Cheap Auto Insurance in Rockville, MD

Are you looking for cheap auto insurance in Rockville, Maryland? With CheapCarInsuranceinc.com, anyone can find the cheapest insurance rates available in their area. To acquire car insurance quotes for free from top insurance providers, just enter your zip code below the bottom of the page.

Rockville is home to the “Technology Corridor” of the state, which refers to the many biotechnology and software businesses which call I-270 their home. And when Rockville citizens aren’t working, odds are they are shopping at one of the many upscale shopping areas which the city is famous for.

- Here’s a fun fact: have you heard Rockville is one of the top employers for science and government jobs in the northeastern United States? Click here to learn even more about Rockville, Maryland.

Coverage Requirements - Auto Insurance in Rockville Maryland

Need Automobile insurance in Maryland? You’ll need at least:

| Coverage | Requirements | Most Common |

| Liability Bodily Injury | 30,000/60,000 | 100,000/300,000 |

| Liability Property Damage | 15,000 | 50,000 |

| Bodily Injury - Motorist Uninsured | 20,000/40,000 | 100,000/300,000 |

| Medical Payments | Not required | 5,000 |

| Collision | Not required | 250 deductible |

| Comprehensive | Not required | 0 deductible |

The state minimum insurance required in Maryland is somewhat more comprehensive than in other states. For starters, the Liability limits are higher, which gives you extra financial protection in the event that you cause a wreck. You’ll also have some coverage against uninsured motorists.

For some people, these extra requirements make their insurance rates much more expensive. Most Maryland drivers are forking out around $151 monthly for their coverage. However, Rockville motorists can lower their rates down to $46/mo*! Let us show you how.

Hartford, State Auto, and Amica are offering some of the lowest rates right now in your area. But remember that a low rate doesn’t necessarily accurately reflect a company’s customer service record. And it doesn’t mean they have an efficient claims processing department, either.

Insurance companies consider various elements when figuring out insurance quotes, which include: your driving experience, zip code, your credit score, driving distance to work, and current insurance coverage and limits. Additionally, premiums differ from company to company. To make sure you’re still receiving the best possible price, compare low-cost Rockville auto insurance quotes over the internet.

Most Car Insurance Facts to know in Rockville MD

There are numerous ways that car insurance rates can be estimated for you. But not all of it is out of your control; there are things you can do in order to maximize which discounts you are entitled to obtain. The following are some of these elements in greater detail:

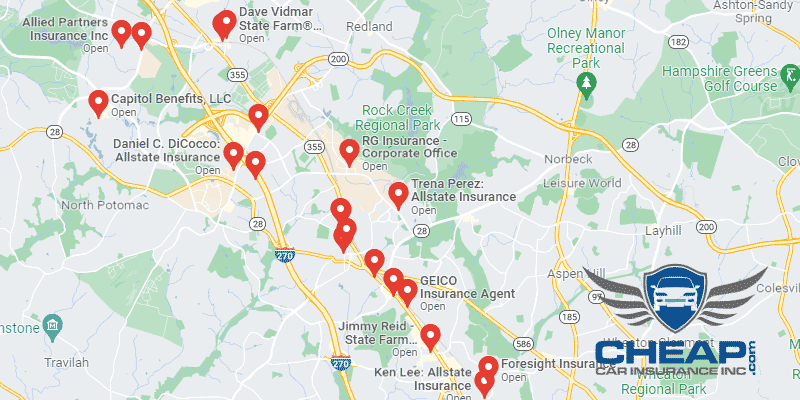

- Your Zip Code

Where you park your automobile each night will have a significant impact on your car insurance rate. Generally, car insurance will be less expensive in rural areas because fewer cars means a smaller possibility that you will get into an accident. The total population of Rockville is 64,072 and the average household income is $98,712.

- Automobile Accidents

As you can see from the chart, the rate of significant accidents in Rockville is thankfully low. And because Rockville is such a safe place to drive, that makes you much less likely to get into an accident. This means that insurance companies will automatically charge lower rates in your area.

- Car Thieving in Rockville

Auto theft is a significant problem, specifically in densely populated locations. If your locale and/or vehicle model place you at a greater risk for theft, you could have problems acquiring low-cost car insurance. The full number of vehicles stolen in Rockville was 96 back in 2008. If you think your vehicle might be vulnerable, consider adding Comprehensive coverage to your Automobile insurance policy.

- Your Credit Score

It often works out that the credit rating is among the greatest influential elements when you’re identifying your insurance rates. Just consider the chart below. For those who have a bad credit score, your rates might be between 2x to 3x greater than someone with better credit.

- Your Age

The more youthful you happen to be, and also the less experience you’ve gained from driving, the greater your chances are to get involved with any sort of accident. However, teenage motorists can help to eliminate a few of their insurance charges by considering good student discount rates, in addition to taking Motorists early education and defensive driving courses.

- Your Driving Record

You can do a lot of favors for yourself by having a clean driving record. But if you already have violations, there may be very little you can do about them – other than asking about Accident Forgiveness discounts, that is. Some companies offer this discount, and will “forgive” at least one violation on your record when calculating your premiums.

- Your Vehicle

As you can tell in the chart below, it is substantially more to insure an extravagance vehicle than the usual type of fuel-efficient sedan that the majority of motorists drive. And the more coverage you buy for the car, which is practically a necessity with luxury vehicles, the greater your rate per month is going to be.

Minor Car Insurance elements in Rockville

Don’t forget about these other elements. They can also influence your rate:

- Your Marital Status

Couples can access lower rates by bundling their insurance products together with exactly the same company. You’re going to get further special discounts by bundling homeowner’s insurance, or renter’s insurance along with your Automobile insurance products.

- Your Gender

Surprisingly, most insurance providers don’t charge immensely different rates for guys or women. Some companies might charge 2-3% more according to gender. However, the growing trend would be to charge grown ups exactly the same rate per month, no matter gender. Seek advice from your provider to learn more.

- Your Driving Distance to Work

Usually, you can expect your commute time to last anywhere from 29-32 minutes if you live and work in the Rockville area. Nearly 65% of workers in Rockville drive their own vehicle to work, while anywhere from 4-19% take some form of group or public transportation, such as carpooling.

Certain companies will pay lip service to your own personal purpose for driving, along with the miles you drive every year. However, whenever you evaluate the information, many of these elements barely create a dent inside your monthly premium – for instance, there might be a maximum of a 4% distinction between driving less miles for work and hundreds of 1000’s of miles for pleasure every year. However, business vehicles generally have about 10-15% greater rates than regular vehicles.

- Your Coverage and Deductibles

Should you add more coverage choices to your policy, you are able to decrease your monthly obligations by raising your deductible. Bear in mind, though, that should you ever need to file claims, you might not have the cash available to have the ability to pay that deductible.

- Education in Rockville, MD

Rockville is a well-educated city, with nearly one-quarter of its residents possessing a four-year bachelor’s degree. Additionally, there are nearly as many people with high school diplomas as there are master’s degrees. If you have a higher education, you may want to check with your auto insurance provider. They might be willing to offer you a lower rate, even more so than if you have a prestigious job or a high salary.

There are multiple prestigious universities which have satellite campuses in or near Rockville. These include the University of Maryland University College, Montgomery College, and also Johns Hopkins University. Additionally, those wishing to pursue a degree with a bit more specialization can look into the Universities at Shady Grove.

Regrettably for most insurance companies, a straightforward internet search can uncover many of their business secrets. But even with the correct information, it can still be confusing for you as an individual to figure out your risk profile and discover low-cost insurance. Make sure you do your due diligence prior to committing to your next car insurance policy.

How We Conducted Our Car Insurance Analysis

Sources:

Maryland Insurance Administration

Department of Highway Safety and Motor Vehicles

Enter your Zip Code into the calculator below to calculate YOUR auto insurance risks!