maryland requirements set their minimum limits higher than most states. They also require Uninsured Motorist coverage, which most states don’t do. This might be part of the reason why Maryland insurance rates are higher than average.

It can cost the average Maryland driver more than $151 each month to maintain insurance on their vehicle. However, Frederick drivers can get great deals and lower their monthly payments down to $35/mo* if they act fast.

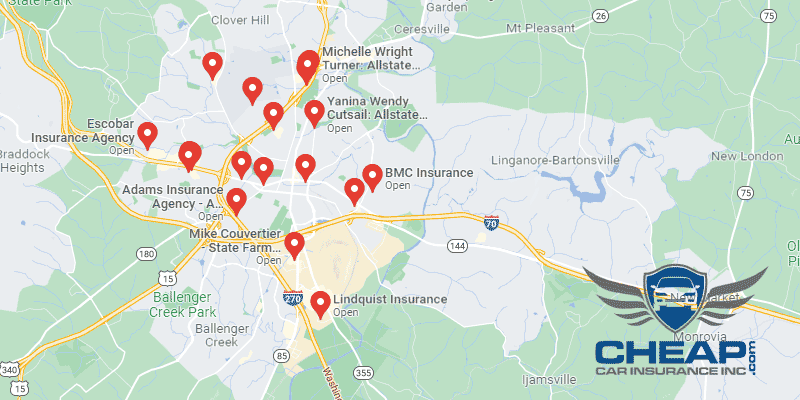

State Auto and Allstate are competing for your business in Frederick. And they’re offering the lowest rates in town in order to get it. But if you’re thinking about switching, make sure you do your homework first. Just because a company offers a low rate doesn’t necessarily mean you’ll get the best service.

This includes such elements as your marital status, zip code, occupation, the number of miles you drive every year, and multiple cars and drivers. Additionally, premiums differ from one company to another. To verify you’re still being charged the best possible rate, compare multiple cheap Frederick car insurance quotes right now online.

Most Car Insurance Facts to know in Frederick MD

There are many ways your car insurance rate can be estimated. But not all of it is out of your control; there are steps you can take so that you can impact what discounts you are eligible to obtain. Listed here are some of these elements in greater detail:

- Your Zip Code

The most affordable car insurance can generally be acquired in cities which have smaller populations. Since there are not as many vehicles on the highway, there is a smaller chance you will become involved in a car accident. There are 66,893 residents in Frederick and the median household income is $62,285.

- Automobile Accidents

Accident rates are very low in Frederick, as you can see in the chart. This means that your Automobile insurance rates are automatically lower than they would be anywhere else, because your provider doesn’t have to worry about you getting into an accident any time soon.

- Car Thieving in Frederick

Residing within a big city (Chiefly one which has a substantial crime rate) tends to increase your chance of becoming a target of car theft. Assuming your overall locality features substantial numbers of theft claims, you should anticipate forking out much more for your auto insurance. The maximum amount of vehicles stolen in Frederick in the year 2013 was only 61. Even though auto theft might not be a big problem in Frederick, that shouldn’t stop you from considering Comprehensive coverage (it’s the only form of coverage which protects against theft).

- Your Credit Score

Your credit rating influences other areas of your existence, as well as your car insurance rates. As you can tell within the chart, getting a bad credit score can make you having to pay two or three times over what a driver with perfect credit would pay.

- Your Age

If you are parents of a brand new teenage driver, finding affordable insurance on their behalf can be quite demanding. Bundling them on your own policy might help lower the price, in addition to speaking with your insurance provider about Driver’s Ed and Good Student discount rates.

- Your Driving Record

Minor driving violations can haunt you and also lift up your insurance rates for a long time. However, many companies offer discount rates which will save you cash on your rates. As the agent about Accident Forgiveness if you have more than one driving violation.

- Your Vehicle

The greater the cost of your automobile, the greater it’ll cost you to pay for with Automobile insurance. It is because it takes greater levels of coverage to be able to sufficiently repair or replace when you get into any sort of accident.

Minor Car Insurance elements in Frederick

Don’t forget about these other elements. They can also influence your rate:

- Your Marital Status

Bundling is a superb method for married people to save cash on insurance. And not simply vehicle insurance – you are able to bundle multiple kinds of policies together, as long as insurance companies offers a variety of coverage and products.

- Your Gender

This may be a surprise to some: most insurance providers don’t charge males and ladies extremely different rates. Actually, many companies don’t charge different rates whatsoever. Individuals which still do only charge in regards to a 2-3% difference.

- Your Driving Distance to Work

Commute times in Frederick are fairly short, usually lasting between 26-38 minutes on average. Approximately 74% of workers would prefer to drive the car they own to work each day, while anywhere from 3% to 32% choose carpooling.

You may think that lowering your miles driven will drastically decrease your monthly premium. In reality, it’ll only help you save a couple of percentage points at the best, and that is if one makes an extreme cut. Just avoid driving a company vehicle, if at all possible, since it may cost around 12% more to insure than the usual personal use automobile.

- Your Coverage and Deductibles

Raising your deductible is really a fast and convenient way to reduce your monthly rates but still maintain decent coverage. Just make certain you’ve some emergency money in the bank just in case you need to file claims and pay that greater deductible.

- Education in Frederick, MD

While many motorists in Frederick have earned a high school diploma, a large number of residents have also gone on to obtain a bachelor’s degree. But did you know that, among other benefits, having a higher education can save you money on car insurance? It’s actually a better way to lower your rates than getting a nice job, or even a higher salary.

You have a few schools to choose from if you’re looking to improve your education in Frederick. Mount St. Mary’s is a four-year, private, catholic university specializing in liberal arts. If you’d prefer a public option, you can also look into Hood College, which educates over 2,000 students each year. And for those who want to fast-track their career, there is always Frederick Community College.

Regrettably for most insurance companies, a straightforward internet search can expose many of their business secrets. But even with the proper information, it can still be confusing for you as an individual to figure out your risk profile and get low-cost insurance. Be sure you do your due diligence prior to committing to your next car insurance policy.

How We Conducted Our Car Insurance Analysis

Sources:

Maryland Insurance Administration

Department of Highway Safety and Motor Vehicles

Enter your Zip Code into the calculator below to calculate YOUR auto insurance risks!