Cheap Auto Insurance in Columbia, MD

Do you require auto insurance in Columbia? With CheapCarInsuranceinc.com, anyone will find the best possible insurance rates for their city. To find free car insurance quotes straight from some of the very best providers available, input your local zip code. You can access the quote box directly on this page.

Unlike most cities, Columbia was erected from the ground up in a very planned and methodical way. The original town founders wanted to eliminate the modern-day problems of suburban sprawl which were already beginning to show themselves as early as the 1960’s. Five decades later, Columbia presently resembles most American cities, yet still boasts high land values and an extremely well-educated population.

- Fun fact: hold on to your caps and gowns! Columbia is #19 on this list of “Top 100 best educated cities (highest percentage of bachelor degree holding residents) (pop. 50,000+)”? Would you like to learn more about Columbia?

Coverage Requirements - Auto Insurance in Columbia Maryland

To drive legally in Maryland, you’ll need:

| Coverage | Requirements | Most Common |

| Liability Bodily Injury | 30,000/60,000 | 100,000/300,000 |

| Liability Property Damage | 15,000 | 50,000 |

| Bodily Injury - Motorist Uninsured | 20,000/40,000 | 100,000/300,000 |

| Medical Payments | Not required | 5,000 |

| Collision | Not required | 250 deductible |

| Comprehensive | Not required | 0 deductible |

It should be noted that these minimum requirements are higher and more robust than in most other states. The required amount of Liability coverage is higher, and Uninsured Motorist coverage is also a deviation from most states.

It costs the average driver in Maryland around $151 monthly for their Automobile insurance premiums. But living in Columbia means you don’t have to pay nearly as much. In fact, you can get your monthly rate lowered to $47/mo* if you know how to find the right deal.

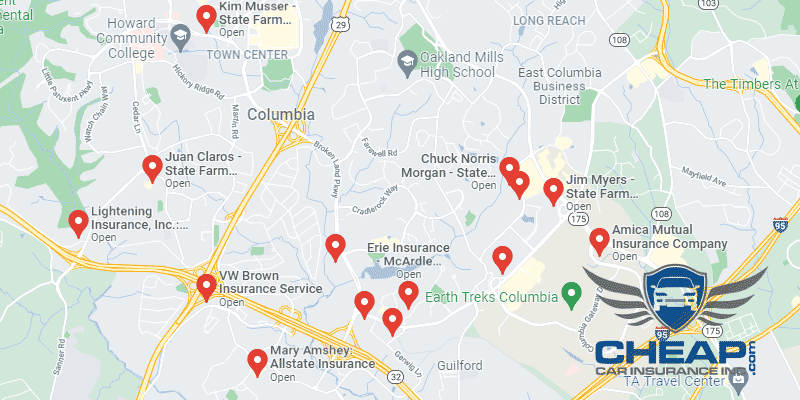

Hartford, Cal Casualty, and State Auto are some of the lowest-priced providers in Columbia today. But a low rate isn’t everything. Sometimes, the company that provides superior customer service and deals with claims efficiently might be worth a few extra dollars per month.

Auto insurance providers consider different elements when assessing your insurance quote, including marital status, zip code, credit history, your level of education, and your current insurance coverage and limits. Additionally, premiums will change from company to company. To discover whether you are still getting the most favorable rate, you should compare cheap Columbia auto insurance quotes on the internet.

Most Car Insurance Facts to know in Columbia MD

There are lots of ways that your car insurance rate might be estimated. But not all of it is out of your control; there are steps you can take to be able to control which discounts you are entitled to get. Listed below are a few of these components in greater detail:

- Your Zip Code

Your car insurance rates may vary based on where you call home. Usually, highly populated areas have higher auto insurance rates because the extra number of drivers on the highway boosts the probability of a car accident! The total population of Columbia is 99,615 and the average household income is $100,902.

- Automobile Accidents

Accident rates are quite low in Columbia. This means that insurance rates in your area will be lower than in other cities, where accidents are more common. And you don’t have to do anything to reap the benefits – your provider makes the adjustment automatically.

- Car Thieving in Columbia

Acquiring cheap auto insurance can often be confusing if you are vulnerable to auto theft. multiple trendy vehicle models are attractive to thieves, and also vehicles which are parked typically in huge cities. The risk of possible auto theft in Columbia is 70% below average theft statistics for the state of Maryland, and also 30% below the national average. But if you still have concerns about auto theft, make sure you have Comprehensive coverage on your policy.

- Your Credit Score

The secret’s out: your credit rating may have a significant effect on how costly (or affordable) your monthly rates is going to be. As shown within the chart below, getting a bad credit score can increase your rate between 100-200% or even more, based on your insurance provider (Along with other elements).

- Your Age

The fewer years you have, the fewer years of experience you’ve got when it comes to driving. And the greater you will probably invest in your Automobile insurance every month. As you can tell within the chart below, a teenage driver (with no Good Student or Defensive Driving discount rates) needs to pay much more every month.

- Your Driving Record

Accident Forgiveness is a terrific way to decrease your rates for those who have a small citation or two on their record. Individuals having a clean driving history pay substantially lower rates than drivers who’ve speeding tickets, other moving violations, or significant accidents within their recent past. For those who have significant violations, like a Drunk driving incident, certain companies won’t insure you whatsoever.

- Your Vehicle

Costly luxury vehicles are not just more costly to insure simply because they are more expensive to exchange. Chances are that you are likely to wish to safeguard a costly vehicle with a lot more insurance policy. And also the more coverage you purchase, the greater you’ll have to pay in rates.

Minor Car Insurance elements in Columbia

Don’t forget about these other elements. They can also influence your rate:

- Your Marital Status

For a solo policy, marital status has maybe a 1-2% difference, on overall rates. But married people can help to save money by bundling their products along with the same company. Insurance providers frequently give discount rates in exchange for bundling multiple issuances together.

- Your Gender

Our research into the data shows no significant factor in monthly rates between men and women motorists. Some companies might charge women more, while some might charge males a greater rate. But for companies who charge different prices, it always varies by a maximum of 2-3%.

- Your Driving Distance to Work

Odds are that if you live in Columbia, you’re got a lengthy work commute ahead of you. On average, most workers spend between 26-32 minutes behind the wheel just to get to work. Up to 11% of drivers may carpool on any given day, but in some areas that number is as low as 5%.

Driving less miles every year, or arranging your automobile for outings back and forth from work only, will not help you save much in your monthly rates. The only real factor that will influence your cost is if you designate your automobile as “for business” use. Business vehicles are usually billed 10-12% more every month.

- Your Coverage and Deductibles

Should you add more coverage choices to your policy, you are able to decrease your monthly obligations by raising your deductible. Bear in mind, though, that should you ever need to file claims, you will need to have the cash available to have the ability to pay that deductible.

- Education in Columbia, MD

Did you know that having a bachelor’s or a master’s degree can save you lots of money when it comes to car insurance? It’s even more effective than having a good job with a nice salary. If you live in Columbia, this bit of news is especially important for you. Columbia is one of the top well-educated cities in the country, and the statistics reflect this: nearly one-third of all residents have completed a four-year degree, and just under 20% have a master’s.

There are multiple institutions in Columbia which have satellite campuses located conveniently close to the city. For starters, there is a Johns Hopkins facility, in addition to the Loyola College in Maryland. For a specialized degree in less time, you may also want to look into Howard Community College, the Lincoln College of Technology, or the local University of Phoenix.

Determining your own personal financial risk might be extremely confusing or impossible for the typical insurance shopper. Insurance companies have an advantage over consumers due to their statistics and experiential knowledge. Learn what insurance companies don’t want you to know.

How We Conducted Our Car Insurance Analysis

Sources:

Maryland Insurance Administration

Department of Highway Safety and Motor Vehicles

You can calculate YOUR auto insurance risks by entering your Zip Code into the calculator below.